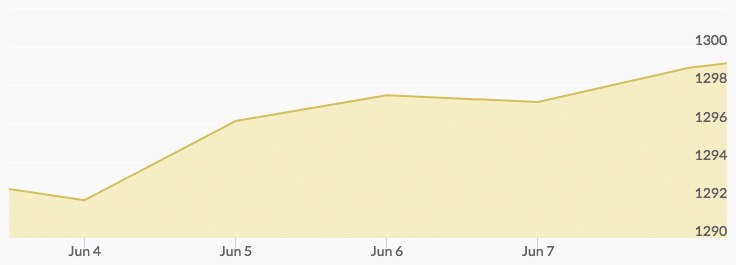

With a low of $1,290.10 and a high of $1,301, the yellow metal traded in a tight range last week, indicated the gold spot price chart. Caught between the push of escalating global economic and political tensions and the pull of a red-hot economy at home, the precious metal could breakout after the much-anticipated Federal Open Market Committee (FOMC) meetings on Tuesday and Wednesday. Another meeting likely to influence the price of gold is that between President Trump and North Korean leader Kim Jong Un on Tuesday. It’s a big week for gold and the world!

Gold Price Movement Indictors:

Monday, June 4, 2018

Weak Dollar

“The dollar is the No. 1 factor for gold,” said senior equity analyst in global mining and metals for Neuberger Berman Marisa Hernandez.[1] Fractious trade talks between the U.S. and China over the weekend sent investors away from the dollar, causing the greenback to decline nearly 0.2 percent. This made gold less expensive for foreign investors, bumping prices up to $1,296.50 at 9 am.

Strong stock market performance and U.S. Treasury yields, however, counteracted some of the lift the dollar drop gave gold, with prices pulling back to $1,290.90 by 9 pm.

Tuesday, June 5, 2018

Geopolitical Risk

A month after President Trump withdrew the U.S. from the 2015 Iranian international nuclear deal and reimposed sanctions against the country, Iranian Supreme Leader Ali Khamenei informed the International Atomic Energy Agency (IAEA) of ‘tentative’ plans to increase Iran’s capacity for uranium enrichment. The nuclear accord, which European powers are still trying to save, limits the amount of uranium Iran may enrich to 3.67 percent, which is much lower than the 90 percent considered weapons grade.[2]

The new nuclear threat emerging from Asia stoked fears and drove safe haven demand. Gold prices reached a high for the day of $1,298.90 at 2 pm.

Wednesday, June 6, 2018

Geo-Economic Security

Market pundits who view President Trump’s trade tariffs as negotiating tactics got some validation on Wednesday from a report indicating that China offered to purchase about $70 billion worth of U.S. farm and energy goods if Trump would back down from his tough trade policy.[3] The deal would bring China closer to reducing its trade deficit with the U.S. by the $200 billion Trump has demanded.[4]

The news allayed investor fears of a global trade war, a significant source of safe haven gold buying in recent months. “Global trade war is the only factor providing the support for the gold price,” asserted analyst Naeem Aslam of Think Markets. However, even if trade tensions ease with China, they’re still running high with Canada, Mexico, and the E.U. Gold prices surpassed the psychologically important $1,300 level by 20 cents at 10 am.

Thursday, June 7, 2018

Geo-Economic Risk

Investors got a glimpse on Thursday of how the Group of Seven (G-7) summit planned for the weekend would go—and it wasn’t pretty. The “war of words” broke out on Trump’s preferred platform when France’s president, Emmanual Macron, tweeted, “The American President may not mind being isolated, but neither do we mind signing a 6 country agreement if need be,” suggesting tough U.S. trade policy could result in its exclusion from the summit in the future.

Trump responded by lashing out against Canada and the E.U.’s trade policies toward the U.S., at one point calling Prime Minister Trudeau ‘indignant.’ He also called for Russia to be invited back to the group of advanced nations and shared plans to leave the summit hours early.

Risk aversion shot through the markets, propelling the price of gold to the week’s high of $1,301 at 9 am.

Friday, June 8, 2018

Rising Interest Rates

Despite a boiling geo-economic climate, market anticipation that the Federal Reserve will raise interest rates at its June 13th meeting hemmed in gold prices. Friday closed out with the yellow metal trading in the narrowest weekly range in more than a decade: the low of $1,294.30 at 3 am was followed by a high of $1,299.30 at 7 am. Last week’s strong jobs report and rising wages have many analysts predicting a quarter point Fed rate increase this month.[5] This would effectively lift the opportunity cost of holding assets that don’t yield interest.[6]

Markets may be surprised at the result of the next Fed meeting, though, predict some analysts. The Fed is planning to unwind its bonds balance sheet more quickly, maybe as early as the end of next year. Minutes from the May FOMC meeting suggest officials are concerned that raising rates too quickly could interfere with this more aggressive schedule for its balance sheet roll-off. Consequently, the Fed could stop hiking rates sooner than markets are anticipating.