Following a powerful rally throughout the beginning of the year, experts are revising their gold price forecasts. Since New Year’s Day, the yellow metal has continuously notched new highs as a confluence of geopolitical, economic, and political factors fuel its rise.

Major banks, financial analysts, and precious metals experts were already bullish on gold going into 2024, but this surge has already shattered expectations merely a quarter into the year. Revisiting the gold price forecasts for 2024 and beyond can give investors a better idea of where this precious metal might be headed so they can put their portfolios in the best position for success.

Tracking Gold’s 2024 Rally

On January 1st, 2024, gold prices sat confidently above $2,000/oz, following a strong performance throughout the post-pandemic years. Barring a few short-lived exceptions, the yellow metal has remained above this new floor ever since. Instead of remaining in this impressive range, gold broke out to the upside, securing an all-time high of $2,390/oz.

This represents a nearly 20% gain only a handful of months into the year. Gold’s stellar performance was even enough to outpace the S&P 500 in Q1. The Great Recession was the last time gold pulled ahead of the stock market, underscoring the desperation of current economic conditions as investors search for ways to protect their wealth.

Revised Gold Price Predictions for 2024-2025

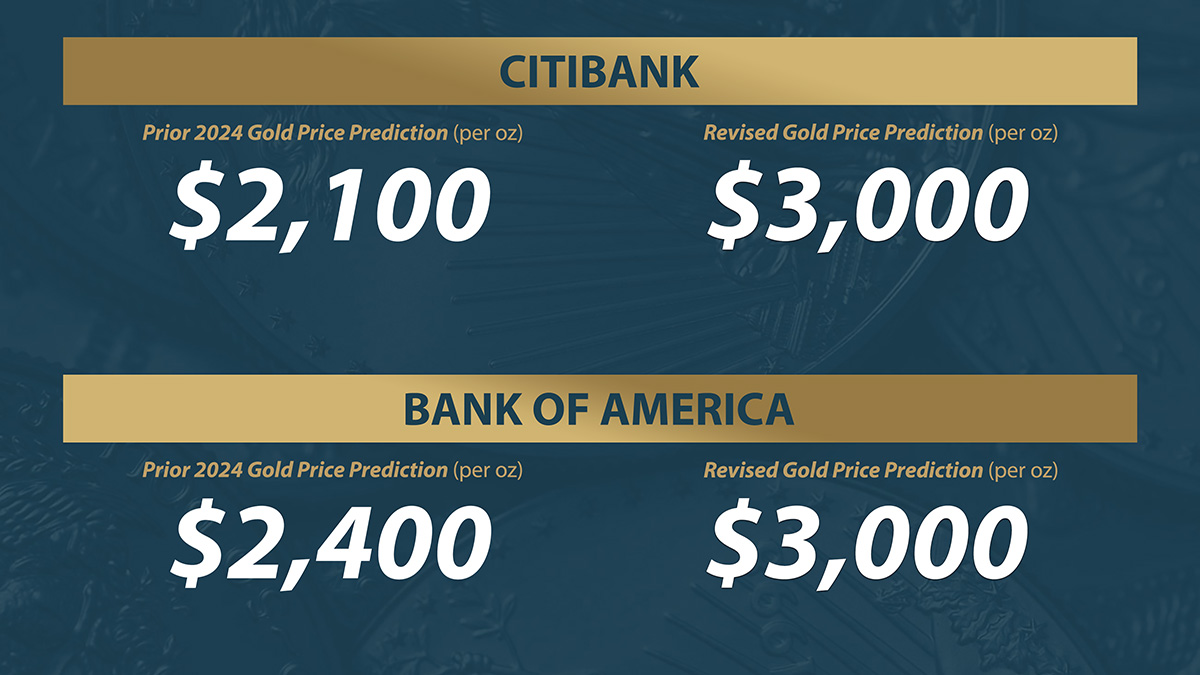

| Financial Institution/Analyst | Prior 2024 Price Prediction (per. oz) | Revised Price Prediction (per. oz) | Time Frame |

|---|---|---|---|

| Citibank | $2,100 | $3,000 | Next 6-18 months |

| Bank of America | $2,400 | $3,000 | By 2025 |

| Gareth Soloway | $2,534 | $3,000 | Next 12 to 18 months |

| Goldman Sachs | $2,300 | $2,700 | EOY 2024 |

| UBS | $2,200 | $2,500 | 2024 |

| J.P Morgan & Chase | $2,175 | $2,500 | 2024 |

| Société Générale | $2,200 | $2,460 | 2024 |

| ANZ Bank | $2,100 | $2,300 | EOY 2024 |

| Commerzbank | $2,100 | $2,200 | 2025 |

| ING | $2,100 | $2,150 | Q4 2024 |

| World Bank | $1,900 | $2,100 | 2024 (Avg.) |

Comments & Quotes for Revised Gold Price Predictions

Aakash Doshi, Citi’s North America Head of Commodities Research

Goldman Sachs

Dominic Schnider Head of Global Commodities & Foreign Exchange at UBS Global Wealth

Bank of America

Société Générale

Natasha Kaneva of J.P. Morgan Chase

Commerzbank

ING

Gareth Soloway

ANZ Bank

World Bank

Why Are Gold Prices Rising?

The economic and geopolitical pictures look bleak which is the primary reason gold’s future is shining so bright. Central banks, institutional investors, and retail investors are hedging their bets with the inherent value of gold rather than the weakening US dollar and dollar-linked assets. According to the experts, here are some of the main drivers behind gold’s ongoing surge:

6 Main Factors Moving Gold Prices Higher in 2024 (According to Market Experts)

1. Looming Interest Rate Cuts

The Federal Reserve has signaled an intention to cut rates following their years-long battle against pandemic-era inflation. Although there’s been some quibbling about when those cuts will hit, the inevitable result is a devalued dollar. Lower returns in traditional markets and decreased buying power will push people into gold and other physical assets to maintain their wealth.

2. Booming Central Bank Demand for Gold

Over the past few years, central bank gold demand has shattered records as governments prepare for a shift in the world economy. With the US dollar teetering on the verge of collapse and various governments vying for reserve currency status, the future of the global financial order looks unstable. Savvy investors are following the plays of the most informed and wealthy investors on the planet by topping up their gold holdings too.

3. Growing Geopolitical Conflicts

A global sense of calm has been obliterated with the rise of wars in Eastern Europe and the Middle East and the rapid deterioration of US hegemony. During periods of worldwide conflict, governments, businesses, and investors alike shift gears to wealth preservation with a heightened focus on gold and other inflation-hedge investments. At the same time, the threat of a fight over Taiwan looms large, creating a perpetual sense of unease.

4. Rising Political Tensions

The upcoming contentious 2024 election has spurred some of the highest political tensions in recent memory. This division further exacerbates economic fears and harms investor confidence, encouraging people to seek safe-haven assets like gold. Most people expect this domestic dispute and instability to bleed over into the following years, regardless of the candidate elected.

5. Ballooning US National Debt

With the national debt topping $34 trillion, the dollar’s dominance is in jeopardy. Domestic and international investors are justifiably losing confidence in the strength and value of the greenback as the government doubles down on its ceaseless spending spree, even in the face of a skyrocketing debt bubble. As the current bedrock of the global economy, the dollar’s decline is driving people into a more stable, secure, and valuable asset – gold.

6. Accelerated De-Dollarization

The failed US fiscal policy is plunging the country into economic catastrophe. Other countries — both allies and adversaries — aren’t coming along for the ride. Over the past few years, there’s been a concerted effort by dozens of nations to decouple from the US dollar through the process of de-dollarization. For these countries, gold has been the asset of choice to replace the USD.