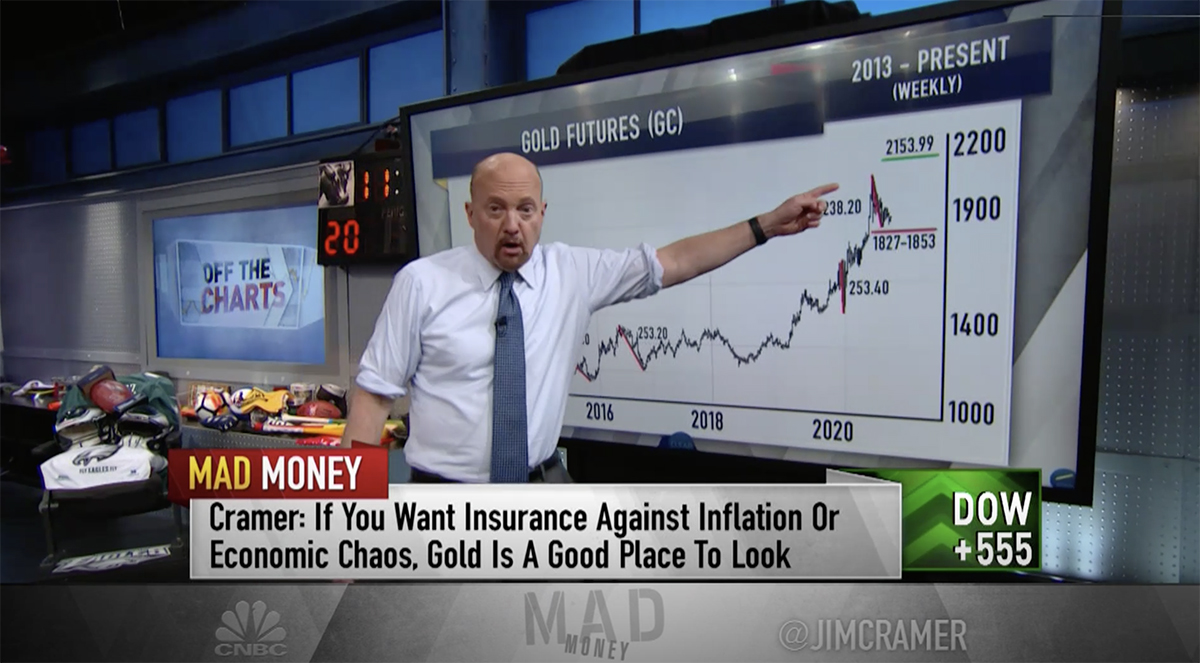

“What do you do; what do you buy if you want some insurance against inflation or just general economic chaos. It’s time-honored. You need some gold.”– Jim Cramer, host of Mad Money on CNBC

You may not know the outcome of the presidential election, but you can count on gold prices heading higher—at least if you believe experts like Mad Money’s Jim Cramer.

“Gold prices could have a lot more room to run,” predicted Cramer.

Citing Fibonacci analyst Carolyn Boroden’s gold price chart analysis, Cramer urged investors to buy gold on November 4, 2020.1

“As long as gold holds above [$1,900 an ounce], Boroden believes the long-term trend remains intact, meaning it can resume its long march higher. How much higher? Well, based on the Fibonacci methodology, she thinks it can take out $2,153. That’s roughly 13% from where the shiny stuff is currently trading. I want that money. I hope you do too,” said Cramer.

What factors are influencing gold prices?

- Another economic shutdown could be coming.

- More stimulus money is certain. And with it, deficit spending.

Combined, these gold price factors could result in rising inflation and continued economic uncertainty, explained Cramer.

Scottsdale Bullion & Coin’s Senior Precious Metals Advisor Damian White offered further analysis of the current economic outlook for the country:

“The current economic environment is rife with instability and uncertainty. Add in a contentious and undecided presidential election that will most likely be headed to the Supreme Court and the future seems very cloudy.

“What is the best insurance against this economic chaos? Gold of course. Regardless of the election, the economy is still devastated from COVID-19, which is apparently far from over.

“Simultaneously, inflation pressures continue as we have unprecedented monetary stimulus with more coming in another economic stimulus package at some point soon when the election is finally resolved.”

Boroden, Cramer, and White aren’t the only analysts predicting gold prices will rise. Several big banks and financial institutions have released bullish gold price forecasts for 2020 and beyond.

If you’d like more information on how to diversify your portfolio with gold, the precious metals advisors at Scottsdale Bullion & Coin can help. Call 1 (888) 812-9892.