Unlike gold, silver straddles two market sectors: as a safe haven, silver appeals to precious metals investors, but its widespread industrial applications also make silver significant to commodities traders. Last week, the white metal acted like the latter and got caught in the melee of a major commodities selloff as traders panicked in response to the worsening trade war. It won’t be long, however, until economic conditions have market participants seeking the safety of silver again. When that time comes, expect the silver spot price to soar.

Silver Price Movement Indicators:

Monday, June 18, 2018

Silver Mining

On Monday, Canadian mining company Falco Resources announced that it has entered into a multimillion-dollar financing transaction with Osisko Gold Royalties. Through a silver stream transaction, Osisko will pay Falco $180 million in Canadian dollars to help fund its Horne 5 project in the city of Rouyn-Noranda in Quebec. Containing an estimated 26.3 million ounces of payable silver, Horne 5 is scheduled to enter full production in 2022. The mine has a 15-year lifespan.

An increase in mine production would add to the silver supply and could put pressure on silver prices. However, silver output from Horne 5 may only offset declines in mine production in 2016 and 2017. If silver demand continues to rise, we could still see higher prices for the white metal in the near future.

Solar Demand

One the world’s leading consumers of solar energy, China, announced it would cut renewable energy subsidies a few weeks ago. An excellent conductor of electricity, silver is often used in the construction of solar panels. The legislation could impact silver demand in 2018. ‘If global solar installations drop by 10 GW, this implies a reduction of a little under 10 million oz in industrial silver demand, equivalent to around 1% of total global silver demand,” indicated German precious metals refiner Heraeus on Monday.

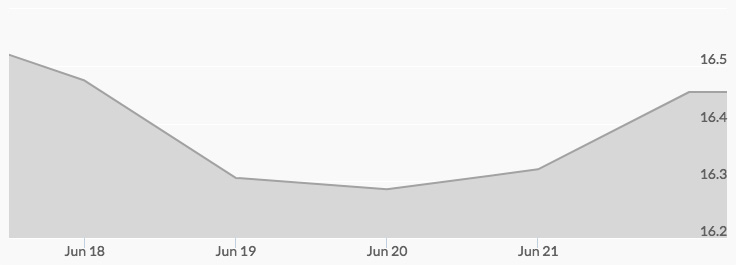

Lower industrial demand could result in a pullback in silver prices. This was the trajectory on Monday, with the high of $16.57 at 5 am followed by the low of $16.43 at noon.

Tuesday, June 19, 2018

Trade War

While gold and silver prices initially rose after the Fed raised interest rates on June 13 and remained steady following announcements on June 14 that the European Central Bank would tighten its monetary policy, news of an escalating trade war on June 15 triggered a selloff in commodities. Although not targeted by China for tariffs, precious metals got caught in the fray. “The market took a ‘sell first, ask questions later’ approach to the tariff news, thus selling nearly everything related to commodities, including precious metals,” argued Christopher Aaron, an analyst with the independent precious metals research firm iGold Advisor.[1]

By Tuesday morning, the price of silver was still recovering from the selloff, with the low of $16.24 hit at 8 am.

Gold Silver Ratio

Market analysts have been laser-focused on the gold silver ratio lately. Why? It’s been historically high, reaching 82.5 last April. As they predicted, it reversed course to 75 and silver prices rallied, hitting a two-month peak of $17.26 on June 14. However, the trade war-related commodities selloff caused the ratio to climb to 77.68 by June 18.[2]

Silver bullion traders are still anticipating the ratio to fall to 72 and resume outperforming gold before hits 68 and starts rising again. Experts predict the precious metal will encounter some headwinds first, specifically a stronger dollar and the destabilizing impact on the markets of the trade war. But they also see the metal finding support from physical silver buyers, especially bargain hunting investors in India. ‘Immediately, the weakness in silver may result in the ratio consolidating around the current levels with a mild upside bias,’ predicted the director of Kedia Commodities Ajay Kedia.[3]

While the long-term outlook for silver is positive, the impact of recent headwinds was evident in its high of $16.49 at midnight, followed by the low of $16.24 at 8 am.

Wednesday, June 20, 2018

Trade War

Following market frenzy on Tuesday over the tit-for-tat trade war between the U.S. and China, national attention shifted to another front on Wednesday when the E.U. initiated the first phase of retaliatory tariffs for the recent U.S. tax on steel and aluminum imports. Red State staples, such as bourbon whiskey, Harleys, and Levi’s, made the list of items the E.U. will impose a 25 percent duty on. An additional set of retaliatory tariffs ranging from 10 percent to 50 percent on an extra 3.5 billion euros of U.S. products could come by March 23, 2021.

While the worsening trade war initially had a bearish impact on the precious metals markets, the consensus among experts is that it could deal a serious blow to the U.S. economy and financial markets—turning the picture quite bullish. With a low of $16.23 at 6 am and a high of $16.32 at 2 am, Wednesday’s trading presented opportunities for savvy investors to buy silver at bargain prices before they skyrocket when the true consequences of the trade war take hold of the markets.

Thursday, June 21, 2018

Recession

On Thursday, David Rosenberg, one of the first economists to issues warnings about the Great Recession in the lead up to the financial crisis predicted the next economic crash would hit in twelve months. ‘Cycles die, and you know how they die? Because the Fed puts a bullet in its forehead,’ Rosenberg asserted at the Inside ETFs Canada conference in Montreal. He argues that the S&P 500’s high last January will turn out to be the “peak of the bull market,” reported Bloomberg. Low unemployment, weak commodities performance, the trade war, and ultimately rising inflation are among the reasons why Rosenberg thinks the economy will nosedive within a year.

Precious metals are seen as a hedge against inflation and economic crisis. However, market participants have historically waited until the heat is on to buy, which was the case on Thursday. The price of silver reached the low of $16.17 at 3 am and the high of $16.32 at 9 pm.

Friday, June 22, 2018

Expert Predictions

“The time might be now to start riding the commodity wave,” wrote Ed Egilinsky, managing director and head of alternative investments at Direxion, on Friday. He said that relative to the S&P 500, commodities are the least expensive they’ve been in nearly five decades and recommended investing in those that can serve as defensive assets.[4]

Analyst Hubert Moolman was also bullish on commodities, particularly silver. Moolman argued that silver rallies often follow Dow peaks and provided technical chart analysis[5] (see chart below) to show that “silver is likely to significantly outperform the Dow” soon.

Chart source: hubertmoolman.wordpress.com

While silver prices weren’t outperforming the Dow on Friday, they were certainly doing better, climbing to $16.43 by 4 pm.

Need real-time silver spot prices? Check out our live silver prices chart.