Precious metals investors celebrated the Fourth of July holiday and opportunities to buy silver and gold last week. Thursday brought another Fed rate hike, but market worries over the darkening domestic and international economic picture eclipsed the usually huge financial event. Silver prices remained in a pullback, but all signs point to a safe haven rally soon.

Want to learn more about what market forces have traditionally moved the price of silver? Read “10 Factors that Influence Silver Prices.”

Silver Price Movement Indicators ¯

Monday, July 2, 2018

Commodities Selloff

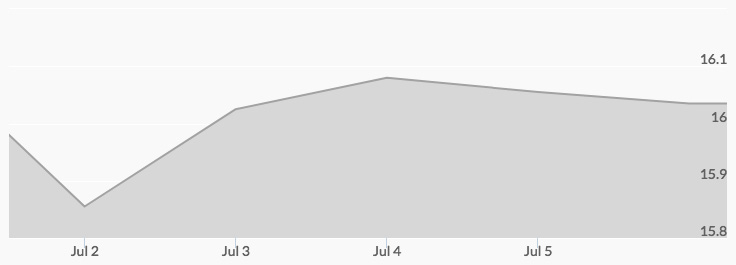

Fearing the economic impact of the escalating trade war, panicked investors have been selling off commodities for weeks. On Monday, the commodities complex saw its biggest decline since 2016. Silver prices dipped by 2 percent, with the low of $15.80 recorded at 1 pm and 10 pm. A high of $16.01 was hit at midnight. The tit-for-tat trade conflict is also behind recent stock market volatility, as well as poor equities performance in emerging markets.[1]

‘The ongoing trade standoff between the U.S. and China has triggered a wave of selling, as traders are fearful the tariffs could hurt economic growth and bring a slowdown,’ explained David Madden of CMC Markets. U.S. factory employers are already reporting higher input prices and plummeting worker confidence. It’s the same story in Europe.

What do long-term precious metals investors see in this economic narrative? Flashing signs to buy silver now before the coming crisis. Some experts even expect silver to outperform gold this cycle.

Tuesday, July 3, 2018

Higher Oil Prices

Disruptions in the global supply of crude oil in Venezuela and Libya sent prices higher on Tuesday. On Monday, the National Oil Corporation declared force majeure on oil fields and ports in eastern Libya, cutting 850,000 bpd of oil from the market.[2] Economic crisis and international sanctions have crippled oil production in Venezuela, cutting its daily output in half. Prices for crude topped $75/bbl on Tuesday.[3] They’ve risen more than 20 percent so far this year.

Higher oil prices could prove to be another blow to U.S. and international companies already paying more for goods due to trade tariffs. Steeper production costs would likely be passed onto consumers in the form of higher prices, causing rising inflation. Historically viewed as a hedge against inflation and recession, precious metals prices would soar.

On Tuesday, however, silver prices were still in a pullback. The low of $15.78 at 1 am was followed by the high of $16.10 from 10 pm to 11 pm.

Wednesday, July 4, 2018

Weaker Dollar

Silver and gold prices hit their weekly high on Wednesday thanks to a softer dollar. Silver prices rose 7 percent to $16.13 from 10 pm to 11 pm as the dollar index dropped 3 percent to 94.421. With the markets anticipating the Fed to raise interest rates on Thursday, the decline was counter to the historical trend of investors turning bullish on the greenback when a rate hike is expected. Maybe the markets were more concerned about the worsening global economic outlook.

A weaker dollar makes precious metals more affordable for foreign investors, driving demand for these safe haven assets.

Thursday, July 5, 2018

Interest Rate Hike

Despite expressing concerns about an overheated economy, inflation, and ‘the possible adverse effects of tariffs and other proposed trade restrictions’ on global and domestic investing, central bankers raised interest rates again on Thursday for the seventh time since December 2015. The fed funds rate increased to a range of 1.75 to 2 percent.

Central bankers weren’t the only ones worried about the economy either. On Thursday, financial expert Jim Rickards predicted that the Fed’s tightening monetary policy and consequent strengthening of the dollar is triggering a debt crisis in emerging markets. “The Fed’s path of rate hikes and balance sheet reductions since December 2015 has reinvigorated the U.S. dollar… A stronger dollar means weaker EM currencies in general. …Right now, EM currencies are in a free fall against the dollar.’ What would a bottom in the currencies of emerging markets mean? A top for the dollar. What goes up must come down.

Silver prices held their ground amid rising rates. The low of $15.92 at 7 am was followed by the high of $16.05 at midnight.

Friday, July 6, 2018

Expert Predictions

News headlines for gold and silver have been dreary lately, but this one should please long-term precious metals investors: “Commerzbank Predicts $1,500 Gold, $20 Silver in 2019.” The German financial institution cited fading dollar strength, seasonal buying, and returning “geopolitical dangers in North Korea, the Middle East and elsewhere” that gold traders “apparently assumed…are suddenly solved.”

The white metal continued to trade in a tight range on Friday. The low of $15.96 was recorded at 8 am and noon and the high of $16.04 at 3 am.

Where are silver prices today? See our Spot Silver Price Chart for live and historic silver prices and read our post on silver price forecast for 2018.