In times of financial trouble, in times of uncertainty and when investors are feeling risk averse, gold will always be a go-to.–Rhona O’Connell, Head of Metals Research and Forecasting, Thomson Reuters[1]

- Financial trouble. Check.

- Uncertainty. Check.

- Investor risk aversion. Check.

All the forces that typically drive investors to safe haven assets are in play—so why hasn’t gold rallied? Many analysts believe investors are treating gold as a commodity and selling it along with industrial metals as the trade war heats up.[2] However, financial experts are issuing warnings about the coming economic and financial crisis and urging investors to buy gold and silver. See why the yellow metal will reclaim its status as the ultimate safe haven investment soon.

What Is a Safe Haven?

In general terms, a safe haven is a place of refuge or security. During market downturns or outright crises, assets that continue to perform when others fail are considered safe havens. These assets are either uncorrelated or negatively correlated to the general market: when stocks and bonds plummet, safe havens will either retain their value or even appreciate.[3]

Portfolio diversification is the practice of buying safe haven assets to protect one’s wealth when traditional investment vehicles fail during times of market volatility.

Why Is Gold a Safe Haven?

Since gold has a “very low or negative correlation with virtually all other asset classes,” it is seen as a safe haven. But gold has qualities that other traditional safe havens like cash and treasury bills don’t. Inflation can erode the purchasing power of dollars and paper currency-backed assets, but gold is immune to its effects. In fact, since gold is viewed as a hedge against inflation, gold prices usually rise during periods of inflation. Plus, gold offers privacy. Whereas other safe havens are usually managed by banks or financial institutions, an investor can buy and sell gold rather discretely.

Everything you need to know to get started in Precious Metals

Learn how precious metals can strengthen your portfolio, protect your assets and leverage inflation.

Current Market Risk Factors

Experts agree that economic and financial problems are mounting. Once the full-scale crisis erupts, these market insiders argue that gold’s unique qualities will make it the only safe haven with a solution to wealth preservation.

Inflation

The purchasing power of the currency is being destroyed right before your eyes, and you’re just not paying attention.-Mark Yusko, CEO and CIO of Morgan Creek Capital Management

Historically, when governments print more money, inflation goes up. Over the last five years, central banks have had the printing presses running at full speed to stimulate the economy. The losses from their monetary policy, however, far outweigh the gains. As Mark Yusko pointed out, the Fed has infused the U.S. economy with $20 trillion since 2008, but economic expansion has been the worst on record—only 1.4 percent real growth. In the meantime, the country has racked up the national debt and devalued its currency. The result is rising inflation.

Yusko also contended that the devalued currency has caused the stock market to become overvalued and pointed to gold as the only true store of wealth: ‘Gold is money. It’s real money. For 5,000 years, an ounce of gold has bought a fine man’s suit.’

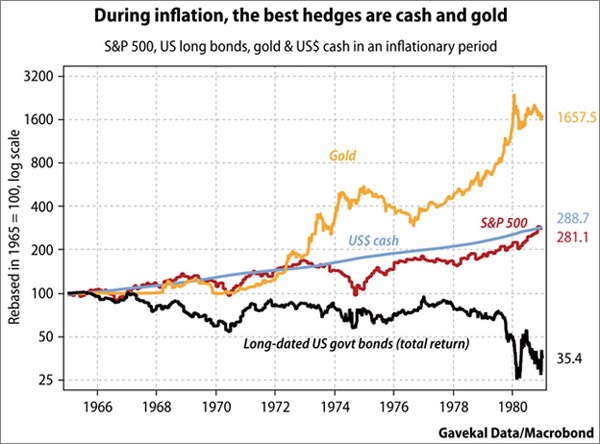

Compared to treasuries and cash, gold has been the best hedge against inflation in the past.[4]

Stock Market Crash

I’m convinced the easy money has been made.-Howard Marks, co-founder and co-chairman of Oaktree Capital Management[5]

When the same billionaire investors and hedge fund managers who predicted the last crash and backed out early are fleeing equities, it’s a good warning to do the same. Investors Sam Zell and Howard Marks both think the market is overvalued and the time for caution has come.

Even the Fed admits it, ‘Current valuation ratios for households and businesses are high relative to historical benchmarks … we find that the current price-to-earnings ratio predicts approximately zero growth in real equity prices over the next 10 years.’

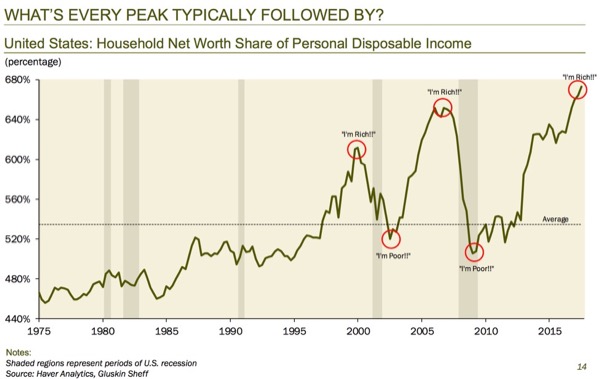

When household net worth’s share of personal disposable income peaks, a stock market crash usually follows.

When the next crash comes, Fed chairman Jerome Powell won’t bail out the market, predicts the chief executive officer of DoubleLine Capital Jeffrey Gundlach. Citing classic technical chart reading, Gundlach sees a massive ‘head-and-shoulders bottom’ base pointing to a $1,000 jump in gold prices.

Recession

We are seeing a significant shift in the markets. The Fed was responsible for 1,000 rally points this cycle so we have to pay attention to what happens when the movie runs backwards.-David Rosenberg, chief economist and strategist at Gluskin Sheff & Associates Inc[6]

David Rosenberg, the economist who predicted the Great Recession is making news headlines again, warning that another one is on the way and could hit by the end of the year. The Fed’s tightening of its monetary policy is one of the main reasons behind his forecast. Out of the 13 cycles that the Fed has raised interest rates since 1950, 10 of them have ended in recession, Rosenberg argues.[7] Like other market analysts, he also sees the trade war as a factor driving the next economic downturn and forecast another consequence of U.S. protectionism: a weaker dollar. “There’s no better hedge against a weak dollar than gold,” said Rosenberg.

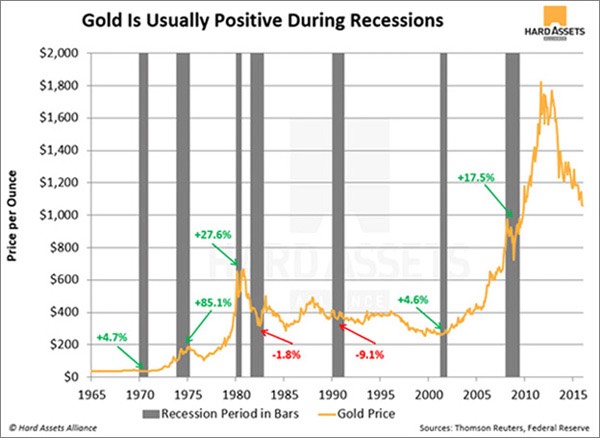

Investors turn to gold during recessions. Gold rallies have accompanied 5 out of the last 7 economic turndowns.[8]

Heed Expert Warnings to Buy Gold!

Experts across the financial markets—not just gold bugs—are warning investors to get out of equities and seek the safety of gold. The yellow metal may be performing like a commodity now, but soon it will be a coveted safe haven. When that time comes, the portfolio protection gold offers will come at a steep price.