Seasons change and so does the silver market! At least that’s what commodity analysts predicted for the spot silver price based on historical factors and technical signals last week. Adding to the shining outlook for silver were escalating geopolitical risk, rising oil prices and inflation, and falling competition from other defensive assets.

Need more reasons to get excited about the white metal? Read “Why Buy Silver in 2018?”

Silver Price Movement Indicators

Monday, August 6, 2018

Seasonality

With many traders and investors away on vacation, summer can be a slow time for the silver market. The trade war’s impact on metals with industrial applications hasn’t helped, either. However, commodity analyst Andrew Hecht, of the Hecht Commodity Report, indicated that the technical signals point to brighter months ahead for the white metal. Seasonal selling doldrums have historically been a problem for silver, especially the month of July, but the market usually rebounds in August and September.

‘Throughout July it seemed like no one cared much about the silver market, but that could be changing now that July is over and August has arrived,’ noted Hecht, pointing out the “favorable risk-reward scenario for investors” in recent weeks. He went on to predict silver prices jumping to $18 and ounce.[1]

Learn about all the market forces that move the price of silver in “10 Factors that Influence Silver Prices.”

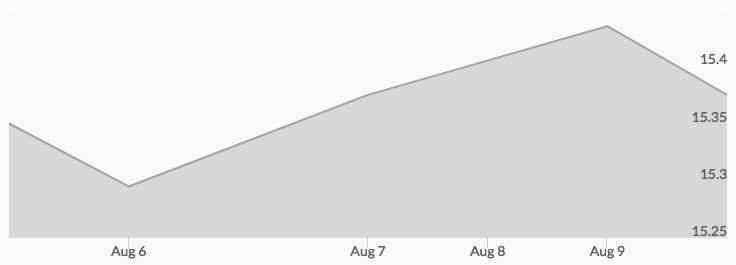

Silver prices had yet to breakout of their mid-summer slumber on Monday: the high of $15.42 at midnight was followed by the low of $15.25 at 9 am.

Tuesday, August 7, 2018

Higher Oil Prices

‘Anyone doing business with Iran will NOT be doing be doing business with the United States,’ tweeted President Trump following the reimposition of sanctions against Iran on Tuesday.[2] This first round of renewed sanctions target the country’s purchase of U.S. dollars, the auto sector, coal, industrial software, and precious metals trading. The second round focuses on Iran’s energy sector and take effect in November.

Market fears over oil shortages as a result of the fall sanctions sent crude prices higher. Brent futures hit a session high of $74.90, and West Texas Intermediate peaked at $69.83. Adding to market jitters were a reduced EIA growth forecast for U.S. crude production this year and decreasing production in Saudi Arabia despite pledges to ramp up output in July.

The situation signals higher silver prices for two reasons. First, higher oil prices are usually accompanied by rising inflation as energy-related operation costs increase for producers and consumers pay more at the pump. Second, escalating geopolitical tensions with Iran could stoke demand for safe haven assets.

On Tuesday, however, the white metal continued to trade in a tight range. Silver prices pulled back from the high of $15.44 from 7 am to 8 am to the low of $15.31 from 2 pm to 4 pm.

Wednesday, August 8, 2018

Bitcoin Crash

First civilizations invested value in precious metals, then in thin sheets of paper, and finally nothing—or digital currencies, as they are called. And they performed astoundingly well last winter. On December 16, 2017, cryptocurrency Bitcoin hit a record high of $19,343.04. Just two weeks later, it crashed to $12,629.81.

Fast-forward to Wednesday when the cryptocurrency lost $14 billion in value overnight and you can see why many market participants have stuck with good old gold and silver as defensive assets. The 10 percent drop was the result of a decision by the Securities and Exchange Commission to delay its decision on a proposed exchange-traded fund for Bitcoin.

Since their inception, cryptocurrencies have been plagued by exchange hacks, scandals, and regulatory concerns, and analysts viewed the delay on the decision as another blow to the digital-asset community. ‘It is hard to find anything positive to say about bitcoin. Failing to hold $8k, it didn’t take long for us to crash under $7k as any hope brought about by the latest rebound vanished faster than it appeared,’ remarked Jani Ziedins of CrackedMarket.

The price of silver stayed on its trajectory for the week, with a low of $15.27 at 9 am and a high of $15.43 from 2 pm to 3 pm.

Thursday, August 9, 2018

Technical Analysis

“The Bottom Is Likely In And a Reversal To The Upside In Gold & Silver Is Likely Imminent,” read the title of an article on SilverDoctors.com on Thursday. Citing the Elliot Wave Principle, which posits that collective investor psychology swings from optimism and pessimism in natural sequences, author Captain Ewave argued that a silver market close above $15.64 could be an indicator that the white metal is set to breakout. Once the price reversal starts, silver could rally to “well above major resistance at 18.30/18.50 level.” See his chart analysis.

Thursday trading brought more of the same for the silver market: prices hit a low of $15.36 at 4 am but climbed to a high of $15.47 by 7 am.

Where could silver prices be by the end of the year? Read “Silver Price Forecast 2018.”

Friday, August 10, 2018

Rising Inflation

Friday brought a harbinger of rising inflation. The U.S. Labor Department reported that its Consumer Price Index rose .2 percent in July versus .1 percent in June. Higher costs of shelter accounted for the jump. Core CPI was up 2.4 percent for year, the biggest increase since September 2008 and .4 percent higher than economists had predicted.[3] Factor in record low unemployment, reports of employers struggling to fill positions, tariff-related rises in material costs for manufacturers, and there’s only one direction for inflation. Up!

Investors hedge against inflation, which decreases the purchasing power of paper currencies, with precious metals. The data, however, had yet to impact the markets. Silver prices pulled back from the high of $15.39 at 8 am and 11 am to the low of $15.27 at 1 pm.

Want today’s price of silver? See our Spot Silver Price Chart.