What’s bigger than the U.S. economy?

It’s public debt.

America is drowning in debt, and the tides keep rising:

- + $1.9 trillion in stimulus

- + $1.9 trillion in forgiven student loan debt

In the next 30 days, you could see the national debt balloon from nearly $28 trillion to $31.8 trillion. Not since World War II has public debt been so high.

This time around, however, there won’t be a post-war economic boom to bail us out.

The Fed’s plan? Print. Spend. Tax. Pretty sophisticated strategy, right? The worst part?

“The problem I see is the government has no exit strategy,” explained precious metals advisor John Karow in the video above with Scottsdale Bullion & Coin’s Founder Eric Sepanek. “We’re back to a policy that’s failed all over the world.”

Smart money investors know the End Game for the Fed’s Grand Experiment is Now. They see the flood gates bending and cracking under the weight of the country’s colossal debt, and they’ve been rushing to gold since President Biden’s confirmation.

“The new administration is simply going to keep raising taxes, and for me that means gold continues to be the life raft it’s always been. As the tide of taxation rises and the tide of government spending rises, there’s no other place to protect yourself,” said John.

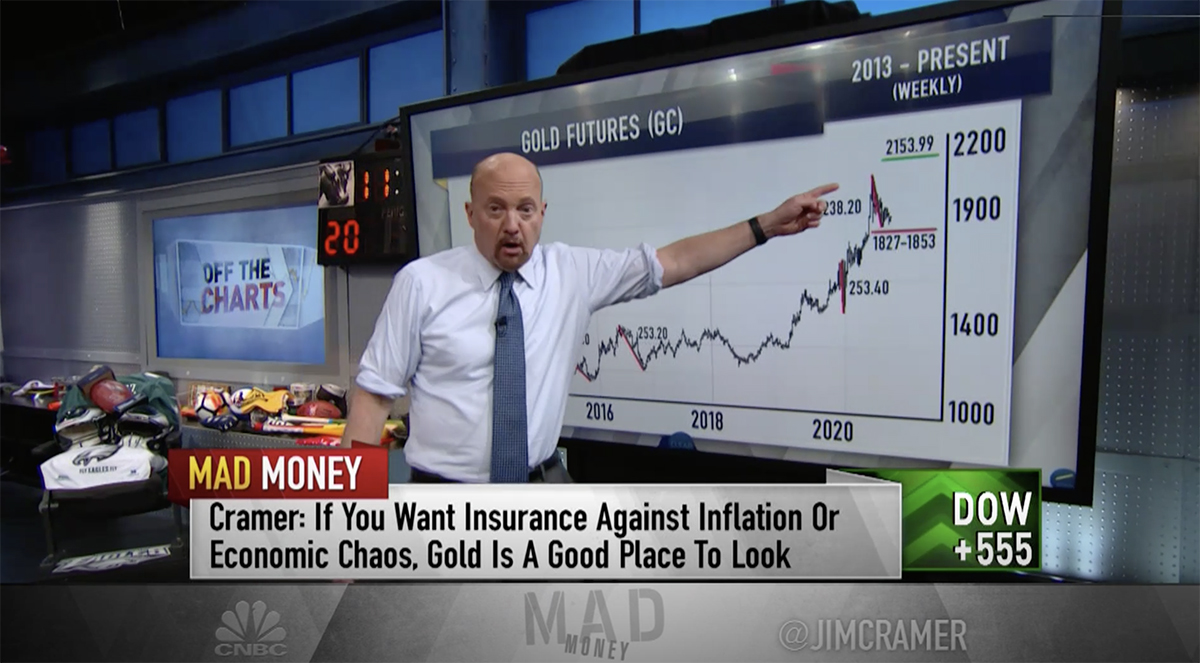

This is evident in the spot price of gold, which has already jumped $35. Analysts are forecasting gold prices to hit $1,950 by the middle of next month.1

Have you secured your life raft yet?

If not, now is the time to buy gold and silver, before prices take off. Speak with your precious metals advisor today. Call 1 (888) 812-9892 today.