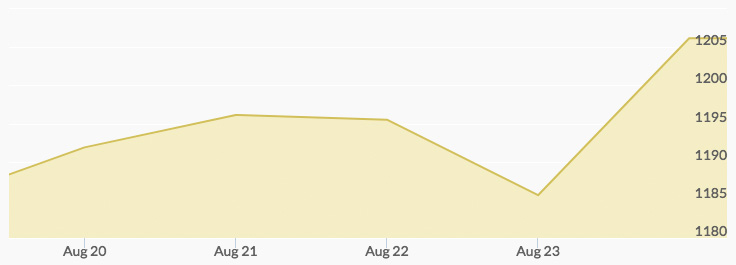

Gold and the dollar switched directions last week. President’s Trump’s criticism of Fed Chairman Jerome Powell’s raising of interest rates and Powell’s subsequent dovish stance at the Jackson Hole Symposium served as headwinds to the dollar. As the greenback fell, gold became more affordable to foreign investors, especially in China where the yuan has been rising amid U.S.-Chinese trade talks. With the President actively working against the dollar and rising interest rates and many experts predicting the currency’s days are numbered, expect this new trajectory for gold prices to stick!

Read more about President’s Trump’s unique relationship to the dollar in “Is President Trump Telling You to Buy Gold Now?”

Gold Price Movement Indicators

Monday, August 20, 2018

Rising Asian Demand

The yuan rose as investors anticipated trade talks between U.S. and Chinese representatives on Wednesday and Thursday and the potential de-escalation of the trade war that could result from them. A stronger currency made the yellow metal more affordable for investors in China, the biggest consumer of gold in the world. Bargain prices added to the resurgence in Asian demand for the yellow metal. And individual Chinese investors weren’t the only ones buying. The Central Bank of Russia reportedly increased its holdings of gold last month.[1]

‘Value-buying in this oversold territory is highly likely to underpin gold prices,’ explained analyst at Religare Securities, Sugandha Sachdeva.

Savvy investors in the U.S. and abroad took advantage of a daily low for the price of gold of $1,184.50 at 10 am. Gold prices gained nearly $10 in day trading, hitting the high of $1,194 at 11 pm.

Tuesday, August 21, 2018

President Trump Disapproves of Fed Policy

U.S. Presidents haven’t historically been considered among the market factors influencing gold prices, but Donald Trump is different. Since his election, he’s commented frequently on the strength of the dollar and Fed monetary policy, and his statements have proven highly influential on the direction of the dollar and assets denominated in it, such as gold.

Gold prices surged on Tuesday following the publication of an interview the president gave to Reuters in which he expressed disapproval of Fed Chairman Jerome Powell.

‘I’m not thrilled with his raising of interest rates, no. I’m not thrilled,’ said Trump. He went on to add, ‘We’re negotiating very powerfully and strongly with other nations. We’re going to win. But during this period of time I should be given some help by the Fed. The other countries are accommodated.’

Stocks and the dollar fell as the markets reacted to Trump’s statements. The gold spot price ascended to $1,196.27, the highest since August 14 and the third straight session of gains for the yellow metal.[2]

Wednesday, August 22, 2018

Mixed FOMC Minutes

Always big news for investors, the minutes of the Federal Open Market Committee’s July 31-August 1 meeting were released on Wednesday. Despite President Trump’s criticism earlier in the week, Fed Chairman Jerome Powell indicated that more interest rate hikes are on the way and the easy monetary policy that has propped up the economy since the financial crisis is set to be phased out: ‘it would likely soon be appropriate to take another step in removing policy accommodation.’

Another hike in September would bump interest rates up to a range of 2 percent to 2.25 percent, much closer to the range of 2.3 percent to 3.5 percent officials consider neutral, meaning it neither fuels economic expansion nor constricts it.

A strong economy, low unemployment, and rising inflation were the impetus for proceeding with the planned rate increases; however, Fed members also discussed threats to the economy: the diminishing benefits of government spending, financial instabilities resulting from the record-long expansion (BALLOONING NATIONAL DEBT), and escalating trade disputes.

‘But I think [the Fed is] more concerned about overdoing it than underdoing it in terms of tightening,’ explained a senior economist at MacroPolicy Perspectives LLC, Laura Rosner.

If interest rates continue to increase throughout the remainder of the year, investors may opt for interest-bearing assets over gold. However, even at 2.25 percent, rates would still be historically low. Recall that rates hit 20 percent in 1980! So, for long-term precious metals investors, the risks of paper assets would likely outweigh the relatively insignificant gains.

Spot gold prices hit a session high of $1,201.51, their highest since August 13.[3]

Thursday, August 23, 2018

Stronger Dollar

After falling briefly over the mixed FOMC minutes on Wednesday, the dollar regained some ground on Thursday. The ICE U.S. Dollar Index, which measures the greenback against six other major rivals, increased .6 percent to 95.679. Although the dollar was still down .5 percent for the week, it was up 3.8 percent for the year.

Wednesday’s recovery could prove to be an anomaly, as many experts predict the dollar is going to fall, whether as a result of the president’s comments and protectionist trade policy or mounting macroeconomic forces. Learn more in “When Will the Dollar Crash?”

Thursday brought more bargain prices for gold: the high of $1,191 at 1 am was followed by the low of $1,183.70 at 8 pm.

Friday, August 24, 2018

Dovish Fed Chairman

A cautious tone from Fed Chairman Jerome Powell during a speech in Jackson Hole, Wyoming, sent the dollar further into decline on Friday. Asserting that the FOMC must balance the risk of allowing the economy to overheat by increasing rates too slowly with the threat of cutting the expansion short by raising them too quickly, Powell said, ‘If the strong growth in income and jobs continues, further gradual increases in the target range for the federal funds rate will likely be appropriate.’[4]

Just how long do economists expect the expansion to last? Read “When Will the Economy Crash?” for predictions.

Market participants interpreted Powell’s speech as dovish. ‘It sounds like the Fed is starting to lean a little bit dovish and that is taking the wind out of the U.S. dollar’s sail now,’ explained a portfolio manager at Sprott Asset Management, Shree Kargutkar.

The dollar suffered its worst week since February, with the leading dollar index, the DXY, falling another .5 percent for a weekly loss of 1 percent. Spot gold rallied from the midnight low of $1,186.60 to the noon high of $1,208.[5]

Need today’s price of gold? Check our Gold Spot Price Chart.