The trade war with China escalated further last week as President Trump followed through with tariffs on another $200 billion in goods. Safe haven buying, along with strong economic data, pushed the dollar higher and weighed on gold prices. Russia and China announced plans to sidestep the dollar, ostensibly as a means of fighting protectionism—though the move could just as easily be seen as part of a long-term plan to undermine its role as the world’s reserve currency.

In other news, a cache of coins from the 5th century, the era marking the fall of the Western Roman Empire, was discovered in Italy, a fitting find considering the current state of global affairs.

Economic events have moved the gold market all summer, but what else affects prices for the yellow metal? Find out in “How These 10 Factors Regularly Influence Gold Prices.”

Gold Price Movement Indicators

Monday, September 10, 2018

Rare Coin Discovery

Monday brought exciting news for numismatists. Hundreds of mint condition Roman gold coins were discovered in Como, Italy, reported Newsweek. Workers converting a disused 19th century theater into apartments found the coins hidden in a soapstone jar beneath the building. Dating back to the 5th century, the coins were among several other Roman artifacts that have been uncovered in the region, which sits near the Roman-era town of Novum Comum.

‘It’s practically an entire collection, unlike anything else ever found in northern Italy. Sometimes coins that are found stuck together but these are all separate, it was like opening a wallet,’ remarked Luca Rinaldi, the local archeology superintendent.

Typically, a discovery of ancient coins can make their known counterparts less rare, potentially bringing down the price. Learn more in “Investing in Rare Coins.”

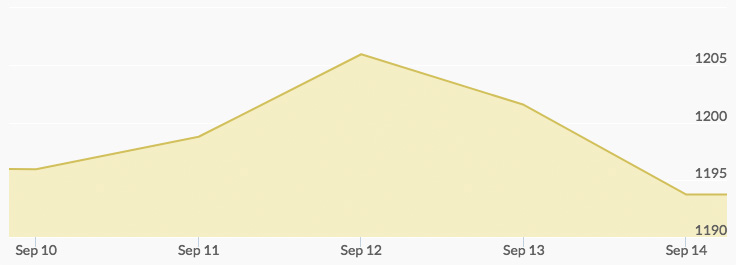

While the find was surely thrilling for rare coin collectors, it probably had little impact on the overall gold market. Gold prices remained in the bargain range on Monday, rising from the 2 am low of $1,191.90 to the 11 am high of $1,196.70.

Tuesday, September 11, 2018

Bargain Buying

Investors took advantage of bargain prices for gold on Tuesday, purchasing more of the yellow metal as it flirted with the psychologically-important $1,200 level when it reached the daily high of $1,198.10 from 5 pm to 6 pm.

‘Some investors see below $1,200 as a small window to buy, because historically we haven’t seen gold remain below $1,200 since late December 2016, even though I think it’s going to go down to match those precious lows,’ noted the senior commodities strategist at RJO Futures in Chicago, Phil Streible.

Read about where the price of gold could be headed for the remainder of the year in “Gold Price Forecast 2018.”

Wednesday, September 12, 2018

Russia and China Threaten the Dollar

CNBC reported on Wednesday that President Vladimir Putin announced that Russia and China planned to use their national currencies in transactions instead of the dollar at a forum for a round table discussion on inter-regional cooperation the day prior.

‘The Russian and Chinese sides have confirmed the interest in more active use of national currencies in bilateral transactions. This will increase stability of banking services for export-import amid continuing risks in global markets,’ explained Putin after the countries vowed to fight protectionism together.

This was not China’s first foray into sidestepping the dollar. As the world’s second biggest economy and largest importer of oil, China has been strong-arming countries to accept payments for oil in the yuan instead of the dollar. With China, as well as Russia, stockpiling gold, many experts believe a gold-backed yuan might be in the making—the perfect replacement for the dollar after China subverts its role as the global reserve currency.

The plan spells higher gold prices for two reasons: increased demand to support a Chinese gold standard and due to a surge in buying as dollar-denominated assets become more affordable.

Get the full story in “Petro-Yuan Rising: The Must-Read Truth Behind China’s Plan to Dethrone the Dollar.”

Gold prices reached higher highs on Wednesday, rising from a low of $1,193 at 3 am to a high of $1,207.90 at 3 pm.

Thursday, September 13, 2018

Warnings from Wall Street

Economists have been predicting that an economic crash is on the way as soon as next year, and on Thursday DoubleLine founder Jeff Gundlach echoed their warnings:

‘Here we are doing something that almost seems like a suicide mission. We are increasing the size of the deficit while we’re raising interest rates. … It’s pretty much unprecedented that we’re seeing this level debt expansion so late in an economic cycle,’ said Gundlach during a webcast to discuss his DoubleLine Total Return Bond Fund.

Gundlach agreed with economists on another issue too: the dollar is set to fall. In mid-August, Goldman Sachs analysts indicated that the dollar rally wouldn’t last much longer. If and when the greenback takes a dive, the price of gold would likely skyrocket. Citing a massive ‘head-and-shoulders bottom’ base, Gundlach recently predicted gold prices could soon jump by $1,000.

Read what other experts are saying about gold in: “Gold: The Ultimate Safe Haven Investment.”

Thursday brought the high for the week of $1,209.80 at 10 am; however, gold prices pulled back to $1,200.90 from 5 pm to 6 pm.

Friday, September 14, 2018

Rising Interest Rates & Geo-Economic Risk

An escalation of the trade war with China and strong economic data signaling more Fed interest rate hikes served as tailwinds to the dollar on Friday, making assets denominated in it more expensive for foreign buyers. The ICE U.S. Dollar Index gained .4 percent to 94.923; however, it still closed out the week .5 percent down, its worst performance in three weeks.

Reports surfaced that President Trump directed aids to follow through with the tariffs on $200 billion worth of Chinese goods he threated last week.

‘I think that’s what’s driving gold lower, the dollar higher and the S&P market lower. Companies are theoretically going to make less money because they will get that tax,’ explained the head trader at U.S. Global Investors, Michael Matousek.

The University of Michigan’s consumer sentiment index for September surpassed expectations of 97 to hit 100.90; it hasn’t been that high since 2014. Industrial production also eclipsed the forecast .3 percent, expanding by .4 percent. Such data will likely compel the Fed to follow through with its policy of monetary tightening for the near future.[1] Companies—and emerging markets—could take another hit as the Fed continues to increase the cost of servicing the massive amounts of debt accumulated during the last decade of loose monetary policy.

While the trade war and overheating economy may be lifting the dollar now, both events could prove detrimental for the U.S. and global economy in the long term. When the crisis hits, gold prices could soar as investors seek protection from the time-proven safe haven.

The price gold enjoyed a morning of higher highs, hitting $1,207.50 at 4 am before pulling back to $1,193.10 at 5 pm.

Check today’s live gold prices with our Spot Gold Price Chart.