Gold is going to shock people.–

Whether you’ve been in the market for decades or days, the past few weeks have been a completely new experience. The price ceilings have been shattered with gold on the move. Amid all the excitement, savvy investors wonder how long the ride will last.

In this week’s The Gold Spot, Precious Metals Advisor Joe Elkjer and Senior Precious Metals Advisor Damian White explain the background of gold’s massive jump and how high the precious metal could go based on historical analysis.

Gold Prices on the Move

To the untrained eye, gold’s explosive rise might seem out of the blue. However, this upward price action is the continuation of the Cup and Handle Pattern that gold charts formed in January. Gold prices had been consolidating for a significant amount of time while showing inclinations to the upside. Now, we’re experiencing that slingshot effect as gold prices routinely blast through new records.

Entering a Commodities Supercycle

Gold is breaking out for the first time in 15 years.–

At first, the speed and scale of this growth might seem unsustainable. However, a better understanding of the broader economic climate puts gold’s recent highs in the proper context. Right now, the market is entering into what’s known as a commodities supercycle. These periods, which last around a decade, see commodities such as precious metals, oil, wheat, and even cocoa achieve abnormal growth.

Inflation is the primary driving force behind these exponential price increases. A devaluing currency means it increasingly costs more to buy the same amount of a particular commodity, thus increasing its value. Additionally, economic uncertainty drives investors into safe-haven assets, many of which are commodities.

Gold’s current surge is one example of how commodities can move during a supercycle when inflationary pressures escalate. These confident moves clearly indicate gold’s further upward trajectory. It’s been over a decade since the past commodities supercycle propelled gold prices to unprecedented highs. Now, that history is repeating.

Incoming Tailwinds for Gold Prices

Global Instability

Conflicts are ablaze across the globe, with the Russian invasion of Ukraine nearing its third year, Iran threatening to turn the Israel-Hamas battle into a regional war, and China continuing to put pressure on Taiwan. This worldwide instability is driving more and more people into gold and other physical assets with inherent value.

Rate Cuts

The Federal Reserve is deadset on cutting rates. It’s only a question of timing. Initially, Fed leaders pointed to three rate cuts in 2024, but less-than-ideal CPI numbers have likely pushed that out to 2025. Regardless, the rate cuts will inevitably weaken the US dollar. Instead of leaving their wealth parked in a devaluing currency, investors will seek protection from gold.

US Debt

The failed fiscal policies of limitless printing and spending have dug the US economy into a $34 trillion hole. Our towering national debt—which is growing by $1 trillion every 100 days—has driven countries away from the US dollar and dollar-linked assets. In lieu of a stable world reserve currency, central banks are opting for gold.

Flashback to the 1970s

Experienced investors are drawing parallels between today’s economic climate and that of the late 1970s. Both periods are marked by high inflation, high-interest rates, and widespread uncertainty. Notably, inflation came in waves during this period, leading many people to think another bout of inflation is around the corner.

Despite a strong dollar and high-interest rates, gold went on an unprecedented tear in the 70s. Today, gold is once again showing tremendous strength as people seek protection from a dying dollar.

People are buying gold regardless of price to protect themselves from the devaluation of currencies.–

Between the 70s and 80s, gold went from just $60 to over $800/oz. If that same growth spurt were to happen today, gold prices would surge over $30,000/oz! That might sound insane initially, but there’s already a clear precedent, and the economic situation is eerily similar.

Experts Adjust Their Gold Price Forecasts

We’re not alone in saying gold prices are going higher. The combination of gold’s surge and deteriorating economic conditions has prompted many experts to adjust their projections. More and more people are calling for a $3,000/oz gold this year.

Bank of America, a reluctant gold advocate, has said gold prices will reach this point by 2025. Similarly, Citi thinks it will happen in the next 6 to 18 months. Famed commodity investor Dennis Gartman posits this record will hit in a couple of years. While the details might vary, it’s clear that gold price forecasts for 2024 are moving higher.

👉 Related Read: Gold Price Forecast for 2025

Don’t Wait to Buy Gold, Buy Gold and Wait

The tried-and-true investment wisdom about not waiting to buy gold is more important now than ever. Investment instincts might tell you to hold back until prices cool off, but all economic indicators and historical analysis point to gold prices going higher for longer.

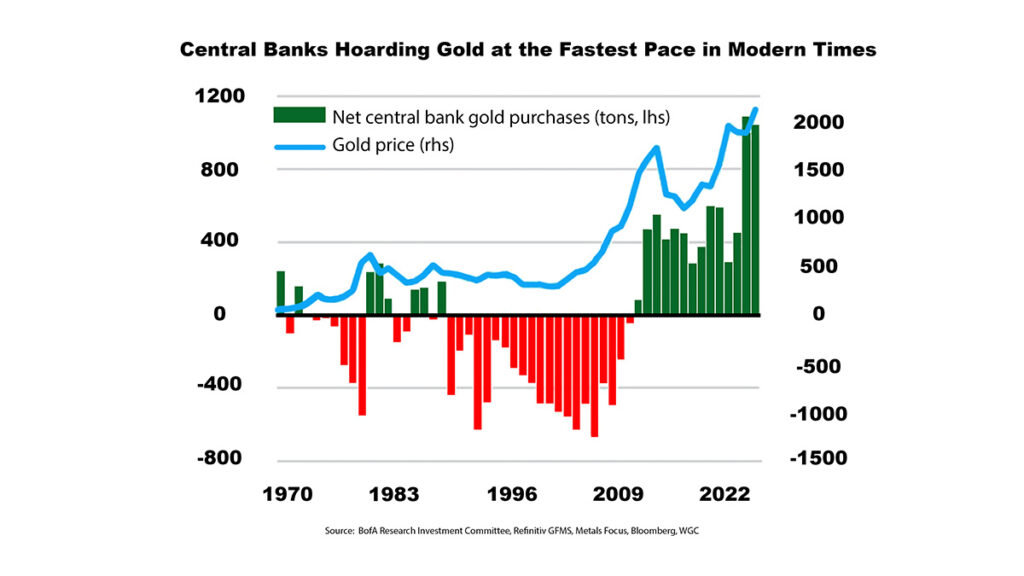

Just look at the playbook of the world’s most knowledgeable, experienced, and wealthy investors. Central bank gold demand has sustained record highs over the past few years.

They’re not trusting their wealth with failing fiat currencies, so why should you? With gold prices on the way to higher evaluations, investing now ensures more significant gains in the long run. Don’t get left behind.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields