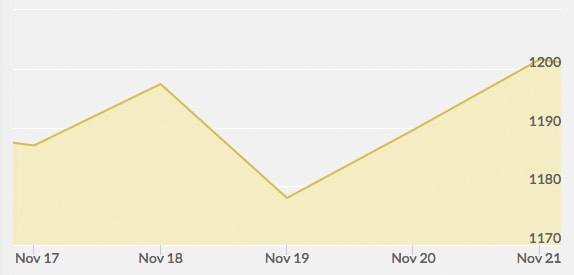

Open: $1,187.20 Close: $1,200.90 | High: $1,205.00 Low: $1,178.20

The gold trading week started out slightly lower than the gains posted on Friday, mostly due to bearish outside markets, including a strong dollar and low crude oil. However, speculators who believed Monday’s prices to indicate the week’s near-bottom were correct. Japan announced overnight that its gross domestic product had declined by 1.6%, compared to an expected 2.2% growth. This news, combined with European Central Bank statements that they were considering future economic stimulus plans, pushed gold to reach a three-week peak on Tuesday.

Tuesday’s three-week high came as a surprise to some in the gold trading world. The yellow metal reached $1,193.95, when just two weeks before it was at $1,131.85. Much of these gains, however, were lost by Wednesday as traders started selling off. There was an FOMC meeting on Wednesday that contained no significant news for the gold marketplace and had little effect on prices.

Japan announced mid-week that it would retain its easy monetary policy, despite concerns about economic growth earlier in the week. More economic data from the European Union trickled in, including a decline of construction spending across the region by 1.8% in September. The gold marketplace took some short losses Wednesday afternoon when a Swiss poll showed that only 38% of Swiss voters are in favor of the Swiss government increasing its gold holdings by 20%. If the measure on November 30th passes, gold demand is expected to increase significantly.

The price tumble from Wednesday, in which gold dropped 1 percent, or about $20, immediately saw a rebound in the marketplace by Thursday. Physical gold buying was featured in Asia, as Asian buyers are sensitive to the price fluctuations of the yellow metal and saw an opportunity to take advantage of a dip in prices. U.S. data also revealed an increase in inflation, which could have been bullish for gold.

By Friday around lunchtime, gold was trading above the key $1,200 level. The reason for this spike? The People’s Bank of China announced it was cutting key interest rates for the first time in two years—down to 5.6% for 1-year loans. This major news caused world stock markets and government bond prices to rise. The price of gold ended the week at just about $1,200.