Summer drew to a close last week, but the forces moving gold prices all summer continued to prove major players in the market. While geo-economic risk showed promising signs of decreasing in North America, President Trump’s stance toward trading partners in Europe and Asia did not soften. What was weaker, as many experts have been predicting and the President has been actively putting pressure on, was the dollar. As a result, gold enjoyed a slight spike in demand.

What exactly has the nation’s leader said and done to push down the dollar? Read “Is President Trump Telling You to Buy Gold Now?”

Gold Price Movement Indicators

Monday, August 27, 2018

Decreasing Geo-Economic Risk

Counter to the role geo-economic risk has historically played in the precious metals market, the potential for an improvement in trade relations on Monday gave gold prices a boost. Mexico and the U.S. reached a consensus on how to revise the North American Free Trade Agreement (NAFTA), and President Trump put pressure on Canada to accept the new terms concerning the trade of automobiles and other issues. Market participants viewed the move as a possible easing of trade tensions—high all summer with major U.S. trading partners—on the North American front.

Global trade disputes have steered investors to safe haven assets all summer, but they’ve opted for the dollar and U.S. Treasuries instead of the yellow metal, the traditional hedge against economic risk. With trade talks underway between the U.S. and its closest trading partners, the leading dollar index, the DXY, fell .4 percent to 94.768, reducing the cost of gold to foreign investors. At the same time, gains in the yuan made the yellow metal more affordable to China, the world’s biggest gold consumer.[1]

‘The precious metal advanced on the greenback as NAFTA deal optimism cancelled out some of the trade war concerns in August,’ explained the senior currency analyst at OANDA, Alfonso Esparza.

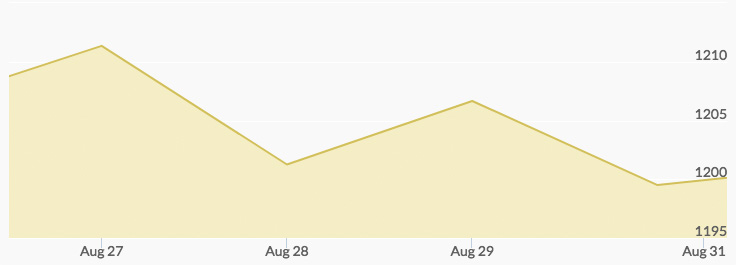

The price of gold hit its daily high of $1,211.10 at 5 pm and then pulled back to the low of $1,207.90 at 11 pm.

Tuesday, August 28, 2018

Weaker Dollar

More headwinds to the dollar blew in on Tuesday. Already battered by President Trump’s recent disapproval of Fed Chairman Jerome Powell, the Fed’s raising of interest rates, and its own strength, the dollar took another hit after the U.S. and Mexico reached an agreement on NAFTA on Monday and investors moved to riskier assets. After falling to a four-week low the day prior, the greenback lost another .2 percent on Tuesday.[2] The dollar has declined 2.3 percent since the president’s criticism of the Fed’s tightening of monetary policy.

Adding to the risk-on market sentiment was confirmation that Canadian Foreign Minister Chrystia Freeland was headed to Washington on Tuesday to negotiate the country’s participation in the revamped trade deal.[3]

Still weighing on investors’ minds, however, was the trade spat between the U.S. and China. So far the preferred safe haven amid a season fraught with geo-economic risk, the dollar was buoyed by continued uncertainty on the other side of the world.

A weaker dollar made gold less expensive to investors in other countries, though many were gambling with paper assets thanks to calmer domestic trade relations. Gold prices reached their weekly and daily high of $1,213.60 at 6 am but then pulled back to the low for the day of $1,200.40 at 3 pm.

Wednesday, August 29, 2018

Strong Economic Data

Wednesday brought news that the U.S. economy grew more in the second quarter than the Commerce Department initially thought. In July, the agency reported that gross domestic product increased 4.1 percent from April to June. That number was revised to a 4.2 percent annualized rate, the fastest it’s been since the third quarter of 2014. A spike in business spending on software and a decline in petroleum imports accounted for the change.

The economy expanded at a rate of 2.9 percent compared to Q2 of 2017. In the first half of 2018, output expanded 3.2 percent instead of 3.1 percent, which means it’s on track to reach the 3 percent the Trump administration is targeting. However, growth could slow as the benefits from the $1.5 billion tax cut package diminish. The surge in exports of soybeans to China in an effort to avoid retaliatory trade tariffs isn’t likely to last either.

Other data underscored economic fragility. The goods trade deficit increased 6.3 percent to $72.2 billion in July due to a 6.7 percent decline in food shipments. Also weaker was the housing market, with homes sales and building pulling back. Overall, the gross domestic output, a better measure of economic activity, was also slightly down: 3 percent in the second quarter compared to 3.1 percent in the first. Learn more about expert predictions for the direction of the economy in “When Will the Economy Crash?”

‘Gold is facing headwinds on higher Q2 GDP reading of 4.2 percent, up slightly in the first revision along with news of U.S.-Canada resuming trade negotiations, which is impacting equity markets positively [and] tempering any interest in safe haven assets,’ said the executive vice president of GoldMining Inc., Jeff Wright.

The low for the price of gold of $1,201.90 occurred at 3 am and 8 am. Day trading lifted gold prices to the 8 pm high of $1,206.80.

Thursday, August 30, 2018

Stronger Dollar

The release of robust U.S. economic data on Wednesday resulted in a stronger dollar on Thursday. The ICE U.S. Dollar index, which measures the greenback against a basket of major currencies, traded up .2 percent despite projections for a weekly fall of .4 percent. President Trump’s disapproval of the currency has weakened it lately. Data supporting a growing economy suggested more interest rate hikes are on the way, which infused new strength into the dollar.[4]

This made gold and other assets denominated in the dollar more expensive for investors in other countries. Healthy economic data also whet investors’ appetite for risk, diminishing demand for safe havens.

But analysts foresee two market factors influencing gold prices coming into play soon: a shift in physical demand as the typically slower summer season draws to a close and rising geopolitical risk out of Turkey.

‘While a relatively stronger dollar and U.S. economic growth are hurting the bullion’s appeal, concerns that Turkey’s financial crisis could spread may give the metal a reversal of fate,’ explained the head of commodity research at Monarch Networth Capital, Renisha Chainani.

The stronger dollar was evident in lower lows and highs for gold prices on Thursday. The price of gold pulled back from the high of $1,204.70 at 9 am to the low of $1,197.20 at 10 am.

Friday, August 31, 2018

Rising Geo-Economic Risk

The threat of rising geo-economic risk loomed on Friday after the U.S. and Canada failed to reach a consensus on revising NAFTA, and reports surfaced that President Trump is planning on following through with proposed tariffs on another $200 billion worth of Chinese imports. Concessions on agriculture, specifically removing steep tariffs on U.S. dairy products, prevented Canadian representatives from signing a new deal with the U.S. and Mexico. More talks are planned to hammer out the issues.[5]

If Trump goes through with the additional tariffs on Chinese imports, they would take effect after the public-comment period ends on September 6 and result in more than half of all Chinese imports being subject to tariffs.[6] Read more about the trade dispute with China in “Why Buy Gold During a Trade War?”

On another front, the president rejected an offer for zero auto tariffs from the European Union, reportedly calling the block ‘almost as bad as China’ on trade. Trump also levied a threat against the World Trade Organization: shape up or the U.S. would withdraw.[7]

‘Trump’s plans have had a significant impact on sentiment and the slightly weaker dollar is supporting gold,’ said an analyst at Quantitative Commodity Research, Peter Fertig. He added that gold was also receiving some support from the crisis in emerging-market currencies.

The price of gold pulled back from the 4 am high of $1,207.80 to the 3 pm low of $1,198.40.

Want to check the latest price for the yellow metal? See our Gold Spot Price Chart.