$1,400, $1,500, and even as high as $174,000—these are just some of the gold price forecasts for 2019 from industry insiders. With physical demand for gold surging at the beginning of the 2nd quarter, experts foresee a gold price breakout soon.

But investors cannot rely on price predictions alone to determine whether or not 2019 is the year to buy gold. An examination of the factors underlying potential shifts in the price of gold is in order first. Only then can investors take a holistic view of the gold market and, in turn, the direction of prices for the yellow metal.

Learn more about the factors influencing the price of gold this year below.

Read the latest year’s post here: Is Gold a Good Investment?

Everything you need to know to get started in Precious Metals

Learn how precious metals can strengthen your portfolio, protect your assets and leverage inflation.

Why Is Gold a Good Investment in 2019?

Markets historically cycle from boom to bust. After 10 years of economic expansion and overvalued equities, the time for contraction has come. Gold demand, already growing, typically surges during economic and financial market downturns. Specifically, there are 7 reasons investors will want to buy gold in 2019.

7 Reasons to Buy Gold this Year

- Central Banks’ Gold Buying Spree Continues

- Gold Supply and Demand Supports Higher Prices

- Gold Shines as a Safe-Haven Investment

- U.S. and Global Debt Soar

- U.S. Dollar Weakens

- Global Currency Crisis Worsens

- Fed’s Interest Rate Hike Cycle Ends

Get in-depth coverage of each of gold’s major market movers in 2019 below.

1. Central Banks’ Gold Buying Spree Continues

Central banks fortified their asset spreads to the tune of 651.1 tons of gold in 2018. With national gold purchases up 74 percent compared to 2017, it was the largest institutional gold buying spree since the gold standard ended in 1971.[1]

Why are central banks hoarding gold?

- The “desire to de-dollarise foreign exchange reserves in response to deteriorating geo-political relations in some parts of the world,” explains the World Gold Council.

- To diversify their countries’ portfolios.

- In an effort to protect their markets and economies amid structural changes in the international financial system.

Central banks aren’t the only heavyweight gold buyers in this market, either. Influential Wall Street players have also been buying up physical precious metals.

Will you be following smart money into gold in 2019?

2. Gold Supply and Demand Supports Higher Prices

Gold glittered for buyers across varied sectors in 2018, enjoying a healthy 4 percent increase in demand, reported the World Gold Council.

Gold Demand Drivers

Central Banks

As mentioned earlier, central banks accounted for much of the growth in gold demand last year, with these institutions adding 651.5t to their official gold reserves.

Investors

Stock market volatility and geopolitical uncertainty throughout the second half of the year sent investors into safe-haven assets. Gold bar and coin buying jumped 4 percent in 2018.

Retail

Consumer purchases of gold jewelry remained steady at 2,200t. The U.S., China, and Russia were among the top buyers.

Technology

The technology sector saw marginal growth last year, using 334.6t of the yellow metal in devices like smartphones and printed circuit boards. Still, gold demand in 2018 was the highest since 2014.

Gold Supply

The supply of gold inched up 1 percent last year to 4,490t thanks to increased recycling and record mine production.

Gold Supply Sources

Gold Mine Production

Despite continually slowing growth, mine production rose 1 percent to 3,346t in 2018, setting the record for the highest level of yearly output ever.

Gold Recycling

After spiking 14 percent in 2016, levels of gold recycling returned to more historical norms by the end of 2018, with annual growth increasing 1 percent to 1,172.6t.

3. Gold Shines as a Safe-Haven Investment

“2019 is the year ‘bad seeds’ are being planted that will eventually threaten the entire global order.–Ian Bremmer, Time magazine.

All across the economic, financial, and political landscape, one can see those dark seeds sprouting.

Domestic and International Economy

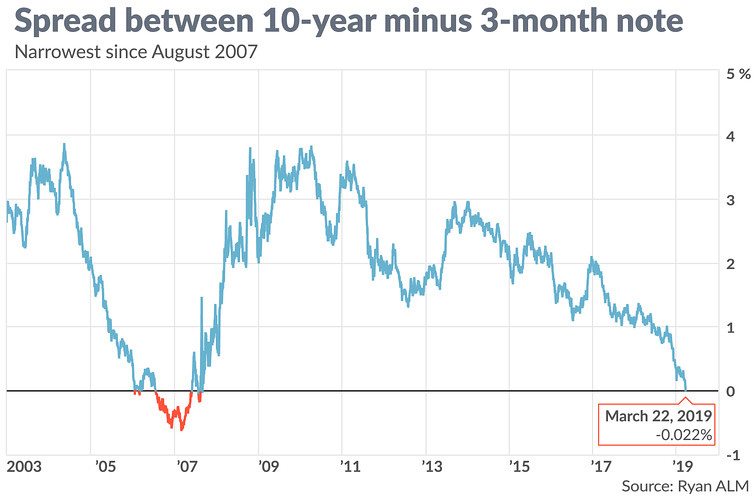

Yield Curve Inverts

On March 22, 2019, the yield on the 10-year Treasury note dipped below the yield on the 3-month T-bill, sending waves of shock through the stock market. What happened? Weak economic data from the European Union triggered a global bond rally. Historically, when this yield curve inverts, a recession follows.

Source: https://www.marketwatch.com/story/the-yield-curve-inverted-here-are-5-things-investors-need-to-know-2019-03-22

U.S and Global Economy Slows Down

“All major economies and most big emerging-market economies are deteriorating,” read the headline of an article published in the Wall Street Journal on April 9, 2019. The International Monetary Fund predicts 70 percent of the global economy will be weaker this year and recently cut its global growth outlook to the slowest pace since the financial crisis. After originally forecasting 3.5 percent growth for the world economy, the IMF revised the number to 3.3 percent.

U.S. economic growth was downgraded from 2.5 to 2.3 percent.[2] This aligns with data showing that a gauge of U.S. factories fell in April to the lowest point since 2016.[3]

Financial Risk Threatens World Markets

Healthy stock market performance at the start of 2019 is by no means a predictor of a strong finish at the end of the year. Recall that equities enjoyed an impressive open in 2018—until stock market volatility rattled them, resulting in the market’s worst year in a decade. Experts at Morgan Stanley predict disappointing earnings reports, lackluster GDP growth, and a rolling bear market to plague investors throughout the remainder of the year.

Globally, signs of economic slowdown or new trade disputes could inject uncertainty into the financial markets, many of which have experienced volatility following the release of weak economic reports.[4] (Read “Why Stock Market Volatility Is Here to Stay”)

We see a narrow path ahead for risk assets to move higher. Yet rising risks could knock markets off this track. This calls for carefully balancing risk and reward in portfolios.

U.S. and Geopolitical Problems Persist

Party clashes under the divided Congress in the U.S. have brought political uncertainty and government shutdowns. In fact, the shutdown that started on December 22, 2018 and ended 34 days later was the longest in the history of the country.[5] Such events can deal a major blow to the economy, already petering out at the tail end of one of the longest expansions on record.[6]

Then there are the numerous threats to the world order: a cyber confrontation with Russia, the implosion of Europe, war with Iran, and escalating protectionism, notes the Eurasia Group. However, we’re unlikely to see these issues erupt this year. Distraction is the real threat in 2019, as world leaders, too busy handling local crises, ignore these growing problems.[7]

During times of economic downturn, financial crisis, and political unrest, the value of paper-backed assets can plummet. A store of wealth for civilizations for centuries, only gold can weather such tumultuous times, making it the ultimate safe-haven investment.

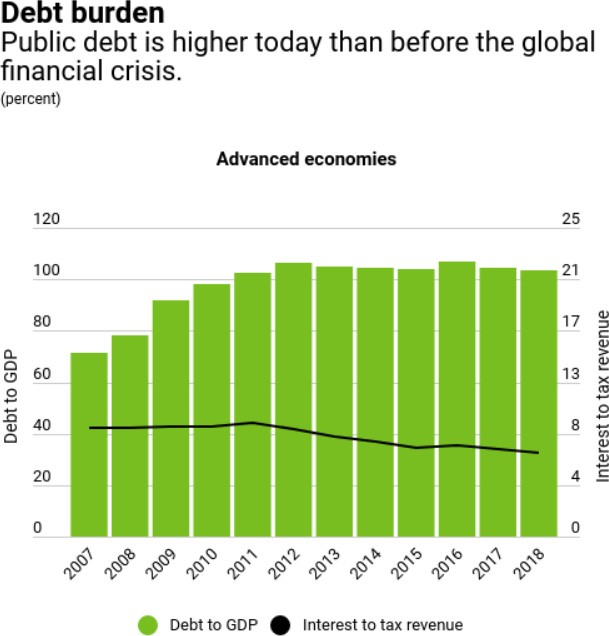

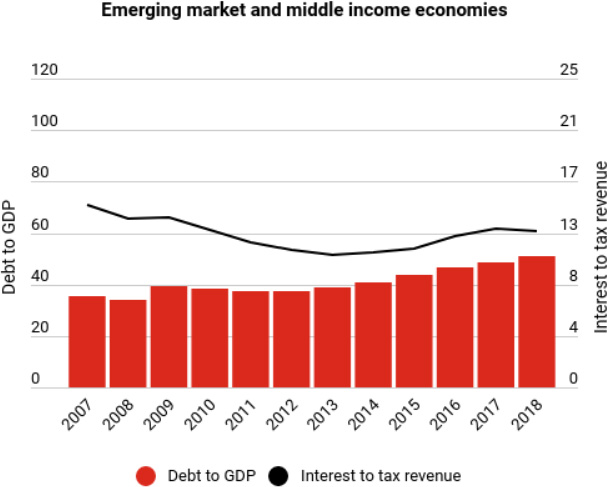

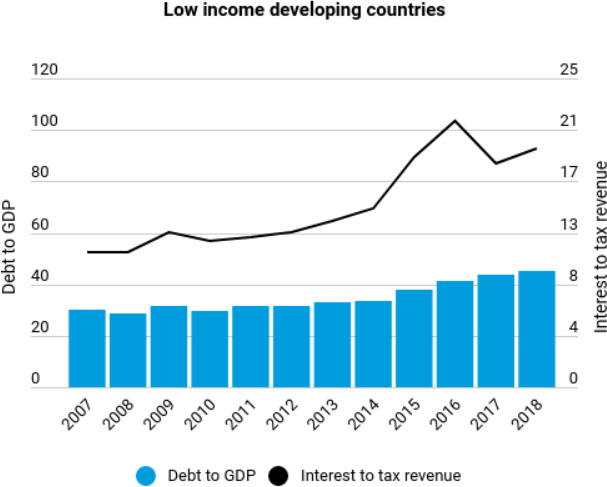

4. U.S. and Global Debt Soar

Soaring public and private debt in the U.S. and around the world could undermine economies and, in turn, their currencies.

U.S. Debt

U.S. Public Debt

Since 2012, U.S. national debt has surged 44 percent from $15.2 trillion to more than $22 trillion, far outpacing that of other developed countries. Total U.S. debt is now about 10 times the size of Germany, France, the U.K., and Italy combined, according to Fitch Ratings.

The portion of this debt the federal government will have to make interest payment obligations to bondholders on could reach $16.5 trillion by 2020. Imagine how expensive that would be if interest rates returned to their 30-year average of 5 percent?[8] It’s a situation that could seriously hamper government spending, which is a major driver of GDP, one of the primary sources of a country’s currency’s strength.[9]

U.S. Private Debt

Consumer spending contributed significantly to GDP, as well, accounting for 68 percent of the U.S. economy in 2018.[10] Unfortunately, consumers’ purchasing power continues to shrink as they struggle under the burden of ballooning debt; student loans, auto loans, and credit card debt have all reached record highs.

Younger generations may be the worst off. Learn why in “Attention Future Thinkers: Is America’s Global Dominance Unsustainable for Younger Generations?”

Global Debt

Global Public Debt

Globally, government debt has doubled since 2007, shooting to an astounding $66 trillion and comprising 80 percent of GDP.

Government debt levels are high, leaving many countries poorly positioned for financial tightening as global interest rates begin to move higher.-James McCormack, Fitch’s global head of sovereign ratings.[11]

‘’

Source: https://blogs.imf.org/2019/04/10/high-debt-hampers-countries-response-to-a-fast-changing-global-economy/

Global Private Debt

Nonfinancial private debt accounted for two-thirds of the $184 trillion in total global debt in 2017, more than tripling since 1950, reported the IMF.

What risks accompany such astronomical levels of debt? Recession. Currency devaluation or even collapse. Deflation. Hyperinflation.[12] How can you protect your wealth against any of these frightening scenarios? GOLD.

5. U.S. Dollar Weakens

If you look back, U.S. dollar rallies end when the Fed ends its tightening cycle. We are at that point or very close to that point.-Adam Button, senior currency strategist at Forexlive.com.[13]

Many of the trends supporting the dollar last year are already starting to reverse in the second quarter of 2019.

Trade War with China

Investors sought safety in the dollar in 2018 as the U.S.-China trade war escalated. But, with the two countries reportedly close to a deal to end some of the tariffs, the greenback could lose its appeal.[14][15]

However, just when it appeared trade relations between the world’s two largest economies were improving, President Trump threatened to hike tariffs after China pulled back on trade promises. Further escalation of the trade war could hurt the economy and reduce U.S. GDP by .01 percentage point, which would ultimately weigh on the dollar.

Interest Rate Hikes

The Fed dropped interest rates to zero during the financial crisis and recession. The agency’s latest monetary policy tightening cycle began when it raised rates to 0.5 percent on December 17, 2015. On March 21, 2019, the FOMC raised rates to 2.5 percent, the level that typically maintains a healthy economy.[16]

At its latest meeting on April 30, the agency did not raise rates, with Fed Chairman Jerome Powell indicating there was not a strong case to hike or reduce rates—despite President Trumps’ urgings to cut them. Did this last meeting signal an end to the Fed’s rate hiking cycle? If so, the dollar could fall as international investors turn to currencies with higher yields.[17]

Economic Slowdown

As mentioned before, a robust economy and GDP underpin America and the dollar’s dominance in global financial markets. A decelerating U.S. economy could soften global investor confidence in the country’s currency.[18]

When could the next economic downturn hit? Read “The Next Recession: Is a Recession Coming in 2019?”

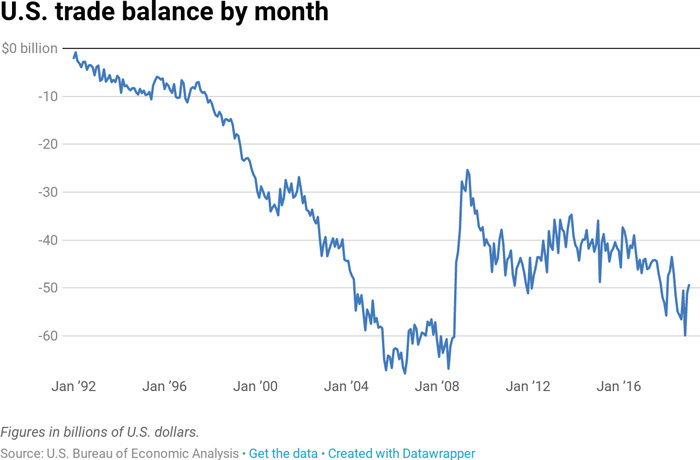

Trade and Budget Deficit

With distractions like the trade war and record-long expansion out of the way, market participants may again worry about the trade and budget deficits, which could also shake support for the dollar.[19]

Source: https://www.cnbc.com/2019/05/07/worst-case-scenario-if-trump-starts-a-trade-war-with-china.html

Given its inverse relationship to gold, a dollar crash could catapult prices for the yellow metal.

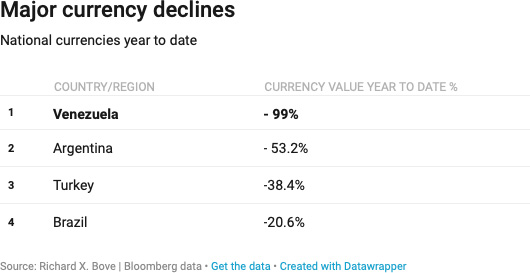

6. Global Currency Crisis Worsens

The greenback may not be the only threat to the paper currency experiment. As of September 2018, a review of 143 currencies around the world revealed that more than 80 percent had deceased in value.[20]

Source: https://www.cnbc.com/2018/09/20/dick-bove-theres-a-global-currency-crisis.html

Why? Disparate monetary policy and economic conditions. The Fed has been raising interest rates and the U.S. economy’s record long expansion continues to run. Meanwhile, growth has been sluggish or nonexistent in other nations, resulting in more lax policies. Some nations are still clinging to quantitative easing.

Currency declines bring further trouble to these struggling economies: increasing inflation, rising interest rates, and delayed economic development as funds are increasingly diverted to overseas debt payments. And when the global economy grinds to a halt, the impact on the U.S. is unescapable.

This alarming state of affairs is a testament to widening fractures in the foundation of the paper currency system. Which could collapse first—the fiat system or the global economy? Only time will tell, but savvy investors can certainly prepare by diversifying away from paper assets into gold.

7. Fed’s Interest Rate Hike Cycle Ends

As mentioned earlier, the Fed did not raise interest rates at its April 30 FOMC meeting, signaling a potential end to its cycle of monetary policy tightening. At least for the remainder of 2019, the Fed does not anticipate increasing rates again.

This means investors can’t expect to see their returns on interest-bearing assets increase any further, so such investments lose some of their appeal. Indeed, the markets delivered a clear sign of the shift in investor sentiment: gold prices jumped into positive territory following announcement of the Fed’s decision.[21]

Source: https://www.tradingview.com/x/grvWnZci/

Taking a larger view of the situation, however, suggests especially favorable conditions for gold. The Fed isn’t raising rates because it expects the economy to ‘slowdown.’ It recently reduced its forecast for U.S. economic growth for 2019 from 2.3 percent to 2.1 percent. In addition, the Fed indicated by September it would stop decreasing its bond portfolio in response to falling domestic and global economic growth.[22]

A weaker economy can often mean a softer equities market, and when stocks are down, gold is typically up, making the yellow metal an excellent play for portfolio diversification and protection.[23]

Learn more about why gold prices are rising.

Is Buying Gold a Good Investment for You this Year?

An in-depth analysis of the gold market suggests that the predictions for rising prices are well supported; 2019 will likely be the year of major shifts in the financial markets, economy, and politically at home and around the world that favor safe-haven investing and portfolio diversification.

The real question, then, is when to buy gold this year. And the answer is Now. Investors who wait until the end of 2019 may pay a steep price for the wealth protection of gold.

Have you added precious metals to your portfolio yet?