Big banks and even bigger debt bubbles—both underlie the precarious state of our financial system today, the result of ten years of cheap debt and rampant subprime lending. Sound familiar?

The major difference this time around is when these private sector debt bombs detonate, the Federal Reserve may not have the trillions of dollars needed to bailout banks again, warned the IMF recently. It’s a concern that’s left many experts wondering if the next financial crisis will be worse than 2008.

CEOs and central banks are certainly preparing for the worst. Corporate executives are rapidly unloading stocks and central banks setting records for gold buying. What do they know?

Even more importantly, how can you prepare for the next financial meltdown?

Debt Bombs Ticking across the Nation

The failure to address our long-term fiscal situation has increased the national debt to over $20 trillion and growing. This situation is unsustainable as I think we all know, and represents a dire threat to our economic and national security.-National Director of Intelligence Daniel Coats speaking to the Senate Intelligence Committee in February 2018

Problem

- In the last ten years, the national debt ballooned by 123%.

- The total debt-to-GDP ratio is 105%, nearly as high as its World War II peak.

- By 2047, the Congressional Budget Office predicts the debt-to-GDP ratio to hit 150 percent, far higher than levels where financial crisis generally occurs.[1]

Risks

- Depressed GDP growth.

- Decreased dollar value.

- Rising inflation.

Despite all of the attention it gets, the national debt isn’t likely to set off the next financial meltdown. Thanks to the Treasury bond market and the Fed, this bubble can keep growing for a while.[2] It’s really just a distraction from a much bigger and insidious problem…

But what we saw last time around is that things can creep up on you. You can turn around and in three years’ time you can go from not much of a problem to a pretty big problem.–Wesley Phoa, bond-fund manager at the Capital Group

Problem

- Household debt shot to 77% of GDP.

- Financial sector debt hit 81% of GDP.

- Non-financial corporate debt reached 72% of GDP.

- When added together, the total debt-to-GDP ratio is approximately 330%.[3]

Risks

- LOAN DEFAULTS.

- BANK FAILURES.

- FINANCIAL CRISIS.

Unlike the national debt, private sector loans don’t have Fed backing. When corporations, investors, consumers, and students default, banks—bigger than ever now—could go down with them.[4]

Just how severe are these private debt bubbles?

Income levels for graduates ‘are not necessarily high enough for debt payments overall. If you have a choice to pay your student loan or for food or housing, which do you choose?’–Ira Jersey, an interest-rate strategist at Bloomberg Intelligence

Problem

- After mortgages, student loans are the second biggest category of consumer debt in America.[5]

- By 2022, the national balance for student loans is predicted to hit $2 trillion.[6]

- American student loan debt has more than doubled since the last financial meltdown to about $1.5 trillion.[7]

- Delinquencies in student loans surged to a record $166.4 billion in the fourth quarter of 2018.[8]

Risks

Default

- More than 8 million student borrowers are in default on their federal loans.

- By 2023, the Brookings Institution estimates about 40% of student borrowers may default on their loans.[9]

Source: Bloomberg

Decreased Consumer Spending and Homeownership

- Since 2005, the approximately 20% drop in homeownership among young adults can be attributed to the rise in student loan debt.

- Home purchases account for a large segment of consumer spending in the American economy.[10]

Your car loan is your No. 1 priority in terms of payment. If you don’t have a car, you can’t get back and forth to work in a lot of areas of the country. A car is usually a higher-priority payment than a home mortgage or rent.–Michael Taiano, a senior director at Fitch Ratings

Problem

- Car sales skyrocketed to a record high of 17.5 million vehicles in 2016.[11]

- Americans had $1.22 trillion in debt from auto loans in the last quarter of 2017.[12]

- Subprime borrowers account for more than 50% of auto loans.[13]

Risks

Delinquencies

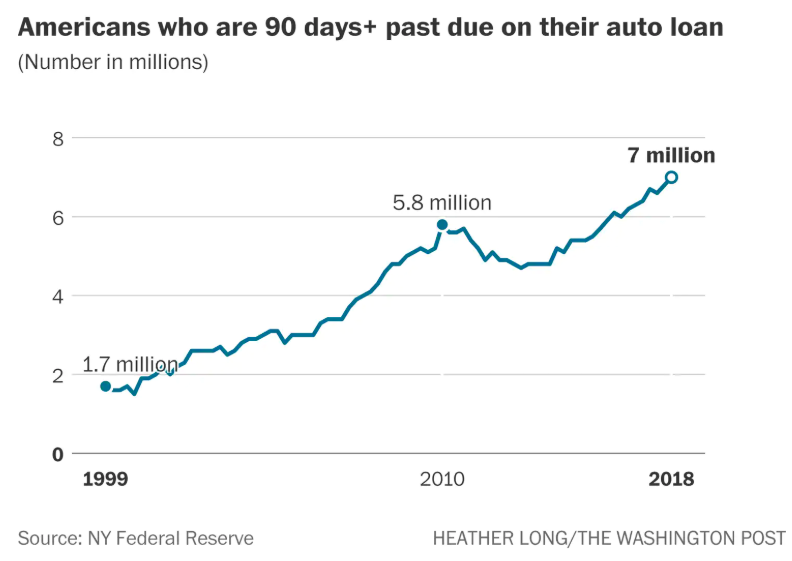

- The Federal Reserve Bank of New York reports that a record 7 million Americans are 90 days or more delinquent on their auto loans.

- Subprime borrowers under 30 years old account for most of the delinquencies, suggesting those with student loans struggle to manage auto debt.[14]

Source: The Washington Post

Auto Repos

- Repossession is common for those who are three months or more behind on their car payments.

- These Americans may struggle to get to work, medical appointments, and other important places.[15]

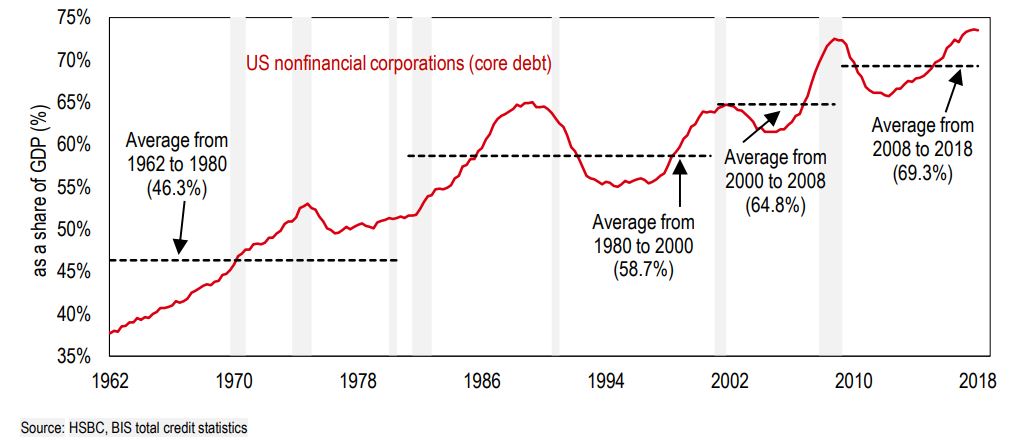

Many of the painful lessons taught by the [global financial crisis] seem not to have had a particularly lasting effect on the U.S. corporate sector’s behavior.–Edward Marrinan, head of North America credit strategy for HSBC

Problem

- Corporate debt in America shot to $9 trillion.[16]

- Corporate debt as a share of GDP hit 69.3 percent in 2018.

- Before each of the last three economic downturns, the corporate debt-to-GDP ratio spiked.

Source: MarketWatch

Corporate Debt Drivers

Corporate Borrowing Binge: BBB and Junk Bonds

‘The high-yield sector, every way we look at it, just seems pretty overvalued and not worth the amount of risk that you’re taking. What we’re seeking now is some spreads widening, which will be more impactful on high yield. We could see triple-B credits, some of them, move from investment grade to high yield.’ – George Rusnak, co-head of global fixed income for Wells FargoProblem

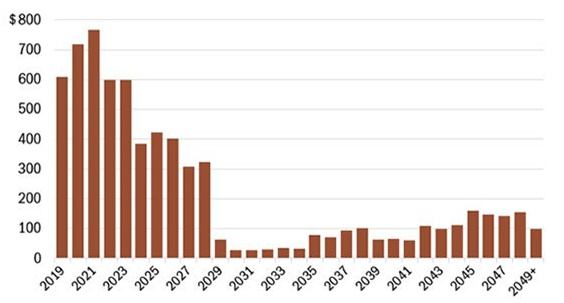

- Over the last 10 years, the U.S. investment-grade corporate bond market has swelled by $3 trillion to reach $5.2 trillion.[17]

- Many are riskier BBB-rated corporate bonds, which account for $1.4 trillion in outstanding debt—the largest segment of the investment-grade corporate bond market.

- Over $500 billion worth of BBB-rated bonds are only one downgrade away from being junk bonds.

- Much of this outstanding commercial debt comes due between now and 2021.[18]

Investment Grade Debt Maturing (Billions)

Source: FXStreet

Risks

Defaults

- As more and more investment-grade bonds slip into high-yield status, rates and defaults could soar.

- Defaults are more likely than ever, as corporate borrowers’ cash-to-debt ratio plummeted to 12 percent in 2017, the lowest level on record.

Poor Investor Protections

- The number of protections in the case of defaults on these corporate loans, known as the Covenant Quality, has slumped to the lowest level on Moody’s classification system for 18 straight months.[19]

Risky Leveraged Loans

‘It is much too early to conclude that nonfinancial businesses will end the current cycle in the way subprime mortgage borrowers did the previous one. Even so, while there are significant differences between leveraged lending and subprime mortgage lending, the similarities are eerie.’ – Mark Zandi, chief economist for Moody’s Analytics.Problem

- Corporations have about $1.4 trillion is risky leveraged loans.

- The total for corporate leveraged loans and junk bonds is approximately $2.7 trillion, not far from the $3 trillion the subprime mortgage market amassed during its peak.

- About 80 percent of leveraged loans issued last year were considered covenant lite, and 91 percent are provided by nonbank lenders in 2019.[20]

Risks

Defaults and Financial Crisis

“With rising leverage, weakening investor protections, and eroding debt cushions, average recovery rates for defaulted loans have fallen to 69 percent from the pre-crisis average of 82 percent. A sharp rise in defaults could have a large negative impact on the real economy given the importance of leveraged loans as a source of corporate funding.” – International Monetary FundBrewing below the surface is the undoing of the prudent regulatory and monetary policies of the last decade. If this continues, it spells a recipe for another financial crisis that will bring back the days of high inflation and high unemployment not seen in more than 30 years.–Victor Li, professor of economics, Villanova School of Business

Problem

- Banking behemoths J.P. Morgan, Goldman Sachs, and Citigroup are bigger than ever, possessing over 50% of the assets of the top 100 commercial banks.

- Wall Street veterans, such as Treasury Secretary Steve Mnuchin and SEC Chairman Jay Clayton, are charged with running the major financial regulatory agencies.

- Congress has been repealing portions of the Dodd-Frank Act of 2010.[21]

Risks

- Greater risk-taking by banks free of the post-2008 regulatory safety net.

- Bigger debt bubbles bursting, triggering massive bank failures, and a financial crisis worse than the last.[22]

CEOs, Central Banks, and Countries Prepare for the Next Financial Crisis

Corporate Buybacks Surge

We give stock to corporate managers to convince them to create the kind of long-term value that benefits American companies and the workers and communities they serve. Instead, what we are seeing is that executives are using buybacks as a chance to cash out their compensation at investor expense.-Securities and Exchange Commissioner Robert Jackson

Problem

- Company executives sold $5.7 billion in stocks last September, and insider sales hit $10.3 billion this past August, the highest for both in ten years.

- Stock buyback budgets for 2018 total $827 billion, much higher than in 2007.

Risks

- Stock buybacks pump up U.S. share prices to sell quickly.

- Since they’re not a real investment like equipment or hiring, companies suffer in the long run.

Central Bank Gold Buying Spree

“Today, gold is perceived to have an intrinsic value, which is why the world’s central banks, the IMF and other financial institutions hold over US $1tn of gold.” – World Gold CouncilCentral Bank Gold Buying

- Central bank gold buying shot to 651.1 tons in 2018.

- This was the greatest demand by central banks for gold since the end of the gold standard in 1971.

- Central banks are stocking up, with net gold purchases dwarfing net sales.

Driving Factors

Portfolio Diversification and Protection

- 76 percent of central banks indicated gold’s role as a safe haven asset was highly relevant and 59 percent viewed gold as an effective portfolio diversifier, reported the World Gold Council.[23]

Countries Repatriating Their Gold

Countries

- Turkey

- The Netherlands

- Germany

- Austria

- Belgium

- Romania[24]

Driving Factors

- After fifty years of a fiat currency system and numerous financial market crashes, foreign governments are seeking ways to move away from dollar dominance and secure their financial stability. Given all of the current risks to the U.S. financial system, it’s easy to see why countries around the world want their gold back—and fast![25]

Protect Your Assets from the Next Financial Meltdown Now!

Hard data and the actions of CEOs, central banks, and countries all point to one worst case scenario: the next financial meltdown is upon us.

How can you prepare? Take the approach recommended by experts and currently being adopted by smart money, business and world leaders, and central banks: diversify your portfolio with precious metals. Gold has served as a store of wealth for thousands of years and can help you weather the next major market crisis.