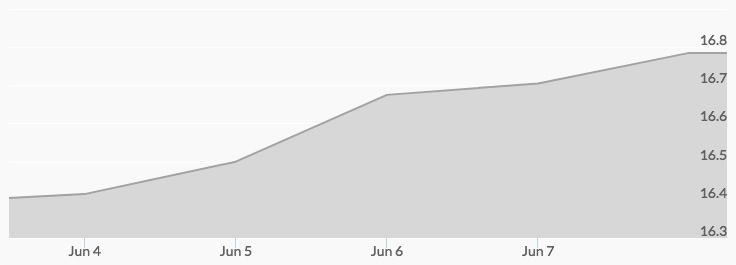

The silver rally has started! Analysts had been predicting that the silver spot price would break out of their tight range for weeks. The major move finally came last Thursday when the white metal burst to $16.84 an ounce, reported the historic silver price chart. Whether it was the flurry of reports projecting a silver rally this summer or the heightened geo-economic risk felt after a war of words between world leaders, market sentiment shifted in favor of silver.

Silver Price Movement Indicators:

Monday, June 4, 2018

Market Fundamentals

“Silver can return near to its multi-year base of $21,” predicted Maria Smirnova, Senior Portfolio Manager at Sprott Asset Management, in a report the firm released Monday, titled Silver’s Critical Role in Electrification May Fuel Its Rise [1]. Three factors support Sprott’s bullish outlook for the white metal: the historically elevated gold silver ratio; supply and demand; and record high silver short positions.

The report put special emphasis on silver supply and demand, highlighting that global supply shrunk by 2 percent in 2017 due to declines in scrap sources and mine output. At the same time, economic growth and thriving industries, particularly solar and electric vehicles, are driving demand for silver. In 2017, photovoltaics accounted for a 19 percent jump in silver demand and auto manufacturing a 5 percent bump.

Silver prices still had a ways to go to reach $21 on Monday, though, with the high of $16.50 recorded at 9 am and the low of $16.36 hit from 1 am to 3 am.

Tuesday, June 5, 2018

Solar Demand

China was one of the main sources of solar demand in 2017, adding 53 gigawatts of new solar photovoltaic (PV) capacity—more than the total solar PV capacity of any other country at the start of last year. The markets were understandably shocked, then, when China announced it would slash subsidies for renewable energy. On Tuesday, Forbes contributor Robert Rapier argued that the move may be the result of the looming trade war: “China may have made a decision to signal to the U.S. that it will stop allowing Chinese solar panel makers to substantially undercut U.S. manufacturers.”

Whatever China’s motivation, the decision caused analysts to lower their forecasts for installations around the world this year due to an excess in the supply of solar panels. Investors reacted to the news by selling off stocks for solar companies.

Silver, however, remained within the tight range it’s been trading in lately: the low of $16.35 at 7 am was followed by a high of $16.50 from 2 pm to 10 pm.

Wednesday, June 6, 2018

Technical Analysis

“Silver might be one of the last real contrarian investments as it seems to be very undervalued at current price levels,” wrote financial analyst Florian Grummes[2] in a report published by Midas Touch Consulting. Similar to the Sprott report, Grummes cited the market fundamentals of supply and demand as a silver price driver, but he also provided technical analysis. Examining the silver monthly chart, he noted that a constricting moving average may spell a Bollinger Band Squeeze in the making.[3] This suggests volatility is on its way back into the markets.

Grummes also referenced the formation of a triangle on the silver daily chart from which he expects a breakout within one or two months. He recommended buying silver in the next couple of weeks, as the white metal is set to rally in July. He predicted silver prices will hit $18.50 in the third quarter and $21.15 in the fourth quarter of 2018.

Thursday, June 7, 2018

Geo-Economic Risk

Twitter exchanges between the leaders of the world’s industrialized nations on Thursday set the stage for a contentious Group of Seven (G-7) summit over the weekend. It all started when French President Emmanuel Macron accused President Trump of attempting to achieve American hegemony through trade tariffs and suggested excluding the U.S. from the summit. In response, Trump fired off a series of tweets criticizing the trade policies of Canada and the European Union concerning the U.S., as well as announced he would exit the summit hours early.

The verbal spat fueled fears of a worldwide trade war and sent investors to the safety of precious metals, setting off the much-anticipated silver rally. The white metal broke above its 200-day moving average, hitting the highest price in more than six weeks of $16.84 at 9 am.[4][5]

Friday, June 8, 2018

Silver Coin Supply

On Friday, Coin World reported that 16,000 Morgan dollars purchased in 1964 from the Treasury Department stockpile and stored in a New York City bank vault ever since would be placed on the market. Valued at between $1 million and $1.5 million, the coins were struck at the New Orleans, Philadelphia, and San Francisco Mints. The original owner left them to his son and daughter, who are selling them to avoid continuing to pay to $800 annual rental free for the safe-deposit box. Once the Numismatic Guaranty Corp (NGC) grades the coins, whose dates range from 1878 through 1889, they’ll hit the market.

An increase in the supply of specific types of numismatic coins could impact their rarity and slightly affect prices.

The news was significant for coin collectors but not a huge market driver. Silver prices finished out the week strong with a high of $16.77 reached at 5 pm.