Key Points:

- Gold and silver prices are roaring to record highs, providing better returns than stocks.

- Big banks forecast $2,000-an-ounce gold.

- Bulls jump into the market! Miner stocks and silver prices breaking out.

Gold is a stable source of value with thousands of years of trust among humans supporting it,—JP Morgan Commodities and Rates Strategist Craig Cohen[1]

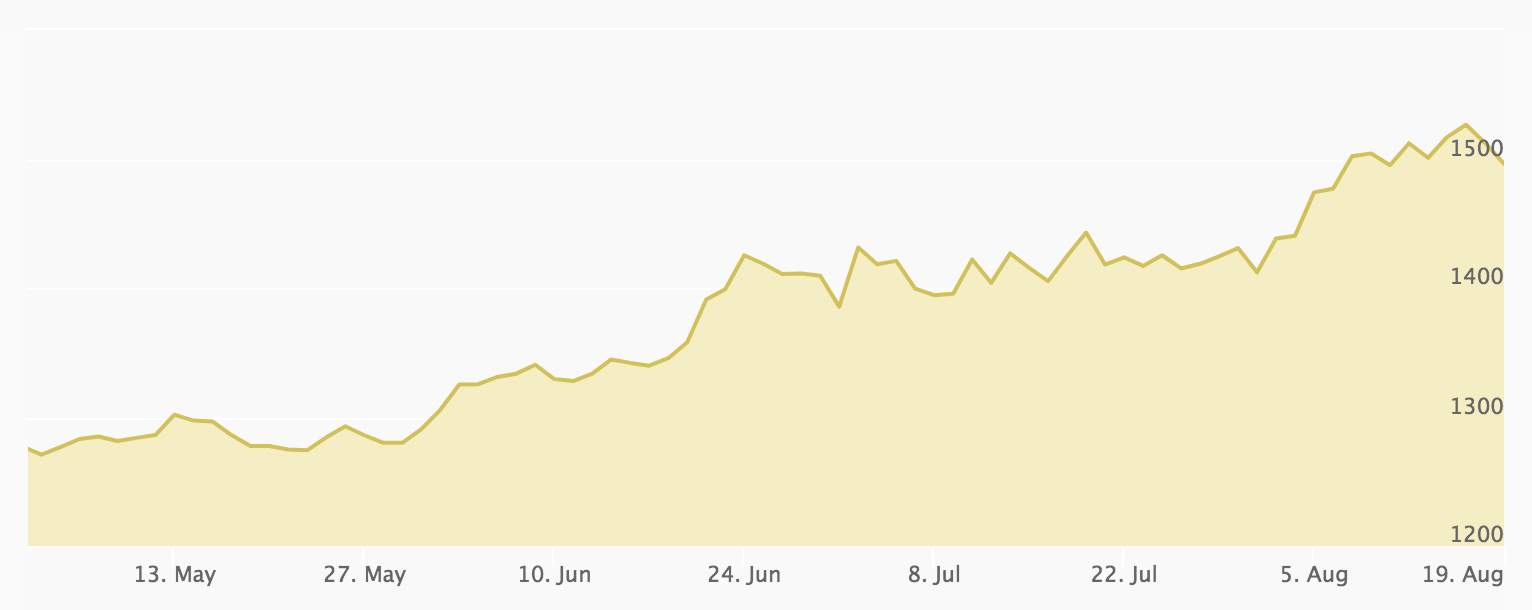

Amid calls by big banks to ditch the dollar and buy gold and silver; an inverted U.S. bond yield curve; and $15 trillion worth of bonds with negative rates, the yellow metal is shining as the ultimate safe-haven asset.[2][3][4] Flirting with a six-year high at $1,518.40 and already trading above $2,000 in Canada in mid-August, gold prices keep ascending. And, the consensus among major financial institutions is that $2,000-an-ounce gold isn’t far off.

“How long do you have before affordable gold is gone?”

More than a Gold Rally—A Market Shift

Spikes in gold prices in recent years have come and gone. But worsening geo-economic conditions, swiftly softening monetary policy around the world, and the breakout in mining stocks and silver prices suggest the entire market is shifting.

Gold Prices Skyrocketing

Fundamentally, the sharp downtrends in bond yields firmly support the bullish case for gold.—Tom Essaye, founder of The Sevens Report.[5]

Surpassing the psychologically important $1,500/oz level in early August, gold prices are now returning better year-to-date gains than stocks:[6]

Year-to-Date Gains: Gold vs. Stocks

| Asset | Year-to-Date Gains |

|---|---|

| Gold | 18.5% |

| Silver | 9.3% |

| Dow | 10.2% |

| S&P 500 | 14% |

| Nasdaq | 17.4% |

Bulls Race into Gold and Silver

Gold bulls have a three-pronged assault force working for them: heightened geopolitical risks, bullish technical charts and notions of easier money policies coming from the major central banks of the world in the months ahead.—Kitco’s senior technical analyst.[7]

- Silver prices are tracing gold’s trajectory, rising steadily to smash through the psychologically important $17/oz threshold on August 8.[8]

- Silver mining stocks followed spot silver prices higher, blasting through previous trading ranges.[9]

- Gold-mining stocks turned bullish amid stock market volatility and geopolitical chaos, with ten logging new highs.

Commodity Super-Cycle Starting

In the short-run, the market is a voting machine, but in the long-run it is a weighing machine.—Benjamin Graham, British-born American investor, economist, and professor[11]

Technology’s rein in the spotlight could soon come to a screeching halt. As central banks around the world battle to increase liquidity amid tight labor markets, inflation will likely rise, triggering the next commodity super-cycle.[12]

Why Gold and Silver Prices Are Soaring

What’s really playing into people’s fears is does the depreciation of the yuan signify a larger threat to the economy.—Ryan Giannotto, director of research at GraniteShares

The impact of the economic and political problems plaguing global economics in recent years is finally being felt in the markets.

Trade War

Trade disputes between the U.S. and China escalated to the verge of a currency war as China allowed the yuan to depreciate against the dollar.[13]

Debt Bubbles

Debt bubbles are getting out of control: American household debt hit $14 trillion, about $1 trillion higher than during the Great Recession, and bankruptcy filings jumped 3 percent in July 2019 from July 2018.[14]

Recession Indicators

- Bank of America’s global economist, Michelle Meyer, forecasts a greater than 30 percent chance of a recession in the next year. She added that three of the five economic indicators tracking business cycles (industrial production, auto sales, and aggregate hours worked) are at levels reached right before recessions in the past.[15]

- The S. Treasury yield curve inverted on August 14 for the first time since 2007. Historically, this is a sign to investors that a recession is imminent.[16]

- More than 30 central banks around the global slashed interest rates this year.[17] And, investors are counting on the Fed following suit: ‘Markets are pricing in a September interest rate cut at 100% at the moment, a December cut at 87% and a March cut at 70%. That would bring interest rates down to 1%,’ said Global Head of Commodity Strategy at TD Securities Bart Melek.[18]

- There are currently more than $15 trillion worth of bonds with negative rates.[19]

Probability of Recession Peaks

How Much Longer Can You Afford to Wait to Buy Gold?

Negative yields are symptomatic for the search for safe assets. The reason they’re trading at negative yields is because the demand for safe assets is bigger than the supply for them. Gold stands to benefit quite a bit from that… I would argue we are likely on the cusp of a multi-year bull market for gold.—Daniel Ghali, commodities strategist at TD Securities.[20]

What will fuel this bull market for gold?

- The End of Dollar Dominance

In the coming decades we think the world economy will transition from U.S. and USD dominance toward a system where Asia wields greater power. In currency space, this means the USD will likely lose value compared to a basket of other currencies, including precious commodities like gold.—Craig Cohen, a commodities and rates strategist at JP Morgan[21]

- Zero Interest Rates

It’s no secret President Trump isn’t a fan of a strong dollar and high interest rates (Read “Is President Trump Telling You to Buy Gold Now?”). As the biggest debtor nation in history with the strongest major currency, the U.S. is paying $1.5 billion in interest every day. The solution? Slashing interest rates to zero (or lower!) to weaken the dollar. It’s already happening.

- De-Dollarization

Russia, China, and central banks around the world are snapping up gold and unloading U.S. dollars in an effort to diversify portfolios in the face of mounting global and economic uncertainty and a move away from the reserve currency (Read: “Global De-Dollarization and Diversification Drive Gold Demand and Prices Higher”).

Central Bank Dollar Selloff

How High Could Gold Prices Go?

We do think gold is on its way higher for the time being…Over the coming years as the likelihood of the unconventional policy becomes more of a reality, I could see a case for gold at $2,000.—Daniel Ghali, commodities strategist at TD Securities[22]

Bank of America Merril Lynch’s metals strategist Michael Widmer agrees, forecasting $2,000-an-ounce gold by the second quarter of 2020. Central banks are buying gold. Smart money is snapping up the yellow metal. Retail investors and bulls have jumped into the market. Will you buy gold before it hits $2,000 an ounce? Learn why your window for affordable portfolio protection is closing—and fast!