Gold prices rose to a three-week high for the second day in a row on Thursday, November 16. 1 The gold spot price increased to $1,287.74 per ounce by 2 pm in New York, after having hit a previous high of $1,286.19 on Wednesday. The surge in gold was driven by a dollar crash on reporting of issues with the GOP tax plan before Congress and an increasingly fertile environment for economic bears. What’s driving the unrest?

Essentially, concerns about the overvaluation of the dollar are driven by three key factors: long-term loose economic policies, the “holy grail” of a GOP tax plan, and the history of the dollar.

Loose Monetary Policy

Since the global financial crisis of 2008-2009, U.S. monetary policy has been more accommodative than at any point in our country’s history. The Federal Funds rate, which represents the rate banks charge each other to borrow money overnight and off of which all other interest rates are based, is targeted by the Federal Reserve as a way to lower or increase borrowing costs in the economy. Since borrowing costs affect investment in terms of financial assets and capital expenditures, the Fed Funds target rate, or the rate to which Fed officials are looking to push the actual Fed Funds rate, is a major policy lever used to speed up or slow down the economy. 2

From October 29, 2008 to June 14, 2017, the Fed Funds target rate was below 1.00 percent and currently remains only just above that level at 1.00-1.25 percent, which represents an unprecedented era of stimulative monetary policy. The effective Fed Funds rate has closely followed the targets, and thus has resulted in nearly a decade of the loosest monetary policy in the history of the country. 3

In other words, the economy has been pushed to grow as fast as possible by the Fed, and therefore one might reasonably question what additional ammunition the Fed has left to keep this economy going. What’s worse, these historically low interest rates have the intentional effect of increasing borrowing, such that now the country and the world appear to be heading towards a “Minsky moment,” or a sudden crash of markets and economies with too much debt. How else could such a prolonged period of low rates come to an end?

Faulty Tax Plan

At this point, equities markets and the dollar seem to be inextricably linked to the success or failure of the GOP tax plan. Interestingly, the markets aren’t considering the actual content of the plan; they’re only betting on whether it passes or not. This focus is puzzling given the fact that all parties agree that both House and Senate versions of the bill include unfunded spending of $1.5 trillion over the first ten years, which would add directly to the national debt, already at more than $20 trillion. Additionally, the GOP plan is openly politically motivated, as it seeks to benefit red states at the expense of blue states, a fact pointed out by many blue-state Republicans going back as far as last summer. 4 While political motivations are perfectly understandable, they are not necessarily economically beneficial to the country.

The Trump administration and supporters of the GOP plan argue that the tax cuts will stimulate sufficient growth to reduce the country’s crushing debt burden. Yet, as the president himself acknowledged in his now-dormant infrastructure investment plan, the ability of our economy to grow without investment in infrastructure is minimal, a view widely shared by economists and businesspeople alike. 5 6

Weakening Dollar

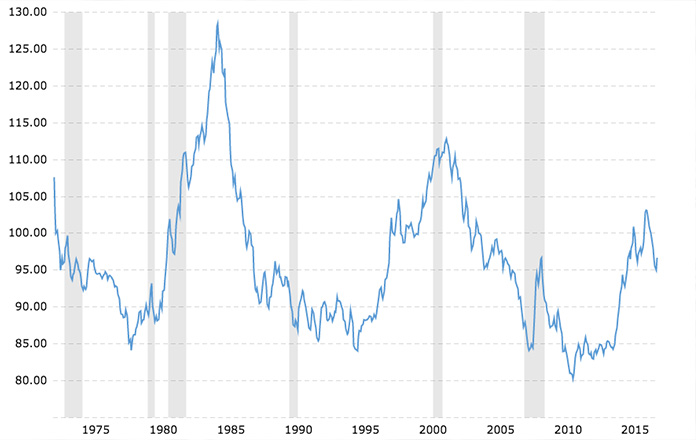

Finally, dollar strength appears to be closely linked to confidence in U.S. future growth. And yet…as the below chart shows, the cyclicality of dollar rates over the last 43 years is remarkably consistent. The unmistakable peaks and valleys of the chart suggest that another valley for the dollar cannot possibly be too far off on the horizon. In the end, economies and markets typically revert to the mean over time.

Chart source: macrotrends.net

Chart source: macrotrends.net

Precious Metals Offer Financial Security

The dollar is overvalued, the economy is puffed up by years of excessive borrowing driven by loose monetary policy, and the equity markets are pinning their hopes on the economic effectiveness of our elected representatives. Yet the markets seem to be focusing on the wrong question. It isn’t whether or not the GOP tax plan passes that’s crucial, it’s whether or not any tax plan, no matter how perfectly crafted, could be enough to prevent the bursting of the stock market bubble in which we find ourselves. It’s time for a flight to quality, and a good buying opportunity for precious metals.