Last week brought mixed market signals for silver prices. Oil traded lower on news of a domestic supply surplus in the face of an anticipated decline in the global economy. Demand from the solar sector, a huge consumer of silver, was also predicted to decrease due to trade tariffs. However, the potential for a de-escalation of the trade war, technical analysis, and market fundamentals of supply and demand all supported higher silver prices.

Learn more about silver’s historical price movers in “10 Factors that Influence Silver Prices.”

Silver Price Movement Indicators

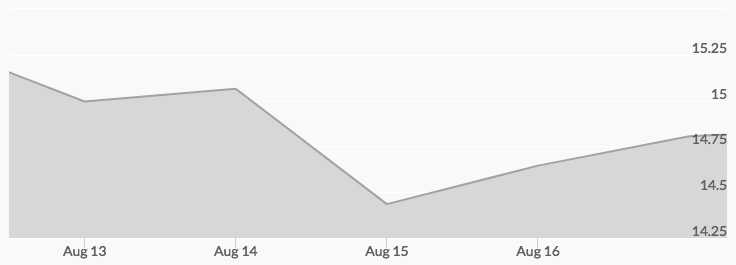

Monday, August 13, 2018

Supply and Demand

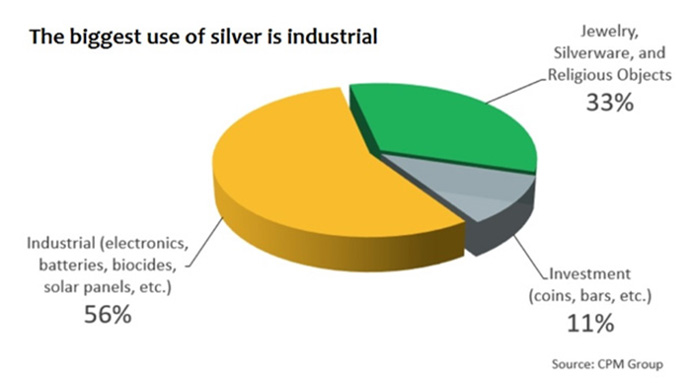

In recent weeks, a commodities selloff over fears of decreasing demand in China due to the trade war has weighed on silver prices. However, in the long term, it is silver’s large role as an industrial metal that will push prices higher, highlighted an article in Seeking Alpha published on Monday.

Source: CPM Group via SeekingAlpha

Electronics and technologies, such as batteries, biocides, and solar panels, account for more than half of the demand for silver. Silver fabrication is also a significant source of demand that, along with these other sectors, is set to grow in the coming years. Learn more in “Little-Known Facts About The Importance of Silver in Technology.”

What’s not increasing, however, is silver mine output, and diminishing ore grades from existing mines coupled with a dearth of new promising silver projects isn’t helping the situation.

Whether in times of peaceful or contentious international trade relations, industry will remain a constant, supplying nations with vital infrastructure and consumers with essential goods. Silver stands to benefit from this supply and demand equation.

On Monday, however, the price of silver remained subdued: the high of $15.25 at 2 am was followed by the low of $14.96 at 1 pm.

Tuesday, August 14, 2018

Technical Analysis

In recent weeks, SBC has covered how oil prices may be impacting the economy and in turn silver prices. On Tuesday, analyst Hubert Moolman reminded us that the relationship between the Dow and silver is an equally important measure of economic conditions.

In “Silver Price Points To A Depressed Economy And A Silver Boom,” Moolman provided chart analysis to show that silver priced in the Dow is near record lows. A bullish wedge on the chart indicates that the economic conditions that have steered investors to risky debt-based and paper assets are about to change. When the economy nosedives, as many economists have been predicting it will within a year, expect a silver rally that is “larger and more intense than the one from 2001 to 2011,” argued Moolman.

Silver Priced in the Dow

Source: Hubert Moolman via SeekingAlpha

“The wise is buying right now while the fearful are selling,” concluded Moolman.

Silver prices followed a similar trajectory to Monday, with a high of $15.06 at 11 am and a low of $14.95 at 11 pm.

Wednesday, August 15, 2018

Trade War Weighs on Solar Demand

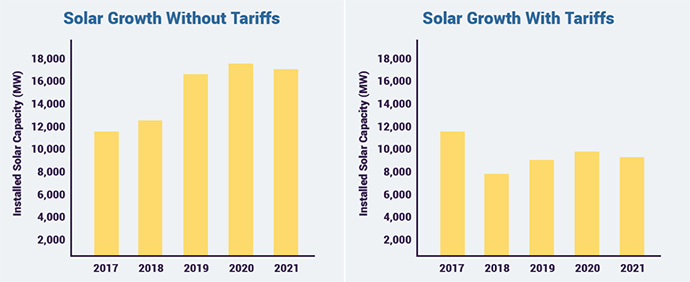

Wednesday brought reports that China has filed a complaint with the World Trade Organization in concern to U.S. import tariffs on solar products. Last January, the Trump administration announced four-year safeguard tariffs on Chinese solar products: starting with 30 percent in the first year and gradually reducing the tariff to 15 percent by the fourth year. China asserted that the duties have proven detrimental to its domestic producers and interfered with the global market.[1]

China isn’t the only one concerned about the impact of tariffs on the solar industry. ‘Taxpayers should not have to bail out one foreign-owned company only for their foreign financers to get another. American solar can compete just fine on its own,’ asserted Sean Hannity.

The Heritage Foundation and the American Legislative Exchange Council (ALEC) have joined solar industry leaders, such as the Solar Energy Industries Association (SEIA), to form The Energy Trade Action Coalition (ETAC).

Opponents of the solar import tariffs argue that they will “raise electricity prices, kill jobs and bring an American economic success story to a halt.” Ultimately, solar tariffs could not only hurt the economy but also the demand for solar.

Source: Solar Tribune

An excellent conductor of electricity, silver is widely used to make solar panels. In 2017, 19 percent of the demand for silver came from solar photovoltaics. A decline in solar panel production could result in a decrease in demand for silver. (Read more in “Silver Supply and Demand: 2018 Outlook.”

Silver prices traded in a similar range to the first half of the week on Wednesday. Following a 1 am high of $14.93, they pulled back to the 11 am low of $14.35.

Thursday, August 16, 2018

Geo-Economic Optimism

News of a potential de-escalation of the U.S.-China trade spat infused the markets with optimism on Thursday. The Associated Press reported that day that later this month China will send a delegation led by a deputy minister of commerce to discuss trade with U.S. Treasury undersecretary David Malpass.

As a result, the dollar traded sideways while the yuan saw a sharp rise.[2] Investor sentiment also improved amid diminished fears that Chinese demand for industrial metals would decline as a result of the trade war. Silver prices rose from the $14.45 low at midnight to the high of $14.75 at noon, surpassing the important $14.50 threshold.[3]

Friday, August 17, 2018

Lower Oil Prices

The supply and demand equation for crude pointed to lower prices following reports from the U.S. government on Wednesday indicating large stockpiles and increases in production. At the same time, slowing global economic growth and the trade war could dampen demand. U.S. crude prices dipped 2.6 percent and Brent 1.4 percent for the week. However, prices aren’t expected to fall too far because of U.S. sanctions against Iranian petroleum that take effect in November.

‘Investors remain cautious as Wednesday’s surprise gain in U.S. stockpiles remained fresh in their minds,’ explained ANZ bank on Friday.

Precious metals typically have a direct relationship with oil prices. If this trend continues, it could push down prices for the white metal. On Friday, the price of silver was little changed, with a low of $14.60 at 6 am and a high of $14.79 at 4 pm.

See where silver prices are right now in our Spot Silver Price Chart.