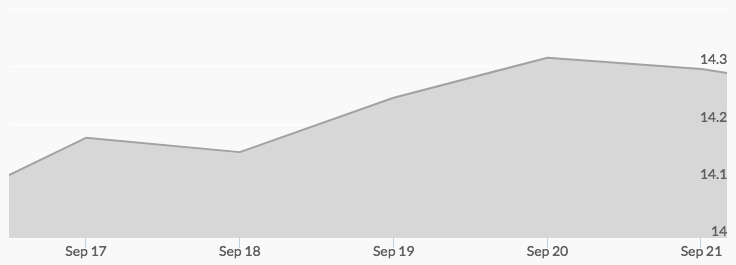

It’s only fitting that after a summer marked by incessant news coverage of the “strong dollar” experts are now increasingly predicting the currency’s demise. That was certainly the case last week, and there were signs there might be some truth to them, as the dollar traded lower. This was good for silver prices, which surpassed the important resistance level of $14.30. With the gold silver ratio back up at record highs, disruptions at South American mines potentially diminishing supply, and experts once again calling for silver to outperform gold, it’s no wonder that smart money has been buying up precious metals.

Read more about silver’s typical market movers in “10 Factors that Influence Silver Prices.”

Silver Price Movement Indicators

Monday, September 17, 2018

Expert Predictions

More predictions that silver would outperform gold came on Monday, this time from commodity analysts at Capital Economics. The research firm, based in the United Kingdom, projected gold prices to jump to $1,350 an ounce and silver to hit $17.50 an ounce by the end of 2019.

The analysts cited several factors to support their silver price predictions:

- Historically high gold silver ratio (84.41 on Monday).

- Expectations for the Fed to end its rate hike cycle.

- Negative investor sentiment toward silver.

- Declining silver supply.

- Growing industrial demand.[1]

Starting out at $14.06 from midnight until 3 am, silver gained 17 cents to hit the daily high of $14.23 at 10:40 am.

Tuesday, September 18, 2018

Strong Stock Market

Stock markets across the globe were mostly higher on Tuesday despite an escalation of the trade war with China. Traders seemed unfazed by the latest round of tariffs the Trump administration imposed on China: 10 percent on $200 billion worth of goods. China responded with 5-10 percent tariffs on $60 billion in U.S. goods.

Surveys of fund managers revealed that traders’ concerns over the impact of the trade war have eased: only 43 percent of those polled indicated that the trade war was the greatest ‘tail risk’ the markets faced, down from 55 percent the month prior. In a report titled, “another day, another tariff,” Voya Investment Management wrote, ‘The Chinese trade issue has been hanging over the market for quite some time and the market has become adept at shrugging it off.’

Experts, however, have grown increasingly worried that the trade war is getting out of control, as each escalation pushes both countries further away from a resolution. On Tuesday, Moody’s warned that the trade disputes could have a long-lasting impact on the global economy, reducing U.S. growth by .02 percentage points next year and China’s by between .3 and .5 percentage points.[2]

The economic consequences of the trade war could make the predicted stock market crash much worse—an event that would likely garner traders’ full attention and drive demand for safe havens gold and silver. In the short-term, both trends weighed on precious metals prices. Silver rose from the 4 am low of $14.10 to the 7 am high of $14.21.

Wednesday, September 19, 2018

Dollar Downfall Prediction

Amid a tense geo-economic and political climate in recent months, the dollar has had a strong influence on spot gold and silver prices. However, expert arguments for its downfall have been mounting, and Wednesday brought yet another. In “President Trump’s Legacy: The Beginning of the End of the US Dollar?” author Rick Mills asserted that the trade war with China could further undermine the dollar, which he claimed has been in decline since the Federal Reserve was created in 1913.

Mills contended that poor U.S. monetary stewardship over the years has led its major trading partners to seek ways to subvert American economic and political hegemony by circumventing its source: the dollar’s status as global reserve currency. The European Union has been exploring ways to work around U.S. sanctions on Iran by avoiding the dollar payments systems, perhaps following China’s lead (Read “Petro-Yuan Rising: The Must-Read Truth Behind China’s Plan to Dethrone the Dollar.”) Yuan-ruble exchanges are growing between China and Russia. And China’s One Belt, One Road projects holds the potential for the country to create a trading block that could operate independent of the U.S.

U.S. protectionism, asserted Mills, gives China even more of a reason to ‘drag its feet on free-market reforms, to support local companies and to harass and exclude foreign business—all things Chinese leaders are inclined to do anyway.’

Rather than strong-arm the world’s second largest economy and greatest holder of U.S. debt into opening up its markets, the Trump administration has provided the perfect catalyst for China to strengthen its sphere of influence in the East and—along with other major trading partners—operate independently of the U.S.

What could be the last domino to fall? The U.S. dollar. Once economically independent of the U.S., China could unload U.S. debt, causing interest rates to skyrocket and the dollar to plummet. Read the full article.

In the event of such a scenario, gold and silver would become less expensive to foreign investors. Industrial buyers could also scoop up more silver, which would align perfectly with major projects underway, such as the One Belt, One Road.

On Wednesday, silver jumped significantly from the 6 am low of $14.15 to the 10 pm high of $14.31.

Thursday, September 20, 2018

Weaker Dollar

The dollar slumped on Thursday, supporting silver prices and growing expert arguments of its decline (Read “When Will the Dollar Crash?”). The dollar fell to a nine-week low against a basket of major currencies amid market “relief that fresh U.S. and Chinese tariffs on reciprocal imports were less harsh than originally feared.”[3]

Investors may have been relieved by the perceived relaxation of trade tensions, but many financial analysts were sounding the alarm bells. ‘America is killing itself with these trade tariffs. [They] actually hit America far harder than [they] hit China. The idea that the dollar is all mighty and going to continue to rise is not true,’ said Alasdair Macleod, head of research at GoldMoney.com.

Silver prices rose thanks to the weaker dollar, hitting the daily high of $14.37 at 10 pm, above the $14.30 level Christopher Lewis of FXEmpire indicated was ‘the beginning of significant resistance.’ He continued by saying, ‘That resistance can be seen as reaching towards the US$14.35 level, so I think there is a high likelihood that sellers could return.’

Friday, September 21, 2018

Decreasing Mine Supply

News came on Friday that the situation for Tahoe Resources at its flagship silver mine, Escobal, in Guatemala worsened as the firm was forced to lay off another 169 workers, shrinking the number of employees working to a paltry 158. Earlier in the month, Guatemala’s Constitutional Court upheld a suspension of the mine’s licenses because of an appeal indicating that “the ministry did not consult with the Xinca indigenous people before awarding the Escobal mining license to Tahoe.”

As a result of the suspension, Tahoe produced nearly no silver and spent more than $8 million maintaining basic operations at Escobal, forcing it to report first quarter losses and its share prices to fall.

Disruptions in South American mines resulted in an approximately 1 recent drop in silver production in 2016 and 2 percent decline in 2017. Learn more in “Silver Supply and Demand: 2018 Outlook.”

The problems in Guatemala could foretell another year of diminishing silver mine supply in the face of increasing industrial demand, an equation that could mean higher prices. The price of silver was certainly higher on Friday, hitting the weekly peak of $14.38 from 4 am to 5 am before pulling back to $14.24 between 9 am and 3 pm.