As the year draws to a close, investors are reflecting on their portfolio performance and looking ahead to see what 2024 holds. Watch this week’s The Gold Spot to hear Precious Metals Advisor John Karow and Scottsdale Bullion & Coin Founder Eric Sepanek explain the climate of the economy, what investors should expect in 2024, and why precious metals are a necessity moving into next year.

The State of the Economy

The economy is closing out 2023 in dire straits with national debt towering at $34 trillion and mounting at a record pace. In 2024 alone, the government is expected to add half a trillion dollars to the fiscal budget. At this rate of borrowing and spending, the national debt will surge past $50 trillion by 2033. That means the US spends roughly $218 million hourly and $5.2 billion daily.

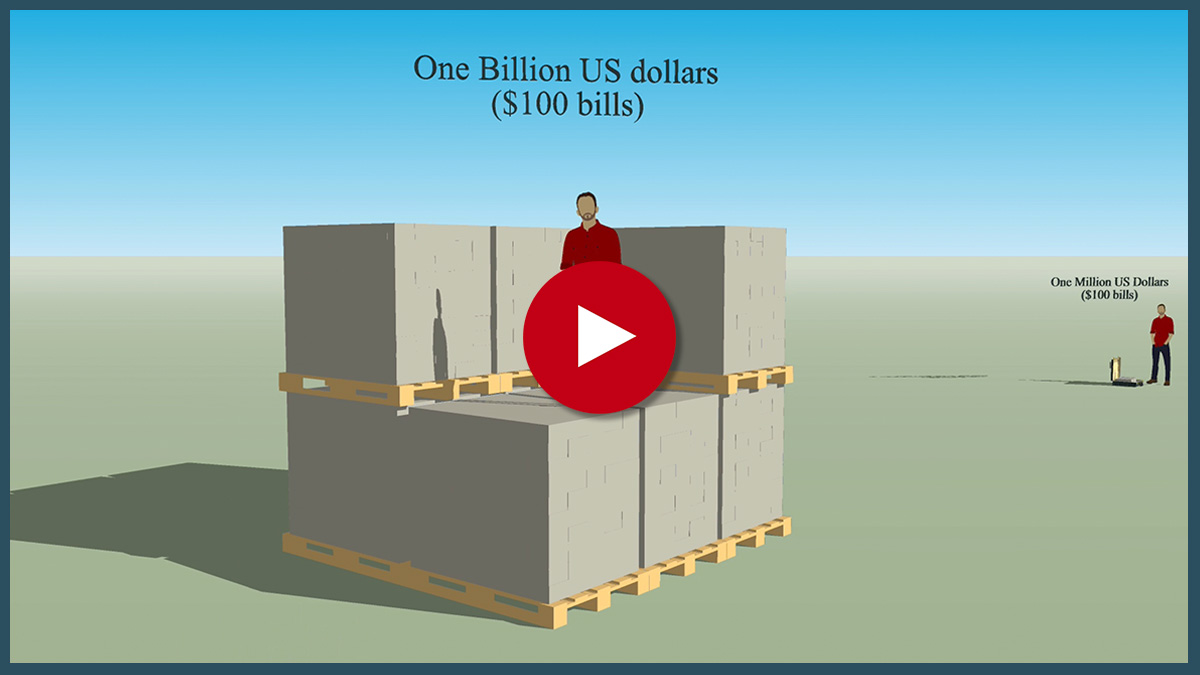

The monumental weight of US debt is getting hard to conceptualize which is why we’ve created a visual graphic of national debt to put this pressing issue into perspective for investors.

2024 Gold Price Predictions

The economy’s grim outlook is reflected in gold’s impressive performance and forecasts. We’ve compiled gold price forecasts for 2024 from some of the brightest and most respected experts to give investors a comprehensive picture of where gold could go next year. The average of 2024 projections put gold prices at around $2,500 an ounce – roughly 17% higher than 2023 highs.

The predictions for 2023 of $2,188 an ounce was remarkably close to the actual peak of gold prices which stood at $2,135 an ounce in early December. The main driver behind the boost in gold prices has been the relentless central bank gold demand as countries bail out of paper-backed assets in favor of physical gold bullion bars and coins. All signs point to gold being a good investment for 2024.

Related Reading: Is Gold a Good Investment in 2024?

Keep in mind that this is merely a forecast, not a hard-and-fast number. Gold prices are influenced by a slew of factors including Federal Reserve policies, geopolitical conflicts, investor sentiments, and more.

Related Reading: How These 10 Factors Regularly Influence Gold Prices

Happy Birthday to Scottsdale Bullion & Coin!

Scottsdale Bullion & Coin is excited to announce another birthday. Almost 12 years ago, on January 2nd, 2012, we opened our doors to the public with the goal of helping people reach their wealth goals through the investment of physical gold and silver.

From a mere idea and dream to our current state…managing hundreds of millions in bullion and rare coin is a moment of pride and satisfaction for us.–

We’ve been honored to be a part of our clients’ financial journeys over the years, and we thank everyone for their unwavering support and trust. We look forward to continuing to serve your investment needs in 2024 and beyond.

Protect Your Wealth in 2024!

For many, 2023 was a reality check of the true instability of the economy and the vulnerability of their portfolios. However, 2024 will bring a series of significant challenges too. Geopolitical conflicts are raging around the globe, the most contentious election in United States history looms on the horizon, and the Biden administration is planning to spend like there’s no tomorrow.

“[2024]...is a time to stay vigilant. The world is in turmoil, so keep an eye on what's happening.”

Smart money investors have been diving into physical gold and silver coins in anticipation of worsening economic conditions, rather than leaving their wealth vulnerable to government incompetence or foreign interference. Unlike conventional assets, physical precious metals boast inherent value which means steadier price action, greater privacy, and more predictability.

Finding the right allocation of gold and silver is essential for optimizing financial gains and security in an unstable and unpredictable market. Request our Free Gold and Silver Report to learn how to maximize your precious metals investment in 2024 and beyond.

Questions or Comments?