Gold’s seemingly non-stop surge has many investors wondering how to approach this booming asset. Several questions have arisen: Is it too late to buy gold? How much higher is it going? What’s behind the gold (and silver price) rally?

In this week’s The Gold Spot, Scottsdale Bullion & Coin Founder Eric Sepanek and Precious Metals Advisor Brian Conneely explore the economic backdrop of this record-setting rise in gold prices, where the yellow metal is headed in the near future, and how people can best position their investments for long-term success.

Fed Baulks at Rate Cuts

Late last year, the Federal Reserve announced its expectation of three rate cuts throughout 2024. However, March’s worse-than-anticipated CPI data has the government shifting the goalposts. Currently, the greatest likelihood is a measly reduction of 0.5%. Inflation is proving to be more stubborn than Fed leaders suspected, and their fiscal policies are proving to be less successful than hoped.

Gold Soars to $2,400 an Ounce!

On Thursday, gold prices jumped above $2,370/oz, marking another record-setting number in April. On Friday, April 12th, 2024, the bullion spot price of gold briefly broke through the $2,400/oz barrier (intraday) on safe-haven demand. Bank of America, which is notoriously bearish on gold, adjusted its 2024 gold price forecast from $2,400/oz to $3,000/oz on the back of the yellow metal’s rally. Our own analysis of various expert predictions for gold put prices at a high of $2,500 for the year. At this pace, however, gold prices could hit that sooner than expected.

China Far Outpaces US Gold Buying

The media’s focus might be on the US economy, but China is doing the heavy lifting behind gold’s impressive rally. Although the US maintains the world’s largest gold reserves at 8,133 tons (nearly 70% of global reserves), the CCP is dead set on closing the gap.

In 2023 alone, China added a whopping 225 tons to its gold reserves, pushing the country’s total reserves to 2,235 tons. For comparison, US gold reserves have remained virtually unchanged for nearly a decade.

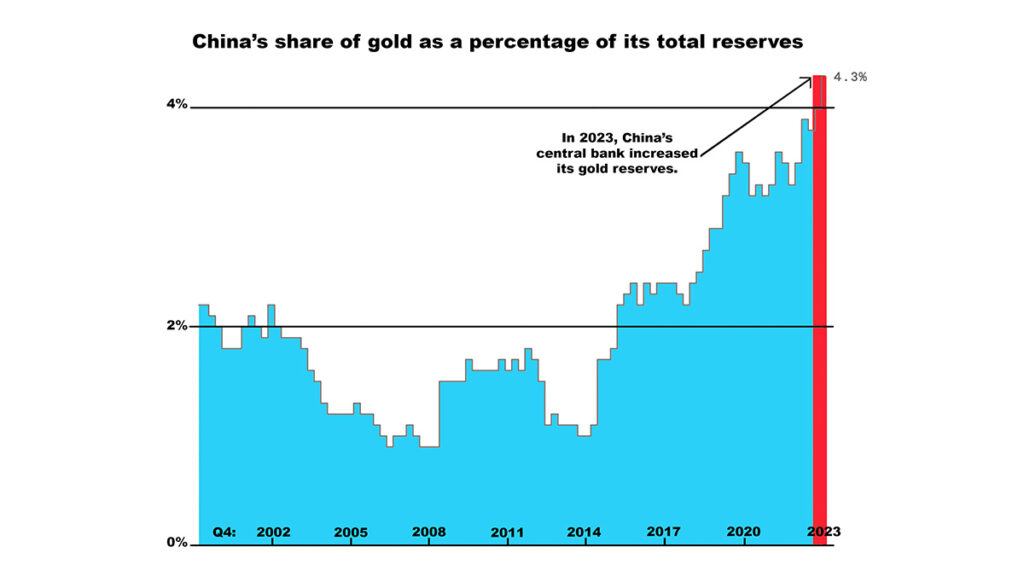

China’s gold binge doesn’t only demonstrate its eagerness to accumulate precious metals but also reflects its move away from the US dollar. In 2023, the yellow metal represented 4.3% of the Bank of China’s foreign reserves, up from 2.9% in 2019.

What’s Driving China’s Gold Rush?

If China is the driving force behind gold’s recent surge, investors naturally wonder what’s prompting the CCP to dive into physical metals. In short, the mismanagement of the US dollar is to blame.

Dollar Weaponization – The weaponization of the greenback in the form of economic sanctions has driven China and Russia closer together while prompting their collective move away from the dollar.

Central Bank Gold Demand – An unprecedented spate of central bank gold buying by countries around the world has further prompted China to add to its stockpiles to further its leading position on the global economic stage.

Yuan Influence – The weakness of the US dollar, resulting from disastrous monetary policies, has created a gap in the global economy the Chinese government would love to fill with the Yuan.

BRICS Nations Aim to Topple USD

China is joined by Brazil, Russia, India, South Africa, and a slew of emerging economies in its mission to topple the US dollar. Under the banner of the BRICS nations, these countries are full steam ahead in the process of de-dollarization.

[The goal of BRICS] is to replace the US dollar as the [world] reserve currency.–

The group’s rapid expansion is a testament to the worldwide lack of confidence in the power, stability, and future of the US dollar. The world is shifting from a fiat-dominated economy where the dollar reigns supreme to a gold-focused economy where inherent value is key.

How High Can Gold Go?

All the economic, geopolitical, and political stars are aligning in favor of gold’s continued upward momentum. The yellow metal has consistently burst through all-time highs over the past few weeks, inching closer to overall gold price forecasts for 2024. Experts are already adjusting their expectations following gold’s strong performance.

👉 Related Read: Gold Price Forecast for 2025

Look out! We’ve broken those resistance levels, so now it’s anybody’s guess where [gold prices] can go from here.–

Silver Joins the Rally

Silver is following close behind gold’s rally, recently reaching its highest point in years. This week, silver prices confidently sit above $28/oz which marks a 17% gain since the beginning of the year. In April alone, the shiny metal has grown by an impressive 12%, more than doubling gold’s price jump during the same period. The familiar factors driving up the price of gold (i.e. central bank demand, geopolitical conflicts, and economic instability) are the same forces pushing silver higher.

Don’t Wait to Buy Gold, Buy Gold and Wait

The well-earned excitement around gold’s record-setting leaps can distract from the big picture. Investors must bear in mind that gold is most effective as a long-term asset. When viewed from this perspective, gold’s recent rally is a reason to buy gold and wait instead of waiting to buy gold.

“Do not short-term this product. [Gold] is a long-term hold. That's it what it does best.”

Everything points to gold’s continued upward movement. Whether you’re only exposing yourself to precious metals or adding to your stockpiles, now is a good time to catch gold prices before they go higher.

If you’re interested in getting the most out of your gold investments, request a FREE copy of our Precious Metals Investment Guide. It covers everything you need to know about diversifying with gold and silver assets for a more secure, stable, and rewarding financial future.

Don’t Miss The Gold Spot Overtime

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields