One of our viewers recently asked about the technical analysis behind the robust predictions for gold prices. Understanding the economic and geopolitical backdrop is fundamental when forecasting prices, but an in-depth look at the charts can reveal some helpful insights, too.

In this week’s The Gold Spot, Precious Metals Advisor Damian White and Scottsdale Bullion & Coin Founder Eric Sepanek explain the “Cup and Handle” Pattern, why it’s bullish for gold, and how high gold spot prices could go soon.

What is Technical Analysis?

Before diving into the gold price charts, let’s take a step back to understand the purpose of technical analysis. This trading strategy looks at the past performance of an asset’s prices to make informed predictions about future trajectory. Many changes and patterns, as revealed in price charts, tend to repeat themselves over time. Pinpointing these trends can help investors understand an asset’s potential performance holistically.

The Cup and Handle Pattern

The Cup and Handle Pattern is a technical formation characterized by a rounded bottom resembling a cup followed by a more minor pullback forming the handle, typically indicating a potential price surge.

“[The Cup and Handle]...is a very common pattern on Wall Street. And it's…usually…one of the most bullish patterns that an asset can form.”

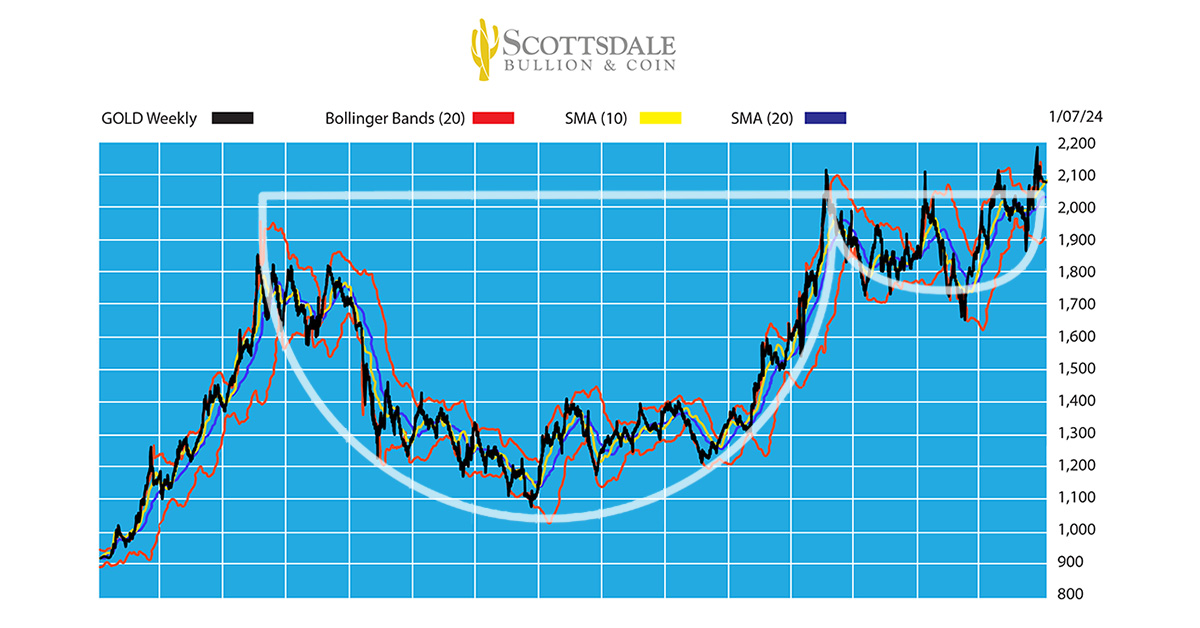

Over the past few days, gold prices appear to be completing the handle of this bullish pattern. The chart below shows gold prices rising from over $800 an ounce to nearly $1,900 an ounce. During this period of growth, buyers overtook sellers. Soon after, sellers took over, and gold prices fell for a few years, creating the cup’s first side. Eventually, sellers and buyers reached a stalemate, which showed up as a sideways price movement. This forms the bottom of the cup.

Cup and Handle Pattern forming in the gold price chart.

In mid-2019, gold buying kicked back into gear, and prices rose to set a record. This surge is the other side of the cup. Over the past few years, you can see gold prices have struggled to break that ceiling, retesting it many times before eventually setting an all-time high. That constant upward momentum without a severe drop in value is forming the handle of the pattern.

The Pressure is Building

This particular Cup and Handle Pattern is 15 years in the making, which is a fairly reliable indicator. The past few years have been a stalemate between buyers and sellers. This back-and-forth builds pressure, indicative of an incoming surge in gold prices.

“The pressure that's being built is going to relate to an explosion of [gold] prices to the upside.”

With gold prices hovering around a record high and refusing to retreat, gold indicates its desire to go up. Looking back at the first price explosion preceding this Cup and Handle Pattern, gold prices jumped around $1,000 an ounce. Given the pressure mounting from stubborn inflation, incoming rate cuts, economic turmoil, geopolitical conflagrations, and other factors, it’s safe to assume the price of gold will shoot up dramatically, possibly in 2024.

“I…say we probably have about a $1,000 move in our future, which is about a 50% move from where we are right now.”

How High Will Gold Prices Go?

Bullish technical patterns, strong gold price action, and a weakening global economy all contribute to a healthy gold price forecast for 2024. While it’s impossible to say with certainty, many analysts predict gold will hit new highs in the coming year. This Cup and Handle Pattern is reaching maturity, indicating that gold prices could break out in 2024. By the end of 2025, we might even see gold at $3,000 an ounce!

Don’t Wait to Buy Gold, Buy Gold and Wait

Everything suggests that gold is a good investment in 2024. Right now, you have a limited opportunity to scoop up this precious metals asset at a discount before gold prices break out to the upside.

If you want to maximize your gold and silver investments, request a FREE COPY of our insightful Gold and Silver Investor Report.

Related Resources

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields