There is no such thing as a global anthem, a global currency or a global flag.–President Donald Trump, speech at the annual Conservative Political Action Conference (CPAC), February 24, 2017[1]

President Trump has had it out for the dollar since day one. A strong greenback interferes with his plan to “Make America Great Again,” especially with China’s currency devaluation in response to the tit-for-tat trade war.[2] Since Trump took office, he’s been uncharacteristically vocal about the dollar and Fed policy for an American president, and his words and actions have proven highly influential on the currency’s performance.

With the trade deficit with China at record highs, could President Trump soon pull the trigger on the dollar’s long-planned downfall? See why this gold bug president may be signaling that now is your best time to buy gold and silver before prices skyrocket.

Is the President Preparing to Drive Down the Dollar?

“The U.S. administration is engaged in what we have called a ‘cold currency war’—and it is winning.” –Joachim Fels, Pimco investment firm economist.[3]

Since the president controls the Exchange Stabilization Fund[4], all he has to do to weaken the dollar is give the order. However, rather than directly intervene in the currency markets, the Trump administration has undermined the dollar’s strength with “words and covert actions,” argues economist Joachim Fels.

President Trump Comments on the Dollar

‘There are certain comments most presidents wouldn’t make. They’d defer monetary policy to the Fed and the dollar to the Treasury secretary. But Donald Trump is not most presidents.’ –Michael O’Rourke, chief market strategist at Jones Trading.[5]

Following Trump’s presidential victory in November 2016, the greenback jumped to a 13-year high amid market expectations of a stronger economy, effectively throwing a wrench in his plan to reduce the trade deficit.[6]

What exactly has the President and his administration said about the dollar—aside from negating its role as the global reserve currency?

January 13, 2017

‘Our companies can’t complete with [Chinese companies] now because our currency is too strong. And it’s killing us,’ he told The Wall Street Journal. Trump’s comments sent the greenback tumbling.[7]

April 12, 2017

‘I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me. But that’s hurting—that will hurt ultimately,’ said the president in an interview with The Wall Street Journal.

Less than 15 minutes after his comments, the U.S. dollar index, which measures the greenback against a basket of major currencies, fell .5 percent.

July 25, 2017

“I do like low interest rates. I mean, you know, I’m not making that a big secret. I think low interest rates are good. I like a dollar that’s not too strong. I mean, I’ve seen strong dollars. And frankly, other than the fact that it sounds good, lots of bad things happen with a strong dollar,” Trump explained to editor-in-chief of The Wall Street Journal Gerard Baker in an Oval Office interview.

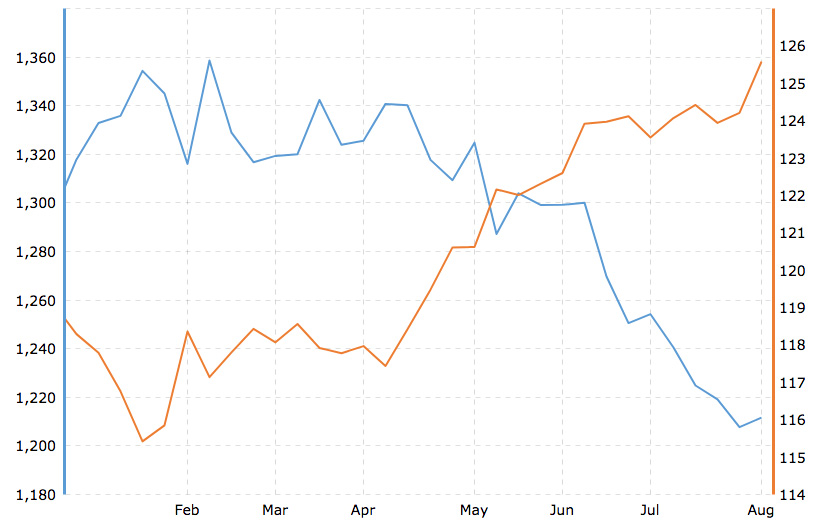

How much did the President’s comments about the dollar in the first half of 2017 impact its performance?

Source: CNBC

Overall, the dollar dropped 10 percent in 2017, marking its worst annual performance since 2003.[8]

January 24, 2018

‘Obviously a weaker dollar is good for us as it relates to trade and opportunities,’ said Treasury Secretary Steven Mnuchin to reporters at a press conference at the World Economic Forum in Davos, setting off a two-day decline in the value of the dollar. It was the worst dollar sell-off in 10 months.

January 25, 2018

‘The dollar is going to get stronger and stronger, and ultimately I want to see a strong dollar,’ Trump indicated during an interview with CNBC at the World Economic Forum in Davos, Switzerland. Some analysts viewed this comment as an attempt to quell backlash from Mnuchin’s statement the day earlier, as Trump also indicated that the Treasury Secretary’s comments were ‘taken out of context.’ The dollar index spiked after Trump’s interview.[9]

Faced with an escalating trade war with China, a hawkish Federal Reserve stance on continued interest rate hikes through the end of the year, and a record-high trade surplus with China, President Trump reverted to criticizing the dollar and Fed policy via interviews and Twitter in July 2018.[10]

July 19, 2018

‘I’m not thrilled. Because we go up and every time you go up they want to raise rates again. I don’t really—I am not happy about it. But at the same time I’m letting them do what they feel is best,’ the president explained to Joe Kernen of CNBC.

July 20, 2018

China, the European Union and others have been manipulating their currencies and interest rates lower, while the U.S. is raising rates while the dollars gets stronger and stronger with each passing day – taking away our big competitive edge. As usual, not a level playing field…

— Donald J. Trump (@realDonaldTrump) July 20, 2018

….The United States should not be penalized because we are doing so well. Tightening now hurts all that we have done. The U.S. should be allowed to recapture what was lost due to illegal currency manipulation and BAD Trade Deals. Debt coming due & we are raising rates – Really?

— Donald J. Trump (@realDonaldTrump) July 20, 2018

“China, the European Union and others have been manipulating their currencies and interest rates lower, while the U.S. is raising rates while the dollars gets stronger and stronger with each passing day – taking away our big competitive edge. As usual, not a level playing field…” -President Trump on July 20, 2018

“….The United States should not be penalized because we are doing so well. Tightening now hurts all that we have done. The U.S. should be allowed to recapture what was lost due to illegal currency manipulation and BAD Trade Deals. Debt coming due & we are raising rates – Really?” -President Trump on July 20, 2018

These comments sent the dollar and stock futures lower, stopping gold bears in their tracks as the price of gold quickly jumped $10 higher.[11][12] The Bloomberg Dollar Spot Index fell as much as .74 percent for the greatest intraday drop since March.

Overall, there appears to be a strong correlation between Trump’s public position on the dollar and the currency’s value.

Trump’s Covert Actions to Drive Down the Dollar

While it’s clear President Trump has been able to sway the markets with his mere dollar comments alone, he has also taken covert actions to suppress the currency’s value.

The Trump Administration slashed taxes and boosted spending when the economy was already thriving. It was the ‘wrong time’ for such measures, argues economist Joachim Fels, suggesting they could be part of a plan to drive investors away from U.S. Treasury bonds (dollar assets) by increasing government debt.

Moreover, Trump’s unpredictability, especially when it comes to trade relations, has undermined the dollar’s strength in the past—and it could again in the future.[13]

The Problem with the Strong Dollar

Ultimately, a strong dollar makes U.S. exports more expensive to foreign markets and the country less competitive on the global stage. The result is a higher trade deficit, which Trump has stated it is his goal to reduce.

Already, we’ve seen Trump shift from covert actions against the dollar to explicit threats to China and other countries to wield one of America’s potentially greatest weapons: protectionist trade policy.[14]

However, Trump’s real problem may not be dollar strength alone:

‘A monetary system based on a reserve currency is unsustainable, since foreign official dollar reserves (for example) are acquired and must be repaid in goods. In other words, the increase in official dollar reserves equals the net exports of the rest of the world, which means it must also equal U.S. international payments deficits—an unsustainable situation,” explained John D. Mueller, Director of the Economics and Ethics Program at the Ethics and Public Policy Center.

As long as the dollar serves as the world’s reserve currency, the United States will be plagued by a trade deficit. Mueller argues President Trump has three options to deal with the issue:

- Continue to use protectionist trade policies and criticize the dollar in an effort to reduce the trade deficit.

- Convert the International Monetary Fund into a world central bank issuing paper reserves.

- Create a modernized, international gold standard.

We all know the president is a gold bug, so option three isn’t really that far-fetched, now is it?

President Trump and Gold

President Trump has been just about as vocal about his love of gold as his disapproval of a strong dollar. In fact, he has even mused about how great a return to the gold standard would be.

‘Bringing back the gold standard would be very hard to do, but boy would it be wonderful. We’d have a standard on which to base our money,’ Trump said in a GQ interview in 2016.[15]

While that statement may have been wishful thinking, it’s clear the president is partial to the yellow metal. Financial statements Trump was required to release when he was running for the nation’s highest office revealed he owns between $100,000 and $200,000 in gold bullion. His holdings of gold securities in his portfolio is almost $90 million. He even authorized the Trump Organization to accept $176,000 worth of gold bars as a security deposit from a new tenant.

Right Now Is the Prime Opportunity for Investors to Buy Gold!

What’s clear from President Trump’s actions and words since he took office is he is set on reducing the trade deficit and the dollar is standing in his way. While the dollar is still relatively strong now, experts are predicting its fall. Given the inverse relationship between the dollar and gold, prices for the yellow metal could skyrocket soon.

Gold and the Dollar’s Inverse Relationship

Image source: macrotrends (use year-to-date chart)

‘There is an underlying weakness that isn’t reflected in the [dollar] indexes right now,’ said the head of research at Murenbeeld & Co, Chantelle Schieven, adding that many companies have expressed “concerns about the strength of the U.S. dollar in their earnings reports.”[16]

The World Gold Council also argues that the dollar may weaken due to the negative impact of the trade war on the economy. Macroeconomic trends, particularly rising inflation and the potential for the yield curve to invert, will also likely drive demand for gold in the second half of 2018, argues the WGC. Read “Why Buy Gold During a Trade War?” for more information on how trade tariffs could hurt the economy.

With 17 percent of global fund managers indicating they think gold is undervalued[17], what’s clear is that now is the time for investors to take advantage of bargain prices.

“Gold’s current price presents an attractive entry point as investors should expect macro trends to boost the yellow metal’s relevance in the coming months,” noted the WGC.[18]

So, back to our initial question. Is President Trump telling you to buy gold now? Considering that each comment on the dollar and escalation of the tit-for-tat trade war stands to push the dollar down and gold up—he just might be.