Just as geo-economist risk potentially decreased on one front last week it escalated on another, and this new threat to the global economy sent shocks through financial markets. Investors sought safety in paper assets, only to see their returns drop days later—evidence that the true safe haven is gold.

If that didn’t convince the markets of this, President Trump’s comments on the greenback’s strength, which some believe could be part of a plan to soon intervene in the currency, and expert predictions of the dollar’s downfall, certainly should have. All signs last week pointed to dropping risky paper assets and buying gold and silver before prices soar.

Suggested Read: “Is President Trump Telling You to Buy Gold Now?”

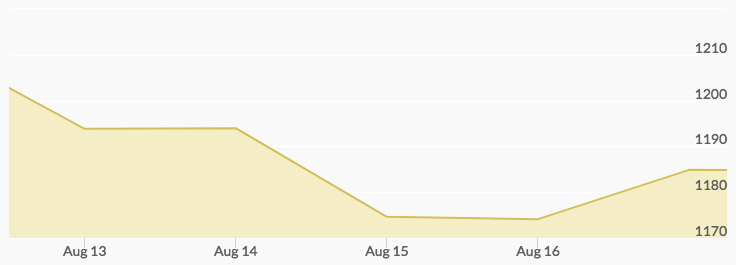

Gold Price Movement Indicators

Monday, August 13, 2018

Rising Geo-Economic Risk & Rival Safe Havens

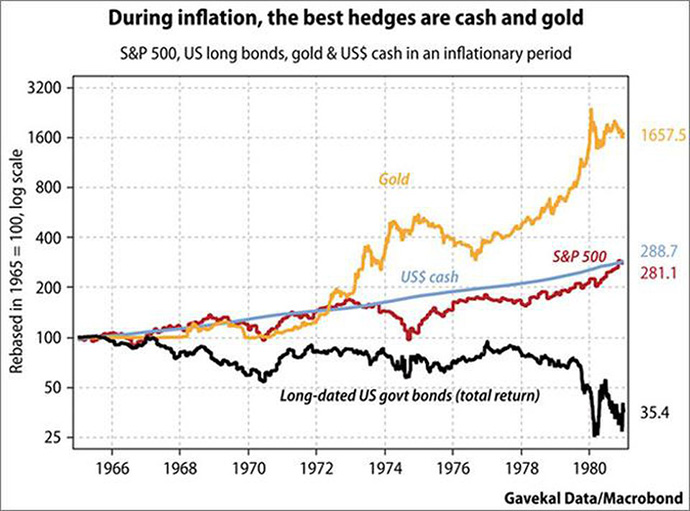

Deteriorating U.S.-Turkish relations and a tumbling lira continued to rattle the markets last Monday. Even through the national debt has grown faster than the size of the U.S. population and U.S Treasuries have historically performed poorly during periods of inflation, investors sought safety in government bonds.[1][2]

Source: via Forbes & Gavekal Research

‘The safe haven demand that has been triggered by the crisis in Turkey is going into the dollar rather than gold, which has been a trend going on for a while now,’ said Simona Gambarini, an analyst at Capital Economics.

As investors bought dollars to purchase U.S. Treasuries with, the greenback rose, making assets denominated in it pricier for foreign investors. Gold prices pulled back throughout the day as a result: the 2 am high of $1,208.10 was followed by the 8 pm low of $1,192.30.

Tuesday, August 14, 2018

Stronger Dollar

The dollar reached a 14-month high on Tuesday, with the ICE U.S. Dollar Index up .3 percent. Analysts attributed the greenback’s strength to investor anticipation of another Fed interest rate hike in September.[3]

Globally, the Turkish lira rebounded against the dollar and the euro, allaying investor concerns of disruption to financial markets.

As for gold, there was buzz in the markets that it’s oversold and set for a turnaround soon. ‘Gold is a proven inflation hedge and a safe haven asset in the case of shocks to economic growth, and we believe that current weakness presents an opportunity to benefit from the recovery of this undervalued sector,’ asserted the fund manager and managing partner at Baker Steel Capital Managers, David Baker.

After briefly climbing to the session high of $1,197.70 at 11 am, the price of gold dipped to $1,188.80 at 11 pm.

Wednesday, August 15, 2018

Falling Treasury Yields

All those U.S Treasury notes investors bought on Monday brought them lower returns by Wednesday as prices rose and yields fell.

- 10-year Treasury note: ¯ 4.2 basis points

- 2-year Treasury note: ¯ 2.9 basis points

- 30-year Treasury note: ¯ 3.5 basis points

Consequently, the yield curve flattened to a level not seen since 2007: the spread between the 10-year note and the 2-year note hit 24.8 basis points. This signaled mounting investor fears of a potential recession or additional tightening of Fed monetary policy. With the Fed stating more rate hikes are on the way in 2018 and economists predicting a recession within the next two years, neither concern could be considered unfounded. Learn more in “When Will the Economy Crash?”

What was behind the jump in Treasury prices on Wednesday? An escalation of geo-economic risk as Turkey retaliated with tariffs on U.S. imports of tobacco, cars, and alcohol. True to form, president Trump took to Twitter to respond: ‘Our Country was built on Tariffs, and Tariffs are now leading us to great new Trade Deals.’

Although investors usually move to gold when the price of Treasuries rise, this was not apparent in the gold markets. The price of gold pulled back from a high of $1,188.10 at 3 am to the low of $1,165.50 at 9 pm.

Thursday, August 16, 2018

Decreasing Geo-Economic Risk

Markets were in risk-on mode following news that China had accepted the U.S.’ invitation to discuss trade at the end of August and that Qatar promised to invest $15 billion in Turkey. This strengthened the yuan against the dollar, and generally put pressure on the ICE U.S. Dollar Index, which was in the negative at 96.671, as investors returned to emerging-market currencies.

A softer dollar lowers the price of gold for investors in other countries. Demand for the yellow metal was slightly better on Thursday, evidenced in the higher session low of $1,173.40 at 4 pm. The daily high of $1,180.50 was reached at 8 am.

Trump Tweets about the Dollar

Since his election, Donald Trump has been uncharacteristically vocal about the strength of the U.S. dollar and the Fed’s monetary policy. On Thursday, he changed his stance on the dollar.

“Our Economy is doing better than ever. Money is pouring into our cherished DOLLAR like rarely before, companies earnings are higher than ever, inflation is low & business optimism is higher than it has ever been. For the first time in many decades, we are protecting our workers!”

Just last month, the president commented and tweeted that the dollar was too strong, and the Fed’s policy of monetary tightening put us at a competitive trade disadvantage.

Economists view Trump’s recent praise of the dollar as part of a plan to potentially intervene in order to “be seen as saving the world from a dollar that’s rising too far.” They suggest the administration has intentionally sparked safe haven demand for the dollar through its protectionist trade policy, including ramping up tariffs on Turkish imports and cutting taxes despite a thriving economy, which in turn led the Fed to tighten monetary policy.

Read more about Trump’s potential plan to take down the dollar in the article.

Friday, August 17, 2018

Dollar Downfall Predictions

Goldman Sachs analysts issued a warning on Friday that stock market investors should not expect the dollar to rally for much longer. Over the next year, they forecast the greenback to fall 7 percent. So far in 2018, the dollar has enjoyed some fundamental advantages, they argue:

- Strong U.S. economic data.

- Tightening Fed monetary policy.

- Lower interest rates in other countries.

- Slower global growth.

- Escalating trade tensions weighing on foreign currencies.

The economists predict global economic growth to improve, thereby narrowing the growth differential. They urged investors to “factor that outlook into their equity positions.” Read the full article.

This view was echoed elsewhere in the markets on Friday. ‘I expect the dollar to peak in the coming weeks … Gold should bottom out here,’ indicated Georgette Boele, an analyst at ABN AMRO.

Read more expert analysis in “When Will the Dollar Crash?”

As for the greenback, it has already started its descent. The dollar weakened against some key gold market currencies: the yuan and the euro.[4] The ICE U.S. Dollar Index slipped .5 percent to 96.133.[5]

The price of gold climbed from the low of $1,174.30 at 3 am to the high of $1,184 at 4 pm.

Where is the price of gold today? See our Gold Spot Price Chart.

Want greater insights into the forces that typically move gold prices? Read “How These 10 Factors Regularly Influence Gold Prices.”