Gold has a host of drivers working in its favor, and [we] believe that gold is on its way to new highs.— Austin Pickle, investment strategy analyst for Wells Fargo[1]

UPDATED: Gold Price Predictions for 2024

Will the price of gold go up or down in 2024? What trends should investors be watching? Read the forecasts here: Gold Price Forecast 2024

Global pandemic. Mass unemployment. Political and civil unrest. Few could’ve imagined what a tumultuous year 2020 would start out to be. But now, with a future so uncertain it’s difficult to even make plans, the question on everyone’s mind is, “What’s next?”

Everyone except the gold experts. Because they know gold thrives during uncertain times. It is, after all, the ultimate safe haven investment.

The price of gold has already set records in 2020, soaring past $2,067 an ounce in the 3rd quarter. How much higher could gold prices go?

See what industry insiders, financial analysts, and big banks predict for spot gold prices in 2021 below.

Gold Price Predictions for 2021

Institutional Gold Price Forecast 2021

| Financial Institution | Gold Price Prediction | Quarter of 2021 |

|---|---|---|

| Nicoya Research | $3,250/oz | None specified |

| Technical Traders Ltd. | $2,400/oz | Q1 |

| Natixis | $1,950/oz | Q2 |

| Gov Capital | $2,192.91/oz | Q3 |

| ABN AMRO | $2,000/oz | Q4 |

| Wells Fargo | $2,200 – $2,300/oz | Q4 |

| Citibank | $2,300/oz | Q4 |

| Bloomberg Intelligence | $2,100/oz | Q1 |

| Commerzbank | $2,300/oz | Q4 |

| Credit Suisse | $2,200/oz | Q3 |

| Bank of America | $2,063/oz | None specified |

| Goldman Sachs | $2,000-$2,300/oz | Toward EOY 2021 |

| Capitol Economics | $1,900/oz | None specified |

| Edison | $661/oz | None specified |

| Jeffries | $2,200/oz | None specified |

| Fitch Ratings | $1,400/oz | None specified |

| Oreninc | $1,800/oz | None specified |

Nicoya Research

$3,250/Oz Gold in 2021

Investment firm Nicoya Research foresees the price of gold climbing to $3,250 an ounce in 2021. Diminishing gold supply every quarter since 2019 in the face of increasing demand for gold and silver coins from institutional and retail investors is set to push gold prices higher in the coming year. And, if gold’s current bull run is anything like the last time around, the price of gold could soar to $6,000 by 2025, predicted Nicoya.[2]

Technical Traders

$2,400/Oz Gold in 2021

By the end of January 2021, gold prices could hit $2,400 per ounce, said Chris Vermeulen, the Chief Market Strategist for Technical Traders Ltd. On August 13, 2020, Vermeulen forecast the price of gold to reach $2,160 an ounce and pause briefly before jumping another $250.[3]

Natixis

$1,950/Oz Gold in 2021

If the Federal Reserve introduces yield curve control, you could see $1,950-an-ounce gold in the second quarter of 2021, suggested Bernard Dahdah, head of precious metals research at the international investment bank Natixis on July 3, 2020. The price of gold surpassed $2,000 an ounce a few weeks after he made this prediction and has hovered right below or above $1,950 an ounce since.[4]

Gov Capitol

$2,192.91/Oz Gold in 2021

Utilizing a custom algorithm based on Deep Learning, investor blog Gov Capitol predicted on September 3, 2020 that gold prices would reach $2,192.91 an ounce in one year, which would be the third quarter of 2021. Even more impressive? Gov Capitol’s 5-year gold price forecast of $9,134.90 an ounce.[5]

ABN AMRO

$2,000/Oz Gold in 2021

“The stars continue to align for the gold market,” wrote Georgette Boele, the precious metals strategist at Dutch bank ABN AMRO. Why? Because real interest rates are negative and could descend even further should inflation rise. Factor in the limited upside potential for U.S. Treasury yields if the Fed introduces yield curve control, and the outlook for gold gets even brighter.

Even if there is a correction in the gold market, noted Boele, it will likely be short-lived and should be viewed as an opportunity for investors to “buy-on-dips.” On July 9, 2020, she predicted the price of gold to close 2021 at $2,000 an ounce.[6]

Wells Fargo

$2,200 – $2,300/Oz Gold in 2021

Echoing Boele’s statement, Austin Pickle, a Wells Fargo investment strategy analyst, asserted that market fundamentals are favorable for gold but, “it won’t be a straight line higher in terms of future price moves. ‘Gold could take a breather in the short term.’” And, he argued, this has been the pattern for gold prices since finally breaking through the $1,300-an-ounce resistance level in 2019. The next stop for gold? $2,200 – $2,300 an ounce by the end of 2021.[7]

Everything you need to know to get started in Precious Metals

Learn how precious metals can strengthen your portfolio, protect your assets and leverage inflation.

Request the Free GuideGold vs. Major Resistance Levels

Source: https://www.kitco.com/news/2020-07-08/-We-still-like-gold-at-these-levels-Prices-can-move-another-500-by-end-of-next-year-Wells-Fargo.html

Citibank

$2,300/Oz Gold in 2021

More than any other factor influencing gold prices, Citi economists indicated negative real yields are driving the rally because bond yields equal to or lower than the rate of inflation reduce the opportunity cost of holding gold. Should inflation rise to 3%, investors would likely see a -3% real yield.

And gold prices? They could ‘perform extremely well,’ explained Guy Foster, head of research at Brewin Dolphin. How well? Citi economists foresee $2,300-an-ounce gold by the fourth quarter of 2021.[8]

Bloomberg Intelligence

$2,100/Oz Gold in 2021

Bloomberg Intelligence senior commodity strategist Mike McGlone sees debt and quantitative easing fueling the continued bull run for gold prices. McGlone forecasts gold prices nearing $2,100 an ounce to start 2021.[9]

Commerzbank

$2,300/Oz Gold in 2021

Analysts for the German bank Commerzbank cited similar gold price drivers as McGlone, stating ‘We do not expect a change in the ultra-expansionary monetary and fiscal policy despite the upcoming vaccinations.’

Even if the pandemic is largely contained by the second half of 2021, it could take years to chip away at the astronomical level of public debt and the central bank’s inflated balance sheets—numbers no one talks about anymore but that could seriously weigh on the U.S. economy and dollar.

Consequently, conditions could only grow more favorable for gold, pushing the price of gold past $2,300 an ounce by the fourth quarter of 2021.[10]

Credit Suisse

$2,200/Oz Gold in 2021

‘We think any near-term pullback in gold prices due to COVID-19 vaccine approvals and the rollout is a good entry point because the economy remains fragile and the post-pandemic recovery will be gradual at best, meaning a low rate environment and an elevated gold price environment is here to stay at least for the next few years,’ wrote Credit Suisse analysts Patrick Collier and Nick Herbert.

Such factors should propel gold prices to $2,200 an ounce by the third quarter of 2021. Overall, they expect a yearly average for the price of gold of $2,100.[11]

Bank of America

$2,063/Oz Gold in 2021

Optimism over the reported 90% effectiveness of all three potential COVID-19 vaccines led Bank of America analysts to lower their 2021 gold price forecast from $3,000 an ounce to $2,063 an ounce.

Previously, markets were expecting the vaccines to be only 60% effective, so, with the greater anticipated potency of the vaccines currently rolling out, the bank’s analysts think life could get “back to normal quicker in 2021.”[12]

Goldman Sachs

$2,000-$2,300/Oz Gold in 2021

Similar to Bank of America’s analysts, Goldman Sachs’ top financial experts are optimistic about the vaccines; however, they’re also factoring the possibility of further economic devastation into their gold price prediction for 2021.

Higher inflation, a weaker U.S. dollar, and recovering emerging market retail demand should support a structural bull market for gold, said commodity analysts Jeffrey Currie and Mikhail Sprogis. The biggest tailwind for gold prices? Plummeting real five-year yields. They predict the price of gold to hit $2,300 an ounce in 2021.

‘We believe the bulk of gold purchases which happened this year were made by investors who were more concerned about the real purchasing power of the dollar vs. losses in their equity portfolios,’ explained Currie and Sprogis.[13]

Update August 19, 2021: Goldman Sachs’ analysts are still forecasting strong gold prices in 2021. Their latest gold price forecast is $2,000/oz towards the end of the year.[21]

Capitol Economics

$1,900/Oz Gold in 2021

Rising inflation and low yields are the two main factors driving gold prices in Capitol Economics’ experts’ somewhat contrarian gold price forecast.

Historically, gold has performed well during periods of inflation, but the consultancy’s researchers foresee the Fed responding to an uptick in inflation with higher interest rates, thus triggering a risk-on investing environment. This could hinder demand for gold and keep prices at around $1,900 an ounce in 2021—still at record highs compared to previous years.[14]

Edison

$661/Oz Gold in 2021

Didn’t see that one coming, did you? Well, not to worry, because $661-an-ounce gold is about as likely as the Fed unwinding its astronomical balance sheet by $1.48 trillion this year.

Lofty as it sounds, that is the Central Bank’s plan. Edison, an investment research and advisory company, wanted to show investors its impact if successful, noting that “a 39.2% contraction of the monetary base is without precedent in the modern era and it could cause strengthening of the dollar, a deep domestic U.S. recession and material downward pressure on price.”[15]

Jeffries

$2,200/Oz Gold in 2021

A softening U.S. dollar and perpetually low interest rates will result in an average gold price of $2,200 an ounce in 2021, predict analysts at Jeffries, a U.S. investment bank.[16]

Fitch Ratings

$1,400/Oz Gold in 2021

A weak dollar and low interest rates also factor into well-known credit rating service Fitch’s gold price forecast for 2021; however, the firm foresees prolonged recessionary conditions resulting in a surplus of gold scrap supply, which could temper gold’s recent record-high prices and result in $14,000-an-ounce gold this year.[17]

Oreninc

$1,800/Oz Gold in 2021

‘Theoretically all signs point to up, [but] if all the analysts agree that gold should go up, it usually doesn’t,”’ quipped Kai Hoffman, CEO of boutique merchant bank Oreninc.

Thus, his relatively conservative gold price prediction of $1,800 an ounce in 2021.[18]

Financial Analyst Gold Price Forecast 2021

| Financial Analyst | Gold Price Prediction | Quarter of 2021 |

|---|---|---|

| AG Thornson | $2,300/oz | Q1 |

| Peter Krauth | $2,300/oz | None specified |

AG Thorson

$2,300/Oz Gold in 2021

Expert gold technical analyst AG Thorson says gold prices are climbing the ‘wall of worry’ after bottoming last November, its bricks made of the mass of impending evictions and foreclosures; commercial real estate crises; and bankruptcies and defaults—not to mention a modern financial system under siege by cyberattacks.

Expect gold prices to breakout. Fast. $2,300-an-ounce gold could be here within the first few weeks of 2021, predicts Thornson.[19]

Peter Krauth

$2,300/Oz Gold in 2021

‘Tis the season for gold buying, says veteran resource market analyst Peter Krauth. Glittering gifts of gold for Christmas and Chinese New Year; growing savings accounts thanks to additional stimulus money; and the changing of the guard in the White House could all fuel gold buying—and prices—this winter. How high? $2,300 an ounce.[20]

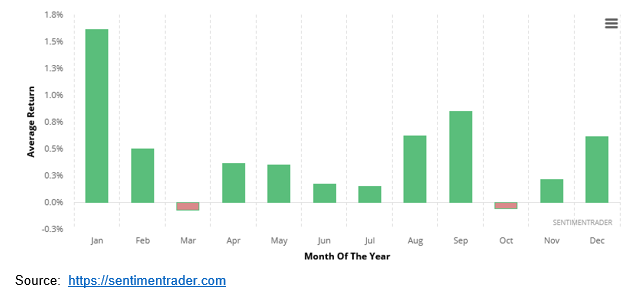

Seasonal Gold Buying Chart

Share Your Gold Price Prediction for 2021:

Check Today’s Spot Gold Prices

Now you have an idea of where the price of gold could be in 2021. But what about right now? See our spot gold price chart for today’s prices.

📚 Suggested Reading: