The extraordinary policy actions to prevent a second Great Depression have had important side effects.–International Monetary Fund[1]

It’s been ten years since Lehman Brothers, the fourth-largest U.S. investment bank, collapsed, triggering the worst economic crisis since the Great Depression.[2] Central banks took drastic and unprecedented measures to ensure 2008 wasn’t a repeat of 1930, or worse, a financial crisis of global proportions.

Now, the same loose monetary policy that saved the economy and fueled what’s become the longest expansion and bull market run in history could be to blame for the next crash, which analysts predict will hit soon. J.P. Morgan projects by 2020.[3] The scariest part? This time around central banks won’t have the same crisis management tools to rescue the financial system.[4]

Financial Risks Render Markets Vulnerable

Underlying the booming economy and bull market are financial vulnerabilities, many of them products of central bank monetary policy.[5]

Debt Crisis

‘The extended period of ultralow interest rates in advanced economies has contributed to the build-up of financial vulnerabilities,’ warns the IMF[6].

Historically low interest rates have been the cornerstone of central banks’ monetary policy since 2008.[7] In response to the financial crisis, the Federal Reserve dropped its benchmark interest rate to nearly zero and vowed to “print as much money as necessary to revive the frozen credit markets” and fight recession. Those newly minted funds went to purchase massive amounts of longer-term Treasury bonds, mortgage-related bonds, consumer loans, and corporate debt.[8]

After years of cheap credit, the world now faces a debt crisis. In fact, the world economy is worse off than before the last financial crisis, reports the IMF. In 2009, debt accounted for 213 percent of global GDP; in 2016, this number jumped to 225 percent. Major contributors to the problem were China, tax cuts and stimulus in the U.S., and emerging markets.

When rates rise, “unregulated sectors of the financial system could panic,” said the IMF. Markets saw glimpses of this frightening prediction coming true when the Fed raised interest rates to a range of 2 percent to 2.25 percent in late September 2018, triggering a massive stock market selloff during the second week of October.[9]

Stock Market & Household Wealth Bubble

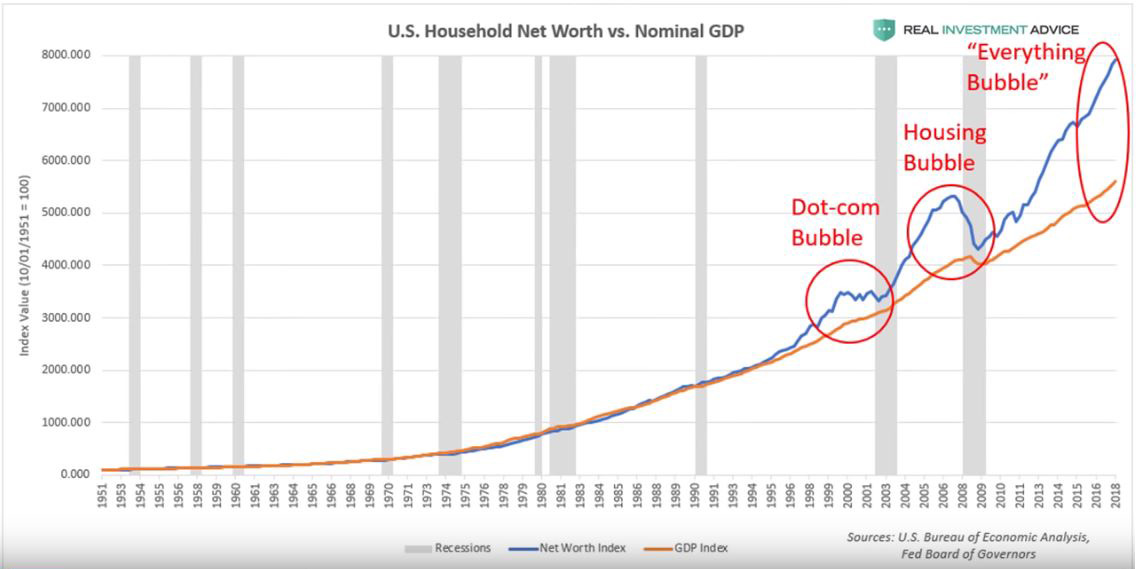

Overvalued equities have contributed to a U.S. household wealth boom since the Great Recession, priming Americans for a worse crash than 2008, argues Clarity Financial analyst Jesse Columbo.

Last June, household wealth topped $100 trillion, surpassing the gross domestic product. This hasn’t occurred since the dot-com bubble of the late 1990s and the housing bubble of the mid-2000s, and we all know the outcome of those events.

“‘Extremely-inflated’ equities drive up that wealth, but such as in prior busts, they drag it right back down when a bear market, or decline of at least 20 percent from a recent market peak, takes hold,” explained Columbo.

Financial Sector Deregulation

Many of the financial regulatory leaders President Trump appointed were once Wall Street heavyweights: Treasury Secretary Steven Mnuchin is a former Goldman Sacks partner; SEC Chairman Jay Clayton was a partner a Sullivan & Cromwell; and Comptroller of Currency Joseph Otting left a position as vice chairman at U.S. Bank.

Their expressed goal is to reverse the financial regulations put into place following the 2008 Wall Street meltdown.[10]

Big Banks

With banking giants, such as J.P. Morgan, bigger than ever, deregulation could certainly trigger a repeat of 2008. Currently, just ten banks own more than half of the assets of the 100 top-tier commercial banks. J.P. Morgan has notched 100 percent growth since 2008.

In the absence of a regulatory safety net, these banking behemoths could crash even harder than last time.

Cryptocurrencies

If repeated Bitcoin crashes and scandals weren’t enough to deter investors from digital currencies, this IMF warning just might:

‘Despite its potential benefits, our knowledge of its potential risks and how they might play out is still developing,’ wrote the IMF in its global financial stability report.

Cybersecurity

The last of the IMF’s major risk factors was cybersecurity. The organization warned that financial institutions, supervisors, and infrastructure were all at risk.[11]

Crisis Management Resources Limited

Much has changed since 2008: the shift from active to passive investing; the rise of protectionism; and the tightening of monetary policy by central banks around the globe. As such, the world is less equipped to handle another financial crisis than it was ten years ago.

Market Liquidity Crisis

The increase in index funds, quantitative-based trading strategies, and exchange-traded funds has resulted in a decrease in actively managed investing; these now account for only about one-third of managed equity assets, escalating the danger presented by market downturns, wrote Marko Kolanovic of J.P. Morgan and colleagues Jan Loeys and Joyce Change:

‘The shift from active to passive asset management, and specifically the decline of active value investors, reduces the ability of the market to prevent and recover from large drawdowns.’

Limited Central Bank Resources

When the next crash hits, central banks will not have trillions of dollars to infuse into the economy again and, therefore, won’t be able to rescue the financial system the same way it did in 2008, predicts the IMF.[12] (Read “What Is Quantitative Easing?”)

Fewer central bank financial resources could result in a longer and, perhaps, worse recession. And the longer a downturn lasts, the greater its impact on the markets, indicates analysis by J.P. Morgan of past episodes:

‘The recession’s duration is a powerful drag on returns, which should dovetail with some readers’ concerns that policy makers lack the necessary monetary and fiscal space to extract economies from the next recession,’ wrote J.P. Morgan strategists John Normand and Federico Manicardi.[13]

Lack of Global Unity Due to Protectionism

The IMF noted that ‘societal support for openness and global economic integration appears to have weakened in many countries after the [2008] crisis,’ making way for the rise of protectionism. Former British prime minister Gordan Brown went further to predict that the erosion of global unity due to this political shift could result in an even worse downturn. During a recent speech, Brown said he feared “the world economy was ‘sleepwalking into a future crisis.”[14]

Learn more about U.S. protectionism in “Why Buy Gold During a Trade War?”

How to Prepare for the Next Financial Meltdown

What happens on Wall Street can have a significant impact on everyday Americans: from layoffs to diminished retirement savings. While workers can often find new jobs, they cannot recover lost savings, so the hit to retirement portfolios can have much longer lasting consequences, especially for older Americans dependent on this income.

Even the creator of the 401(K), Ted Benna, is concerned: ‘2008 was pretty nasty, but I’m expecting the next one to be worse… What concerns me about today is a change in the way people perceive risk.’ Benna explains that too many people consider bonds a safe place compared to stocks during downturns. But, as interest rates rise, bond prices decrease. Stocks and bonds can be risky.

He went on to say, ‘it’s the fact that most retirees right now in this market can’t afford what they’re in—unless we magically skip another 2008. But I’m not counting on that.’ Benna encourages investors to rollover unpenalized 401(K) funds into IRAs.[15]

Do you know what the best type of IRA during a financial crisis is? A well-diversified one (Read “What Is Diversification?”). Why rollover a 401(K) into an IRA but still sink all your savings into the market right before it nosedives?

A self-directed IRA is the solution. It allows investors to include gold, silver, platinum, and palladium in their retirement accounts. When the value of paper assets plummets and that of gold soars—as typically occurs during downturns—your retirement savings will be secure. Read more about How a Precious Metals IRA works.