It wasn’t long ago when the US national debt was relegated to insider professionals or economic aficionados. Now, this key metric of financial health is a front-and-center concern for the average American. Investors feel the pressure as an exponential rise in us debt diminishes purchasing power, crushes markets, and ravages savings accounts.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Precious Metals Advisor Richard Otto and SBC Founder Eric Sepanek discuss the realities of US national debt, where it’s headed in 2024, and how physical gold can help protect investors’ wealth moving forward.

The Alarming Growth of US National Debt

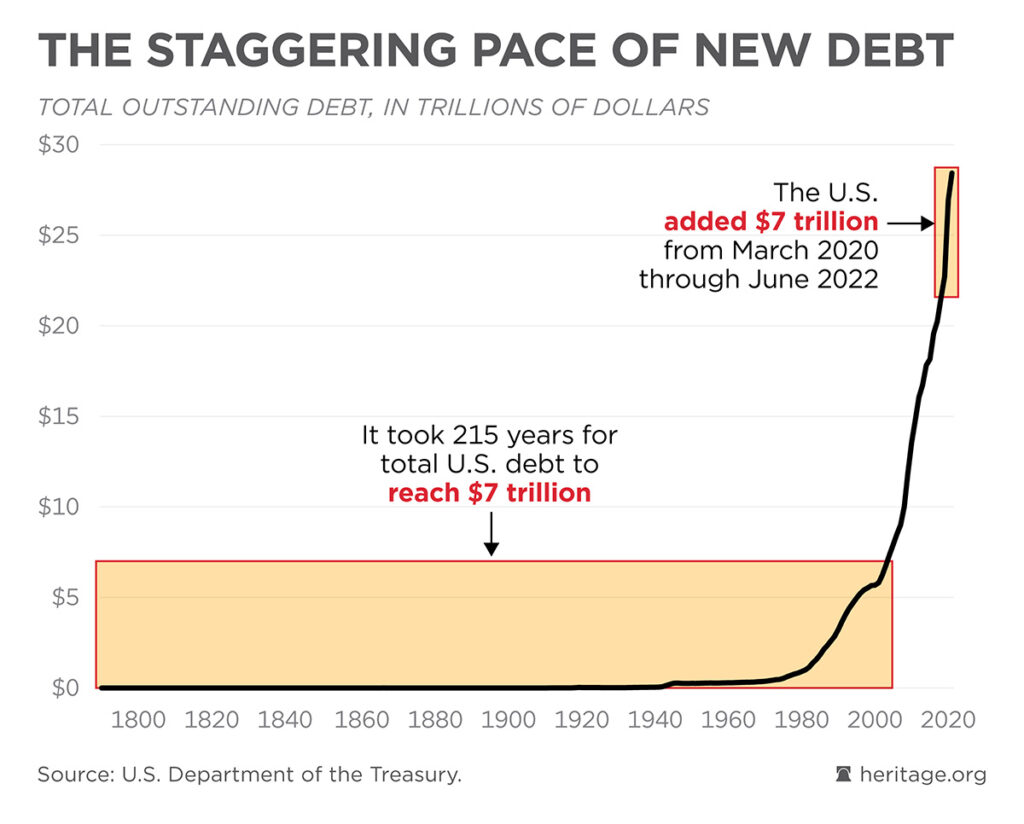

Most people have woken up to the shocking weight of the national debt, which is just shy of $34 trillion. What’s more alarming is the pace at which that debt is accumulating. While the government has continuously operated with a deficit, the pace of borrowing has risen exponentially within the past few decades alone. In the past five years alone, the Fed has increased the budget spending by 55%.

Instead of changing course, the government is doubling down on its loose spending policies. In 2024, the us national debt is projected to grow by half a trillion dollars. That amounts to a 1.5% jump in a deficit that has taken centuries to accumulate. This underscores the sheer insanity of the laissez-faire approach to spending inherent in “Bidenomics.”

Visualizing US Debt

It’s becoming increasingly challenging to conceptualize US debt, but investors must accurately understand where things stand. That’s why we’ve put together a visual display of the national debt that makes it easy to comprehend the scale of our government’s reckless spending and borrowing.

Taxes Are the “Solution”

Surprise, surprise! The Biden administration’s “solution” for tackling the compounding issue of US national debt is raising taxes. The proposed tax hike would siphon $4.7 trillion from the hands of hard-working Americans, making it one of the largest taxation schemes in American history.

The Hail Mary tax plan would hit almost a million small businesses with a 33% tax jump. The controversial death tax would also cost Americans over $77 billion just for passing on their family businesses and farms.

This tone-deaf policy comes when nearly one-third of Americans making $150,000 or more annually are barely scraping by. At the same time, inflation is still driving up costs, eating away at the already compromised spending power of the average person.

The Grim Future of US National Debt

A sober assessment of the economy wouldn’t promote a positive outlook for national debt. The driving forces behind nonstop government spending aren’t going away any time soon. The Fed is married to the disastrous; no politicians want to touch the broken and money-draining entitlement programs, new conflicts are popping up worldwide, and so on.

“If things continue the way they are, [gross debt] will rise to over $51 trillion by 2033.”

Gold Is The Real Solution

The government couldn’t make it more evident that reliance upon its economic scruples is a doomed strategy. There’s a reason central bank gold demand has reached record levels: Governments don’t even have faith in their policies to prevent economic collapse. They’re diving into physical gold and silver bullion to hedge against the incoming storm they caused.

“Gold is insurance on your money.”

The US dollar is partially to blame for this economic turbulence as the US has been exporting inflation over the past few years. A bewildering national debt, collapsing regional banking system, and devalued currency aren’t instilling much confidence in the international community. This has encouraged the process of de-dollarization as governments seek to decouple from the dollar. At this point, investors are justified in their concern about a potential US debt default and its ramifications.

As We Always Say… Don’t Wait to Buy Gold, Buy Gold and Wait

Investors are treated with an advantageous buying opportunity as gold prices settle after surging to record highs. The government’s irresponsible and incessant spending is pushing US debt to a tipping point, with the stability of the global economy hanging in the balance. The resulting market uncertainty is setting the stage for an impressive gold price forecast.

Smart investors are heeding the writing on the wall by scooping up gold in anticipation of grim economic conditions. Nobody can predict exactly when the surmounting US debt burden will cause everything to come crashing down. It’s always better to buy gold and silver and wait than try to time the market in vain. If you’re already holding gold, now’s a perfect chance to dollar cost average gold.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields