Global economic conditions deteriorated further during the short trading week following the Labor Day weekend. Against the backdrop of an emerging market currency crisis, not only did President Trump threaten to levee another $200 billion on Chinese imports but also introduced the possibility of taxing all goods from the country should its leaders refuse to open its markets wider to U.S. companies. With the U.S. Mint running out of the 2018 American Silver Eagle bullion coin following a spike in sales, it’s quite possible many Americans spent the holiday hedging against the looming financial crisis with precious metals.

Geo-economic risk has been a huge force in the silver market all summer and may continue to be into the fall, but what else moves the price of silver? Find out in “10 Factors that Influence Silver Prices.”

Silver Price Movement Indicators

Monday, September 3, 2018

Higher Oil Prices

Oil prices neared two-month highs in London as Asian buyers cut back on purchases from Iran in the weeks before U.S. sanctions against the country become effective. Iranian oil exports consequently dropped to under 2.1 million barrels a day, levels not seen since March 2016.

‘Underpinning the prevailing bullish sentiment is the increasingly supportive supply outlook. Much of this owed to the downswing in Iranian oil shipments,’ wrote Stephen Brennock, an analyst with PVM Oil Associates.

Plunging production in Venezuela and the August outage of the North Sea Buzzard oil field added to market concerns of shrinking oil supplies, helping to boost prices. West Texas Intermediate for October delivery hit $70.10 on the New York Mercantile Exchange, which didn’t settle due to the Labor Day holiday. Brent futures for November settlement closed at $78.15 a barrel on the London-based ICE Futures Europe exchange, the highest level since July 10.

Higher oil prices can drive up inflation because producers and consumers pay more for fuel. When inflation rises, smart investors protect their portfolios by investing in gold and silver because, unlike paper assets, they maintain their value. Thus, precious metals prices increase.

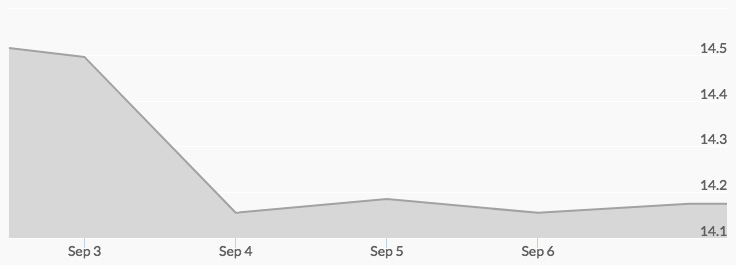

Despite the light holiday trading day, the price of silver rose from the midnight low of $14.42 to the high of $14.49 at 4 am and 11 am.

Tuesday, September 4, 2018

Declining Solar Demand

An excellent conductor of electricity, silver has been an important component of solar panels in recent years. Although only a small amount of silver is used for each solar panel, the precious metal accounts for about 47 percent of its value. To cut down on costs, manufacturers have been reducing the amount of silver in their solar panels. Instead they’ve been employing screen printing and inkjet technologies to replace the white metal with a combination of aluminum, copper, and nickel.

The transition to using less expensive industrial metals could prove detrimental to the environment and silver prices. Recycling solar panels can be costly, and owners may have less incentive if there is less silver to reclaim from them.[1] In 2017, 19 percent of the demand for silver came from solar photovoltaic manufacturers. (Learn more in “Silver Supply and Demand: 2018 Outlook.”) This could decrease as other metals are used, resulting in more silver on the market and, potentially, lower prices.

Silver prices traded in a similar range to Monday, pulling back from the midnight high of $14.45 to the 10 am low of $14.05.

Wednesday, September 5, 2018

Surge in American Silver Eagle Coin Sales

Sales of American Eagle coins have been soaring, reported CoinNews.net on Wednesday. The U.S. Mint recorded an increase in bullion sales for the first time last week and month. Investors and collectors bought 400,000 more ounces of American Silver Eagles and 6,500 ounces of all denominations of American Gold Eagles.

First released in 1986 under the Liberty Coin Act of 1985, the American Eagle silver coin is the official American silver bullion coin. An adaptation of Adolph A. Weinman’s popular “Walking Liberty” from the Walking Liberty Half Dollar coin (1916-1947) graces the obverse. The reverse features the classic heraldic eagle behind a shield, which was designed by John Mercanti. Read more about American Silver Eagle Coins.

Emerging Market Crisis

Wednesday also brought an article in which the author, John Rubino, compared the current debt crisis in emerging markets due to the rising dollar to the ‘subprime’ mortgage lending catastrophe that triggered the financial meltdown in 2008. In “Gold And Silver Are Acting Like It’s 2008. They May Be Right,” Rubino argued that Wall Street viewed both the subprime market and the emerging markets as ‘peripheral,’ and therefore a minor threat.

However, the subprime crisis of 2008 spread to the core, causing investors to panic and all assets, even gold and silver to fall. As a result, the gold silver ratio shot up to 80. The Fed slashed interest rates and infused the financial system with credit. Precious metals skyrocketed.

After years of loose monetary policy and rampant borrowing by emerging markets, the dollar has been strengthening, fueled by Fed interest rate hikes. Now, these countries risk defaulting on their debts to the U.S. and imperiling big western banks. The gold silver ratio is back at 2008 levels. And the possibility of an end to monetary policy tightening and even a reintroduction of quantitative easing could set off another bull run for precious metals. Read the full article.

The price of silver traded slightly lower on Wednesday, rising from the 3 am low of $14.10 to the 9 pm high of $14.20.

Thursday, September 6, 2018

U.S. Mint Sold Out of American Eagle Silver Coins

More flashbacks to 2008 came on Thursday when the U.S. Mint announced that a spike in demand had temporarily depleted its supplies of the 2018 American Silver Eagle bullion coin.

‘This is to inform you that due to recent increased demand, the United States Mint has temporarily sold out of its inventories of 2018 American Eagle Silver Bullion Coins,’ wrote U.S. Mint spokesman Michael White to Authorized Purchasers on Thursday.

September sales of Silver Eagles were higher than every other month in 2018, with the exception of January and August, at 1,037,500 coins. The year-to-date total was 10,275,000 coins.

Skyrocketing demand for these beautiful bullion coins resulted in the temporary suspension of sales during the Great Recession. By 2009, the U.S. Mint was also forced to suspend sales of proof and uncirculated American Eagle silver coins. Looks like ‘smart money’ is preparing for the next financial meltdown! Are you?

The increase in demand had yet to impact the price of silver on Thursday: the low of $14.13 at 2 am and 1 pm was followed by the high of $14.27 at 5 pm.

Friday, September 7, 2018

Escalating Geo-Economic Risk

Markets were rattled on Friday in anticipation of President Trump following through with his threat to levee an additional $200 billion worth of tariffs on Chinese goods after the end of the public comment period on Thursday. Brent crude oil prices, 10-year treasury yields, Asian and European equity markets, and base and precious metals were all down. The Dow was up .08 percent.

President Trump did not allay investor worries, threatening to slap tariffs on all imports from China while aboard an Air Force One flight bound for Fargo, North Dakota:

‘The $200 billion we’re talking about could take place very soon, depending what happens with them. To a certain extent, it’s going to be up to China. And I hate to say that, but behind that, there’s another $267 billion ready to go on short notice if I want. That totally changes the equation.’

Even the dollar, treated as a safe haven from trade war risks all summer, drifted after its recent attempt at rebounding. The greenback was quoted at 94.94. Many analysts believe the president is working to bring down the dollar. Learn more in “Is President Trump Telling You to Buy Gold Now?”

With the growing threat to the global economic status quo, perhaps market participants were becoming aware of the shortsightedness of seeking safety in the dollar. Marking a low of $14.08 at midnight and a high of $14.21 from 10 am to 11 am, the price of silver offered an alluring alternative. Those planning on shifting to precious metals should act quickly, though, as another round of tariffs will likely stoke demand for these tried-and-true safe havens.[2]