Last week brought lows for oil prices, silver mine production, and the yuan. Interest rates could be coming down—or at least not going up much more—following the president’s criticism of the Fed’s tightening monetary policy and statements by Fed Chairman Jerome Powell. All these market forces could push silver prices, which have remained in a pullback, higher. Factor in market buzz that silver prices have bottomed and the only direction for silver is up!

Learn more about silver’s typical price movers in “10 Factors that Influence Silver Prices.”

Silver Price Movement Indicators

Monday, July 16, 2018

Lower Oil Prices

Rising for months, oil prices reversed course on Monday, falling 5 percent. Reports that the U.S. and Saudi Arabia are rushing to avoid shortages resulting from U.S. sanctions on Iran, the fifth-largest oil producer in the world, were behind the crude selloff, explained analysts. Last month, Russia and Saudi Arabia-led OPEC indicated they would produce more oil, and Saudi Arabia has since been offering more crude oil to Asian buyers than it is contractually obligated to, giving the markets the security of a supply surplus. Libya also resumed exports last week after the country’s national oil company regained control of ports.

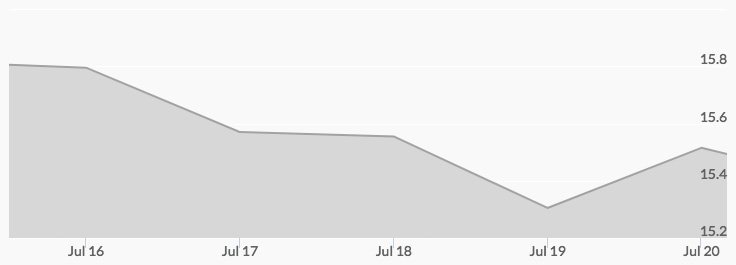

With its direct relationship to inflation, the price of oil can influence demand for safe haven assets like silver and gold. This was evident in Monday’s silver prices: the high of $15.82 at 2 am was followed by the low of $15.73 at noon. However, lower oil prices could translate into lower production costs, stimulating industry. With its widespread applications in solar panels, electric vehicles, and other sectors, silver stands to benefit if oil prices stay low.

Tuesday, July 17, 2018

Rising Interest Rates

On Tuesday, Fed Chairman Jerome Powell confirmed to the Senate Banking Committee the central bank’s plan to “continue raising interest rate at a pace of once every three months, at least ‘for now.’” Powell cited the strong job market and ostensibly manageable levels of inflation as the impetus for the continued rate hikes. However, he also acknowledged the risks the trade war and tightening of the Fed’s monetary policy presented to the economy, which may explain his ‘for now’ caveat. Experts interpreted Powell’s statements as an indication that rate increases could be put on hold next year.

Higher interest rates can increase the yields on interest-bearing assets and raise the opportunity cost of precious metals. Silver prices were only slightly changed on Tuesday, though, with the high of $15.83 at 5 am followed by the low of $15.53 at 5 pm. Maybe investors weren’t that excited at the relatively weak returns on paper assets.

Read more about how interest rates impact precious metals prices in “Investigating the Real Relationship between Interest Rates and Gold Prices.”

Wednesday, July 18, 2018

Housing Market Bubble

“The Economy is Overheating” and “Equities Are Overvalued” have become commonplace news headlines in recent years. On Wednesday, the focus shifted to the housing market. “There’s Trouble Ahead for the Housing Market (In the U.S. and Globally),” read the headline of an article by Adam Taggart of Peak Prosperity. Citing data from John Rubino, Taggart argued that the housing market boom is peaking and heading for the bust-end of the cycle. He offered these statistics to support this view:

- Rising Supply: Last spring, the number of houses for sale increased three times as fast as the year prior. Thirty of the country’s biggest cities have more inventory now than a year ago.

- Falling Demand: Year-over-year, the number of mortgage applications decreased by 9 percent.

The supply and demand equation for the housing markets could result in the default of bad mortgages and, in turn, a plummet in the price of the mortgage-backed bonds attached to them. The situation would be similar to the crisis in 2008.

Taggart concluded that “The tranquil ‘free ride’ the financial and housing markets have had for nearly a decade are ending.” His final advice: sell if you can. Read the full article.

Investors following the “buy low, sell high” strategy would be wise to unload increasingly risky investments in the housing and financial sectors and buy gold and silver. Wednesday brought more bargain silver prices: the high of $15.57 at midnight was followed by the low of $15.39 from 7 am to 8 am.

Thursday, July 19, 2018

Declining Silver Mine Production

Americas Silver Corporation (USA) released its second quarter silver mine production figures on Thursday, and they weren’t pretty: consolidated silver production fell 24 percent in the second quarter of 2018 compared to the first. Year-over-year production dropped a whopping 46 percent. The news comes after reports that output of silver from mines has been declining in recent years, suggesting this trend could continue into 2018. Read “Silver Supply and Demand: 2018 Outlook.”

With demand for silver from industry predicted to increase in the coming years, continued production declines could result in higher prices for the white metal. On Thursday, however, silver prices remained in a tight range, with the high of $15.46 at midnight followed by the low of $15.17 at 9 am.

Stock Market Dips

Following President Trump’s criticism of the Fed’s policy of continually raising interest rates, stocks fell on Thursday. The Dow lost 134.79 points and the S&P and the Nasdaq Composite each dipped by .4 percent. Bank shares also took a hit, causing the Financials Select Sector SPDR Fund to decline by 1.5 percent. Yields on the 10-year Treasury pulled back to 2.83 percent.

Perhaps Trump’s 2016 prediction[1] that the stock market would ‘come crashing down’ if the Fed raised interest rates ‘even just a little,’ is finally coming true—with the added help of his recent public disapproval of the Fed’s rate hikes.

Since silver is negatively correlated to the stock market, expect prices to rise should equities continue on a downward trajectory.

Friday, July 20, 2018

Currency War

Friday brought media chatter that the trade war was escalating into a currency war after China devalued its yuan to the lowest level in two years. On Thursday, President Trump accused Europe and China of “manipulating their currencies and keeping them low against the dollar.” Within hours of his comments airing on television, the People’s Bank of China lowered the yuan by .9 percent.

Strategists pointed to the fact that China controls its currency as evidence that the recent drop in the yuan was intentional. ‘It looked pretty deliberate to me it has been moving so fast. Clearly the currency moving this fast negates the tariffs so from that perspective it’s pretty understandable that [Trump] doesn’t like what he’s seeing,’ remarked the CEO of Exante Data, Jens Nordvig.

A testament to the risks inherent in paper money, currency wars can benefit gold and silver, which have retained their value for thousands of years in times of peace and conflict. The impact had yet to reach the silver markets on Friday. Silver prices climbed from the low of $15.24 at midnight to the high of $15.50 at 5 pm.

Where are silver prices today? Check our Spot Silver Price Chart.