Gold stashing. Gold hoarding. Record gold purchases. THE GOLD RUSH IS HERE!

Have you heard the news? Central banks, countries, and smart money are on a gold buying spree:

- Central banks bought 651 tons of gold in 2018, the highest level since the end of the gold standard in 1971.[1] So far in 2019, reported net purchases total 207 tones, the highest year-to-date total since 2010 when these institutions became net buyers.[2]

- The central banks of more countries are getting in on the gold buying than ever before: Russia, Kazakhstan, China, Turkey, Hungary, Poland, India, Mongolia, Iraq, the State Oil Fund of Azerbaijan, Mexico, Egypt, Indonesia, Thailand, and the Philippines.[3] Who’s next?

- ‘[Gold] has everything going for it,’ billionaire investor Paul Tudor Jones told Bloomberg News, predicting the yellow metal to be a top investing pick and that, if prices shoot above $1,400, they could quickly push to $1,700 an ounce.[4][5]

Why is there a sudden rush to gold? What do those buying see ahead?

THE TIME IS NOW FOR PORTFOLIO DIVERSIFICATION!

Discover why in this article.

3 Reasons Why Gold Demand and Prices Are Rising

Around the world, demand for gold this year is set to rise to the highest level in four years, predicts consultancy firm Metals Focus.[6]

Why? The conditions for a gold rally have arrived: economic, financial, and political circumstances are deteriorating at lightning speed. Within the span of a month, U.S. relations with several major trading partners have worsened; a new nuclear threat has emerged from the Middle East; and Brexit and populism continue to jeopardize the solidarity of an already economically shaky European Union.[7][8][9]

Against this disturbing global backdrop, three trends in particular could prove to be major drivers of gold demand and prices this year.

1. Central Banks Gold Buying Spree Continues

As mentioned above, central banks—ESPECIALLY CHINA—have been purchasing nearly unprecedented quantities of gold.

China’s Gold Purchases Increasing

After selling the most U.S. Treasuries in nearly 2½ years last March, China added 61.61 million ounces of gold to its reserves in May alone.[10] Why?

It’s a diversification away from the U.S. dollar, particularly given the trade tensions and the potential technology cold war that’s evolving–Global Head of Commodity Strategy at TD Securities, Bart Melek

Read the full story: “China Is Buying More and More Gold as the Trade War Drags On.”

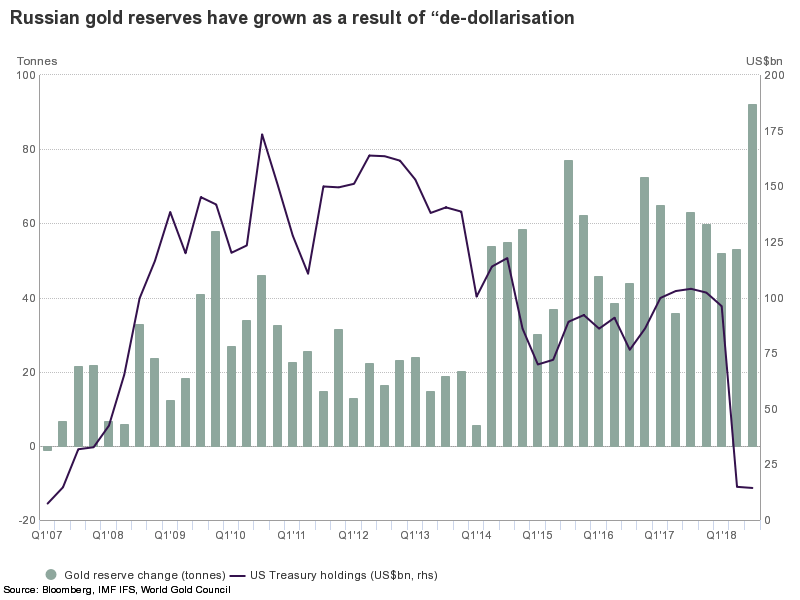

Russia did the same thing in 2018, funding gold purchases with the proceeds from U.S. Treasuries sales.

Russia Buys Gold in De-Dollarisation Effort

Diversification was a major reason for central bank gold buying across the board, with 59 percent citing gold’s effectiveness at protecting wealth from economic and financial uncertainty.[11]

2. Predicted Fed Interest Rate Cut Signals Recession

One sure sign of an imminent recession is chatter among financial experts that the Fed is planning to lower interest rates. And they would have good reason to:

- weak jobs data

- low inflation

- turbulent international trade relations

- stock market volatility

- plummeting bond yields

- and the list could go on.

Investors tend to welcome lower interest rates, but they’ll likely have nothing to rejoice about this time around.

Fed cuts may come too late… Fed could cut as soon as July but it may not halt slowdown/recession–Michael Wilson, an equity strategist at Morgan Stanley

Wilson went on to recommend diversification: ‘Until there is further clarity on the employment picture, we think Friday’s rally should be faded and investors should continue to skew portfolios defensively.’

Read the full article here: “Morgan Stanley: Even if the Fed cuts rates this summer, it could be too late to stop a recession.”

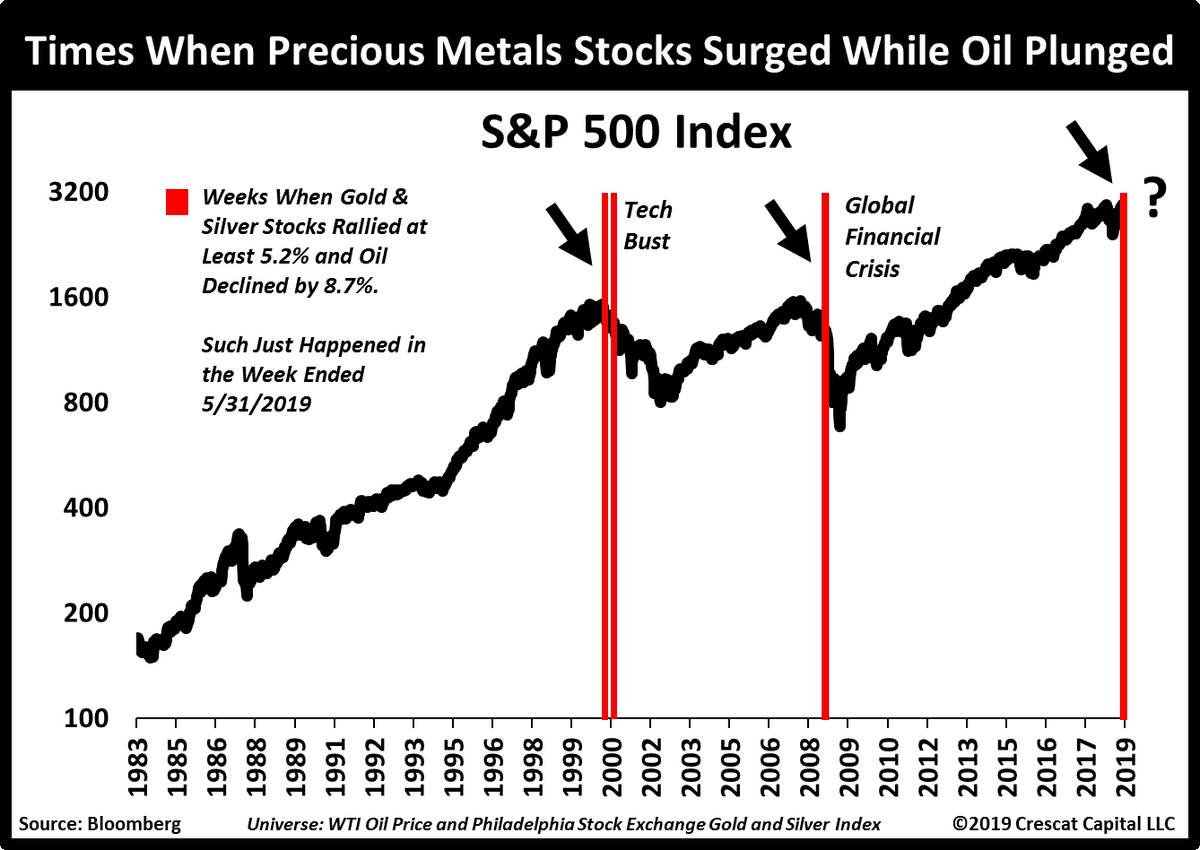

3. Gold-to-Oil Ratio Suggests Impending Economic Downturn

When the global economy starts to slow down or industry fears that the escalating trade disputes will trigger the next US recession, oil consumption can drop, as we’ve seen in recent weeks. These very same fears can stoke investor appetite for safe-haven gold.

Historically, falling oil prices and soaring gold prices have been bad news for the economy.

Only three other times in history precious metals surged while oil plunged! All of them happened during severe bear markets and recessions. Buckle up, folks–Tavi Costa of Crescat Capital[12]

Historically Precious Metals Stocks Surge when Oil Plunges

Read the full story: “Buckle up! When oil and gold trade like this, it usually spells doom for the market”

Institutions and Investors Diversifying with Gold—And You Should Too

Charged with maintaining the fiscal security of entire nations, central banks can be a good indicator of the direction of the markets, and they’ve been diversifying their portfolios with precious metals, particularly gold. Managing fortunes—some as large as small countries—major Wall Street players have been following central banks’ lead and hedging financial risk with gold.

What do they know?

Gold can strengthen an investment portfolio, allowing investors to protect their stock market gains and even profit from a recession or equities market correction.

Want this protection for your portfolio? Who wouldn’t?

Learn how to strategically invest in gold to maximize the benefits to your portfolio with our free gold buying strategy session.

During this one-on-one session an experienced precious metals advisor will:

- Educate you on precious metals investing, in simple to understand terms.

- Provide expert answers to all those investment questions you have.

- Create a personalized diversification strategy for your savings portfolio.

ALL 100% FREE!

On your time. Online, over the phone, or in our Arizona office.

It’s your financial future. Why not take a moment to learn how to protect it using the same time-tested approach as central banks and billionaire investors?