There’s been a record-setting trend of central banks buying gold, and the momentum is only ramping up. This decisive move away from traditional, paper-backed assets to precious metals is sending a clear message: the fiat economy isn’t to be fully trusted. Understanding why central banks are buying gold at astronomical rates can put you in a better position to protect your wealth.

There’s been a record-setting trend of central banks buying gold, and the momentum is only ramping up. This decisive move away from traditional, paper-backed assets to precious metals is sending a clear message: the fiat economy isn’t to be fully trusted. Understanding why central banks are buying gold at astronomical rates can put you in a better position to protect your wealth.

Central Banks Shift From Selling to Buying

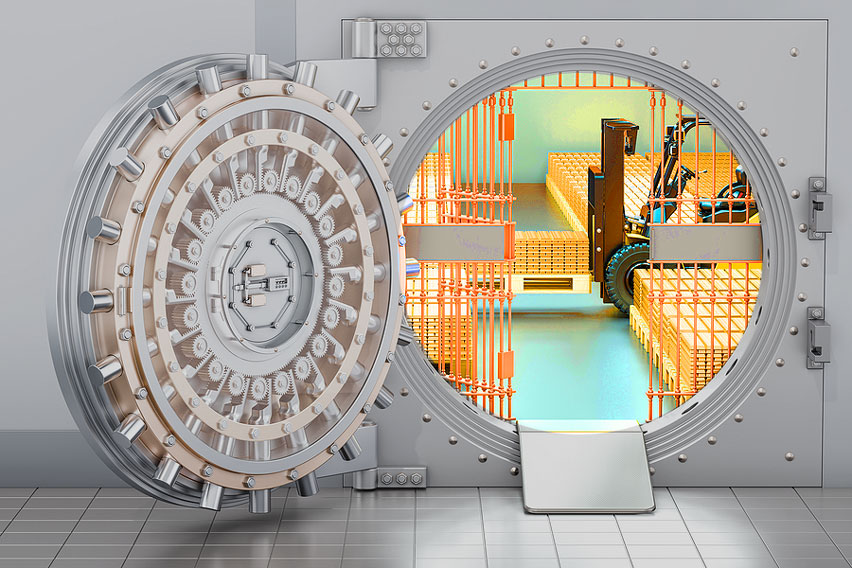

Central banks buying gold is nothing new. Nearly all governments have maintained sizeable reserves even after abandoning the gold standard. This valuable metal has consistently been the go-to asset for promoting confidence and maintaining stability in domestic economies. What’s catching people’s attention is the stark uptick in gold buying on the back of several decades of net sales.

From the 1990s to the early 2000s, auspicious economic conditions created a sense of confidence in the global economy. The resulting higher risk tolerance allowed governments to spend and invest more in paper markets while loosening their grip on safe-haven assets such as gold. For a few decades, the paper monetary system seemed to operate smoothly, lending credence to the prevailing Modern Monetary Theory (MTT).

This confidence was shattered by the sweeping crash of 2008, triggering a decisive swing back toward hard assets. This initial impulse launched a long trend of central banks buying gold which shows no signs of slowing down. Just the opposite, in fact, 2023 has seen central banks buying gold at record rates. Currently, over a fifth of available gold is held by federal banking institutions.

How much gold are central banks buying?

Central banks kicked off 2022 with a bang by consuming gold at the quickest rate since 1967. The 50-year-old record was shattered with collective purchases totaling 1,136 tons. Put another way, world governments poured over $70 billion into gold reserves throughout 2022, highlighting the collective emphasis on hard assets.

The phenomenon of central banks buying gold at record rates didn’t stop there, though. In the first few months of 2023, demand hit 228 tons which marked the strongest Q1 since 2013. First-quarter purchases topped the previous record by 34%, underscoring the growing demand for precious metals.

Emerging Markets Lead Gold Rush

The US might still lead the world in total gold reserves, but emerging markets have been dominating when it comes to accumulation. Between 1999 and 2021, the five biggest gold consumers were Russia, China, Turkey, India, and Kazakhstan. Together, Russia and China accounted for 31% of the world’s gold demand during the period. Both the Kremlin and Beijing have upheld their titles through 2023 by leading gold purchases midway into 2023 with India still trailing closely in third place.

If you’ve noticed that many of the central banks buying gold are members of the BRICS nations, you’ve stumbled upon a crucial development. This powerhouse of emerging economies is quickly gaining economic and geopolitical influence. The block is harnessing that momentum to directly challenge the current global hegemony with gold as its foundation. These countries have even floated the idea of a gold-backed BRICS currency which could flip the global economy on its head.

Related Reading: BRICS Currency: What It Is & What It Means for Investors

Why are central banks buying gold?

De-Dollarization

Over the past few years, the process of de-dollarization has accelerated as more countries excitedly move away from the US dollar. Since the greenback has been the singular world reserve currency for decades, central banks have been turning to gold for stabilization and protection during this transitionary period. While a diverse range of motivations underpin this dollar decoupling, the end result is a global shift from USD to gold. The more central banks invest in gold, the less demand there is for the dollar, and vice versa.

Dollar “Weaponization”

Some countries – primarily Western adversaries – have their central banks buying gold to work around economic sanctions. These punitive measures are levied in response to threatening or outright illegal activity. Unsurprisingly, Russia and China are among the most active recipients of these sanctions which partially explains their considerable jump in gold purchases. This universally recognized and inherently valuable asset allows the Kremlin and Beijing to prop up their respective economies by circumnavigating the dollar’s influence on the world stage.

Domestic Stability

One of the strongest reasons countries are flocking to gold is to prop up their economies in the face of widespread instability and uncertainty. Despite what our financial czars might say, the reality of central banks buying gold betrays their lack of confidence in paper money. At the end of the day, world leaders are going to do what’s in the best interest of their domestic economies. This massive shift toward gold reveals that the largest investors in the world inherently trust physical gold assets over the failing fiat experiment.

Why should you care about central banks buying gold?

What can everyday investors learn from this recent spate of central banks buying gold? A lot, actually. The stakes are obviously higher on a national level, but the same fundamental principles apply. Just like you, central banks have a vested interest in protecting their wealth from the defects of the fiat monetary system.

“Central Banks like Fed are buying gold. Does this mean fiat money is safe? Hell no! Central Bankers are saving themselves from their own incompetence, that’s why they buy gold. Their job is to protect the banks not you. Get smart. Protect yourself from Central Bankers: Save Gold, Silver, Bitcoin.”– Rich Dad Poor Dad Author, Robert Kiyosaki

Unlike central banks which can always tax more to earn more, average investors have a limited amount of wealth. By the same token, the everyman usually takes the brunt of economic damage. For example, in 2022 alone, over $30 trillion was swept away from worldwide stocks and bonds. Some reports estimate that the average 401(k) lost 20% of its value.

With an untarnished track record as a reliable store of value, especially through economic uncertainty, gold is seeing renewed demand from both central banks and retail investors. In addition to informing investors, central banks buying gold reinforces this precious metal’s strength. The more gold held by governments, the steadier its price performance. That’s partially why gold price forecasts for 2023 are so optimistic.

“Central banks are buying a lot of gold despite their constant drumbeat support of fiat currency. They’re either planning something or just reacting to what’s going on in the world economy.”–Precious Metals Advisor John Karow

Invest in Gold to Protect Your Wealth

There’s a reason governments have trusted gold to preserve wealth for centuries. If you’re interested in learning more about how precious metals can secure your financial future, download a FREE copy of our Gold and Silver Investment Guide. It’ll take you through everything you need to know about diversifying with precious metals to protect your wealth no matter what the economy throws your way.