Gold prices are taking a breather after a record-setting jump. Despite standing near unprecedented heights, gold isn’t showing any signs of slowing down. In this week’s The Gold Spot, Sr. Precious Metals Advisor Steve Rand and Precious Metals Advisor Todd Graf explain the fundamentals behind gold’s historic rally, why big banks are revising their price predictions, and how investors should treat this dip.

Gold Prices Remain Strong

Following a massive rally, gold prices remain near a recent record high of $2,400/oz. The yellow metal sat close to $1,800 just over six months ago, marking over a 30% gain. This consistent retesting of the new price ceiling signals continued strength in demand, confident price action, and growing investor sentiment in gold’s role as a safe-haven asset and hedge against inflation.

Predictably, there have been some retracements following gold’s recent peak as long-term holders take profits. However, none of the fundamentals that drove gold prices up in the first place have changed. Even with gold prices sitting close to all-time highs, financial experts are increasing their gold price forecasts for 2024.

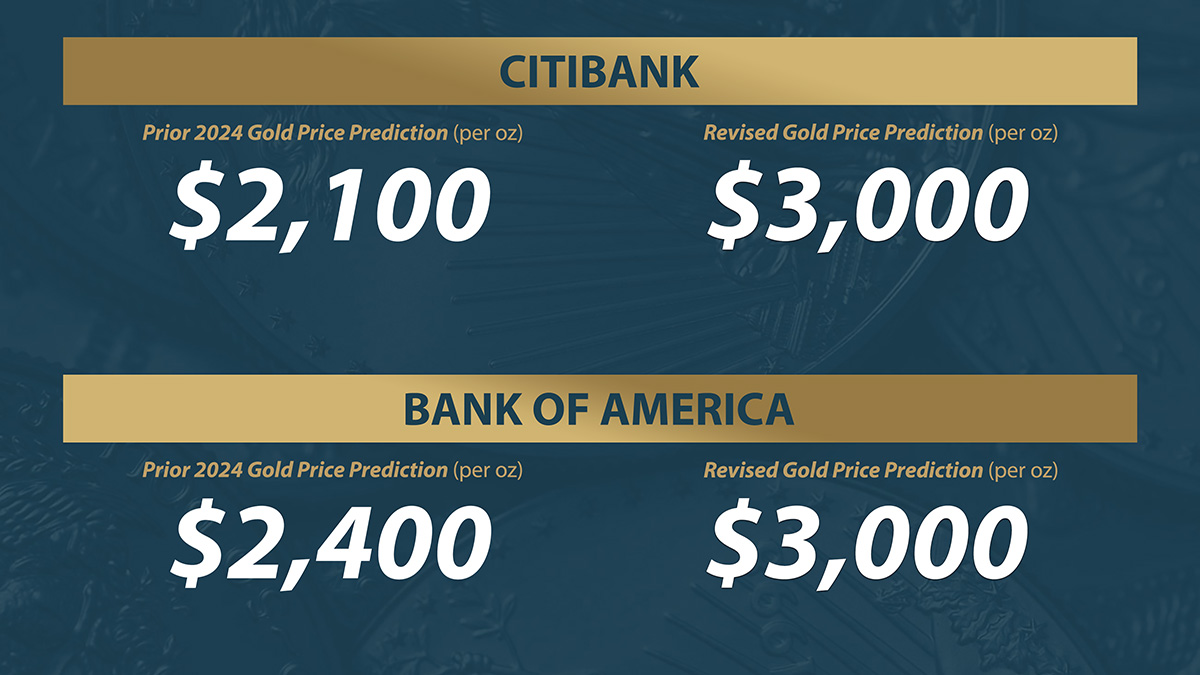

Big Banks Raise Gold Price Predictions

Every year, major banking institutions and Wall Street analysts offer projections for the price of gold. Although the majority called for higher valuations in 2024, the yellow metal’s remarkable surge forced these experts to raise their gold price predictions. For example, Bank of America and Citibank–neither known for their gold advocacy–predict $3,000 an ounce by the end of 2024!

These Wall Street firms are unanimous. They all think that gold is going up.–

There’s no other asset receiving this much agreement from various institutional experts, highlighting the strength of the narrative behind gold as a safe-haven asset and the expectation of worsening economic conditions.

What’s Driving Up Gold Prices?

These gold price predictions aren’t conjured up in a vacuum. They result from in-depth analyses of market indicators, geopolitical events, central bank policies, historical price trends, and investor sentiment.

In short, experts are increasing their gold price forecasts for 2024 because of broad economic deterioration and growing instability. Here are some of the most pressing factors driving up gold predictions:

- Higher Inflation – The Fed has struggled to stamp out inflation, and negative CPI numbers continue to delay their ostensibly incoming rate cuts.

- Debt & Spending – The government adds $1 trillion every 100 days to the staggering $34 trillion national debt.

- Declining Dollar – The combination of a global process of de-dollarization and the declining influence of the US is sucking the value out of the greenback.

- Ongoing Wars – The Russian-Ukraine War drags on, the Israel-Hamas War threatens to spill over into a broader conflict, and China applies more pressure on Taiwan.

Americans Living Paycheck to Paycheck

All these threats to the US dollar culminate in decreased buying power and increased living costs. A recent report found that a person living in a major US city needs to make $96,500 to live comfortably. That number climbs to $235,000 for a family of four if they don’t want to live paycheck to paycheck.

The current economic discomfort stemming from a depreciating dollar merely scratches the surface of the potential depth of the pain that could unfold. This widespread and concrete realization leads investors to pursue the inflation-hedge properties of gold over the deteriorating dollar and dollar-linked assets.

Don’t Wait to Buy Gold, Buy Gold and Wait

All economic indicators, expert forecasts, and geopolitical conditions suggest that we’re only in the early innings of a massive gold rally. The recent pullback is a blip on the radar in light of gold’s overall price increase. Experts point to this short-term dip as a prime buying opportunity before central banks continue their buying spree.

If you’re ready to maximize your gold investments, request a FREE copy of our Precious Metals Investment Guide. It covers everything you need to know about strengthening your portfolio with gold and silver assets for a more stable and profitable financial future.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields