Investors often notice a gap between the spot price of gold and the cost of pure gold assets. This discrepancy leads many to wonder how to buy gold at the spot price. After all, if this standard pricing mechanism determines the value of gold assets, the prices of bullion bars and coins should reflect it, right? In reality, the evaluation of gold and silver assets isn’t so straightforward. A full explanation of the difference between the cost of physical precious metals and the spot price requires an in-depth look at the inner workings of the metals market.

Investors often notice a gap between the spot price of gold and the cost of pure gold assets. This discrepancy leads many to wonder how to buy gold at the spot price. After all, if this standard pricing mechanism determines the value of gold assets, the prices of bullion bars and coins should reflect it, right? In reality, the evaluation of gold and silver assets isn’t so straightforward. A full explanation of the difference between the cost of physical precious metals and the spot price requires an in-depth look at the inner workings of the metals market.

Understanding the Spot Price & Dealer Premiums

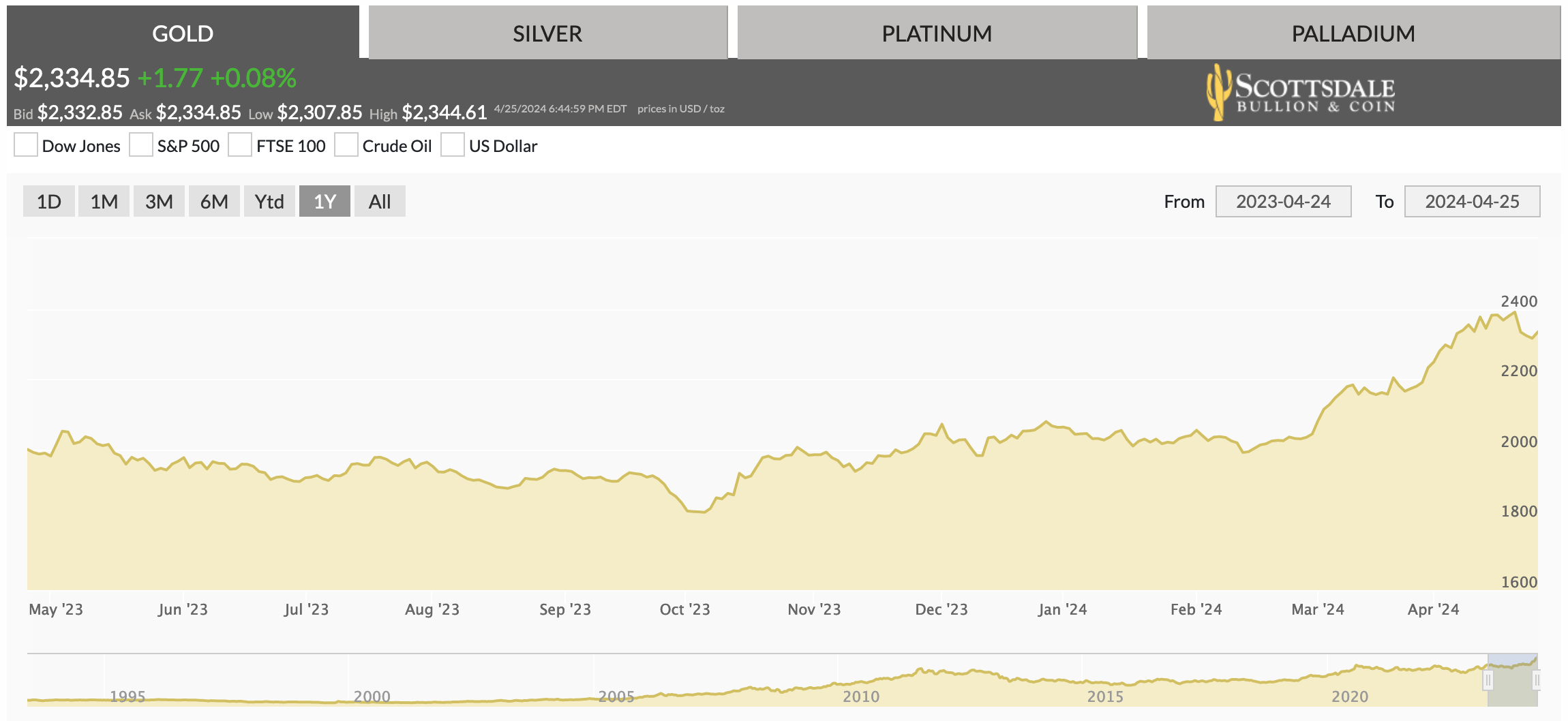

The spot price is the current market price of one troy ounce of gold or silver. It represents the raw market value of these precious metals instead of the actual prices investors pay. Technically speaking, the spot price is an average of the net present value of gold or silver prices, based on futures contracts traded in the nearest month. This benchmark evaluation fluctuates constantly throughout the day based on a variety of market conditions including supply and demand, investment trends, market speculation, mining costs, economic health, and geopolitical events.

Gold and silver assets are priced higher than the spot price because of the overhead costs associated with manufacturing, distributing, and storing these physical investments. These additional expenses are reflected in dealer premiums which mints, suppliers, and dealers add to their precious metals products.

A more familiar comparison to the concept of spot prices and dealer premiums can be found in the oil market. The wholesale price of crude oil represents the base price of this commodity, but no consumers expect to pay this price when showing up at the gas station. They understand the refinement, distribution, and transportation costs involved in converting crude oil into a consumable source of energy. These additional expenses and steps create a gap between the original market price and what they ultimately pay. The same is true for precious metals.

Can gold or silver be bought at the spot price?

No, investors cannot buy gold or silver assets at the spot price. Even precious metals suppliers and dealers aren’t able to source precious metals assets at the spot price. This pricing mechanism provides a basis for the evaluation of pure gold products, but it doesn’t factor in the various costs associated with turning metals into investment assets. Every party between the mint and the end consumer pays a premium to cover their overhead expenses.

It’s important to note that many gold and silver products fetch evaluations beyond the spot price due to numismatic value. For example, the historical significance, scarcity, and condition of rare coins can further elevate their prices. This isn’t the case for bullion coins and bars which are closer to the current spot price of gold and silver.

Buying Gold & Silver Close to the Spot Price

Although it’s impossible to buy gold and silver at the spot price, you can take steps to make sure the final cost is as close to this base price as possible. Here are some effective tips:

Monitor spot prices.

Before purchasing physical precious metals, you should accurately assess recent spot prices. This knowledge is crucial for determining how an asset’s price point relates to the current base value of gold or silver. We provide real-time spot price charts for all precious metals to help investors make more informed investment choices.

Buy in bulk.

Buying in bulk can drive down dealer premiums when calculated per ounce. Generally, the premium over the spot price decreases as the quantity of precious metals increases. That’s because suppliers and dealers spend less on sourcing, distributing, and handling a single large order compared to several smaller orders, on a per-unit basis.

Focus on bullion.

If price is your main concern, gold and silver bullion tend to carry lower premiums when compared to numismatic, rare coins. The value of bullion – in the form of bars, coins, and rounds – is exclusively based on their precious metal content and purity ratings rather than extraneous factors such as historical appeal, scarcity, or craftsmanship. Gold and silver bars especially attract lower premiums, owing to their standardized form and larger sizes.

Avoid high premiums.

Some popular gold and silver products have earned a reputation for attracting high premiums. These above-average premiums often result during periods of rising demand and dwindling supply. The extra effort required to source these highly sought-after items results in higher costs for dealers which are baked into the premiums. You can avoid these high premiums by waiting for conditions to return to normal or focusing on less in-demand assets.

👉 Related Reading: Why Silver Eagles Are So Expensive Right Now

Beware of sales tricks.

Unfortunately, the precious metals market is no stranger to misleading sales tactics. The inevitable cost of dealer premiums is one of the soft spots these “misleading” sellers target to exploit unwitting buyers. If you’re seeing promises of “zero” or “no” premium charge, avoid the temptation to believe it. In reality, these costs are simply going to be reallocated into the base price of the asset.

Stick with reputable dealers.

Dealer premiums can be a daunting and confusing part of the precious metals market. To make sure you’re not paying more than necessary above the spot price, it’s critical to stick with reputable dealers. Experienced and established professionals with a track record of offering market-standard premiums can help ensure you get the most out of your investments.

Looking to diversify your portfolio with gold or silver but not sure where to begin?

Grab a FREE copy of our Precious Metals Investment Guide. It covers everything you need to know to protect your wealth from economic downturns with physical precious metals.