Economic events drove the silver market last week. A record high trade surplus with China triggered fears of a worsening of the trade war on Monday, causing investors to seek safety in the dollar, making silver more expensive for foreign buyers. However, the possibility of an agreement with Canada on revising NAFTA infused some optimism into the markets on Wednesday, weighing on the dollar and lifting commodities.

Technical analysis revealed the bottom is in for silver spot price and the top for the stock market. With equities enjoying several weeks of strong performance and silver prices remaining in a pullback, expect a reversal soon and silver to rally.

At any given moment, several forces are at play in the markets. Learn more about silver’s typical price movers in “10 Factors that Influence Silver Prices.”

Silver Price Movement Indicators

Monday, September 10, 2018

High U.S-China Trade Deficit

More bad news from the international trade front came on Monday. Customs reports indicated that China’s trade surplus with the U.S. reached a new record high in August, fueling market fears of another escalation of the trade war. The trade surplus increased to $31.05 billion in August from $28.09 billion in July. From January to August, the surplus jumped 15 percent. Meanwhile, growth in Chinese imports from the U.S. fell from 11.1 percent in July to 2.7 percent in August, while exports to the U.S. were up 13.2 percent compared to 11.2 percent in July.

The data came after President Trump shocked markets the Friday prior by threatening to slap duties on another $267 billion worth of Chinese goods in addition to the $200 billion in imports planned to be taxed later in the week. With the huge trade surplus among the top issues the Trump administration has with China, the news could exacerbate already tense trade relations.[1]

In recent months, escalating trade disputes between the U.S. and China weighed on silver prices because investors unloaded commodities, including base metals, over fears of decreasing demand from industrial powerhouse China. Rising geo-economic risk also sent investors to safe havens, but they largely opted for the dollar, causing it to rise and lift the price of assets pegged to it.

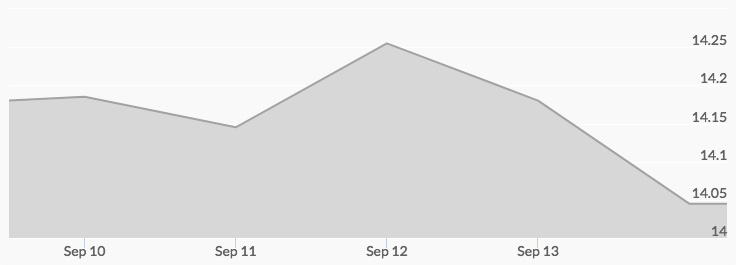

On the opening trading day, the silver spot price picked up where they left off the week prior, rising from the 2 am low of $14.08 to the 4 am and 9 am high of $14.21.

Tuesday, September 11, 2018

Higher Oil Prices

Fears of crude shortages resulting from the havoc Hurricane Florence could wreck in the South and imminent U.S. sanctions against Iran drove the price of oil higher on Tuesday. U.S. light crude closed at $69.25 per barrel, a 2.5 percent increase, and Brent crude jumped to $79.10, a 2.2 percent gain.

Demand for gasoline surged as residents of North Carolina and South Carolina evacuated ahead of the storm. Threats to the Colonial Pipeline, a major conduit to the northeast, also moved the markets into oil.

At the same, American allies in Asia following orders from Washington reduced imports from Iran ahead of the reimposition of U.S. sanctions. Despite efforts by the U.S. government to encourage other major oil-producing countries to ramp up output, worries of a shortage lingered.

Steeper fuel prices can drive up operating costs for manufacturers and living expenses for consumers, pushing inflation higher. When the purchasing power of the dollar falls under such circumstances, investors often turn to buying gold and silver because they maintain their value. Read “How Does Inflation Work?”

The price of silver recorded its daily high of $14.18 from 3 am to 4 am before dipping to the low for the day and the week of $13.94 at 10 am.

Wednesday, September 12, 2018

Decreasing Geo-Economic Risk

Investors caught some momentary relief from the tense global economic conditions that have rocked the markets all summer after news was released that Canada might make a concession in the NAFTA negotiations by offering the U.S. limited access to the Canadian dairy market. Treated as a safe haven from the trade disputes all summer, the dollar weakened. The DXY, a measure of the greenback’s strength against six other currencies, fell .5 percent to 94.789.[2]

‘The dollar is significantly weaker against major currencies today and commodities are supported across the board. Any type of resolution in the agreement is going to support those currencies,’ said the director of metals trading at High Ridge Futures, David Meger.

Demand for assets pegged to the dollar spiked as investors in other countries took advantage of lower prices. The price of silver rose from its low of $14.06 at 9 am to its high of $14.24 not once, not twice, but three times: 2 pm to 4 pm, 7 pm, and 9 pm.

Thursday, September 13, 2018

Technical Indicators

Analysis published in Seeking Alpha on Thursday of technical and fundamental market indicators revealed that precious metals and the stock market are at extreme opposites, evidenced by the historically high Dow Jones-Silver Ratio: 1,823-1.

At the current level, it would require 1,823 ounces of silver to purchase the Dow, which is 65 percent higher than it was in October 2008 when the white metal was trading at $9 an ounce. Moreover, the Dow Jones Index is 90 percent above its 200-Month Moving Average, while the price of silver is 13 percent under its 200-Month Moving Average. Lastly, silver sentiment is back down at the 2013 level of 17, which indicates worse than ‘extreme pessimism.’

What do of these signs point to? Silver prices bottoming and then reversing. This would certainly make sense given the mounting expert predictions that the stock market is set to correct, if not crash.

Perhaps the reversal was already starting on Thursday, which brought the weekly high of $14.29 at 9 am; by 5 pm, however, the price of silver had pulled back to $14.13.

Friday, September 14, 2018

Surging Stock Market

Signs that the top was in for the stock market came on Friday. Despite trade tensions, all three major stock indexes recorded weekly gains. The Dow ended up .9 percent, the fourth week of gains out of the past five. It was the ninth positive week out of the last eleven for the S&P 500, which jumped 1.2 percent, and the third positive one out of the past four for the Nasdaq, which posted a 1.4 percent gain.

Fear was the furthest thing from the minds of Wall Street players, suggested the Cboe Volatility Index (down 19 percent) and the comments of asset managers.

‘I’m not throwing money into stocks by the fistful, and our base is that future returns aren’t great, but stocks still look better than bonds, and there are enough positive that you can’t be too negative,’ said the managing partner of VWG Wealth Management, Richard Weeks.

How long those “positives” will blind investors from glaring market realities—rising inflation, the next recession, and mounting national debt—remains to be seen (Read: “Is Inflation Coming?”) What was certain on Friday was that silver was still a bargain at the 7 am high of $14.20 and the 5 pm low of $14.03.

See the today’s live silver prices in our Spot Price of Silver Chart.