In the wake of surging gold prices, Americans grapple with the uncertain economic outlook, exacerbated by mixed signals from the Fed and a fledgling dollar. In this week’s The Gold Spot, Scottsdale Bullion & Coin Founder Eric Sepanek and Precious Metals Advisor John Karow cover grim warnings from a leading banking CEO, explain why China’s gold spree is ramping up, and implore Americans to act soon to protect their economic future.

Jamie Dimon Warns of Economic Future

JPMorgan Chase CEO Jamie Dimon recently issued a stark warning about the economy’s fate. As the leader of the world’s largest bank, Dimon keenly understands market dynamics and various threats. His track record of accuracy lends weight and credence to his forecasts, which have grown increasingly grim.

This week, Dimon reiterated his “cautious” stance on the economy and “dubious” hopes for a soft landing. He points to frightening parallels between the current market and the 1970s when stagflation ravaged savings accounts and retirement plans. Although the banking executive remains “hopeful,” he’s encouraging investors to think about the long term rather than simply waiting for a miracle in the short term.

China Extends Gold Buying Spree

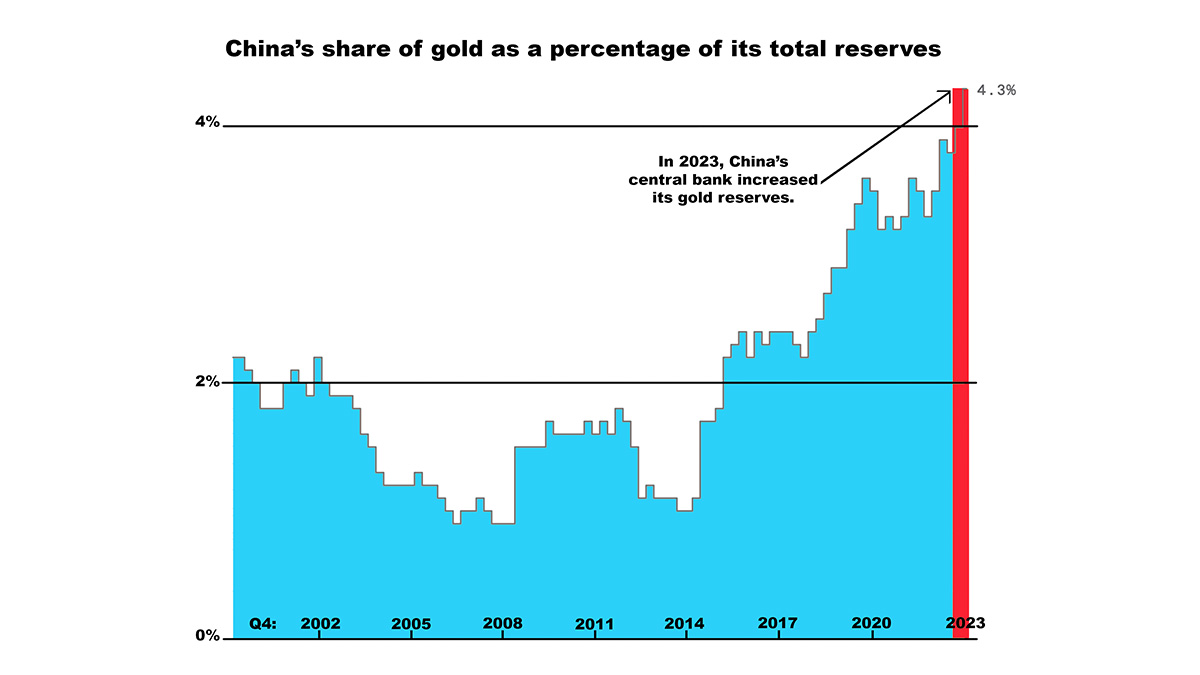

Dimon’s warnings were made for a domestic audience, but investors across the Pacific are already heading the wisdom. China has been ahead of the gold-buying trend for years. In 2023, the People’s Bank of China (PBOC) scooped up more gold than any other government. In fact, its receipt of 225 tons comprised almost a quarter of central bank gold demand.

China topped up its fast-growing reserves with 160,000 troy ounces in March, and when April’s numbers arrive, the trend is expected to continue. And, those are only the numbers the CCP is willing to share. There’s widespread speculation China maintains considerably more reserves than the official tally.

Chinese Citizens Follow Suit

As China’s economy suffers, citizens have been copying the game plan of their central bank by shifting to physical gold. Traditionally, the Chinese have always been a leading consumer of gold, but younger generations are representing a larger percentage of that demand.

In 2024, China beat out neighboring India to become the world’s biggest gold consumer, with demand for jewelry jumping 10% and gold coins and gold bars by 28%. This influx of retail investors into the gold market signals a growing lack of faith in traditional financial institutions and investment vehicles.

Rising Cost of Social Services

As policy debates surrounding the $34 trillion debt enter the public sphere, investors are increasingly conscious and concerned about where public funds are invested. The staggering weight of funding social services has been in the spotlight as Americans try to grasp how the government runs up such an astronomical balance sheet.

According to the Office of Human Services, over 99 million people relied upon at least one safety net program, representing nearly a third of the population. Over 50% participated in two programs or more. Tragically, more people entered into these programs following the pandemic and the ensuing economic struggle.

It’s notoriously challenging to tally up the total cost of this complex web of services, but the Congression Research Service (CRS) puts it at $1 trillion annually. That number doesn’t include Social Security, which rings in at $1.5 trillion for 2024 alone.

Added Cost of Illegal Immigration

Many people point to the massive influx of undocumented immigrants as an unforeseen and incalculable expense. In 2023, Customs & Border Protection (CBP) recorded 2.4 million encounters at the Southwest border, representing a 100% jump since 2019. When attempting to determine the total number of undocumented immigrants in the US, estimates range from around 11 million to over 22 million

Although undocumented immigrants aren’t eligible to receive most federal programs, the additional costs of feeding, housing, and treating millions of people strain an already beleaguered budget. The Federation for American Immigration Reform (FAIR) estimates the net cost of illegal immigration to be $150.7 billion, including federal, state, and local levels. All of these growing expenses exacerbate inflation, weaken the dollar, and fuel the drive towards gold.

The government…doesn’t have the money. They’re going to come after our assets. They’re going to keep creating money out of thin air and inflation is going to go up.–

Steady Interest Rates Bolster Gold’s Allure

On Wednesday, Fed officials opted to keep interest rates unchanged amidst economic uncertainties. This decision has intensified the allure of gold as a stable investment, propelling its prices upward. With interest rates held steady and inflation still a looming concern, gold continues to be a preferred haven for investors seeking to mitigate risk in a volatile economic environment.

Don’t Wait to Buy Gold, Buy Gold and Wait

The relative stability of the US leads to a broad sense of complacency. We always expect negative events to happen somewhere else, not at home. However, gold’s recent price surge serves as a warning that economic pain is reaching a tipping point.

If you’re involved [in gold], you’re ahead of the game.–

Experts are already raising gold price predictions following the recent rally. All economic indicators suggest that the current trough is merely a pre-surge dip. Whether you’re investing in precious metals for the first time or adding to your portfolio, now is the time to get in before gold prices move even higher.

Interested in getting the most out of your gold and silver investments? Grab a FREE copy of our Precious Metals Investment Guide, which covers all you need to know about diversifying, protecting, and even growing your portfolio with physical metals.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields