After years of getting shot down by a stubborn price ceiling, silver has punched through to the upside. With recent memory of sharp dips following strong rallies, many investors wonder what silver products offer the best combination of growth potential and protection.

In this week’s The Gold Spot, Scottsdale Bullion & Coin’s Precious Metals Advisors Todd Graf and Joe Elkjer compare the wealth preservation of investment grade and bullion coins, explain why silver has outshined expectations in 2025, and discuss the best silver coin options for investors looking to take advantage of the shiny metal’s rally.

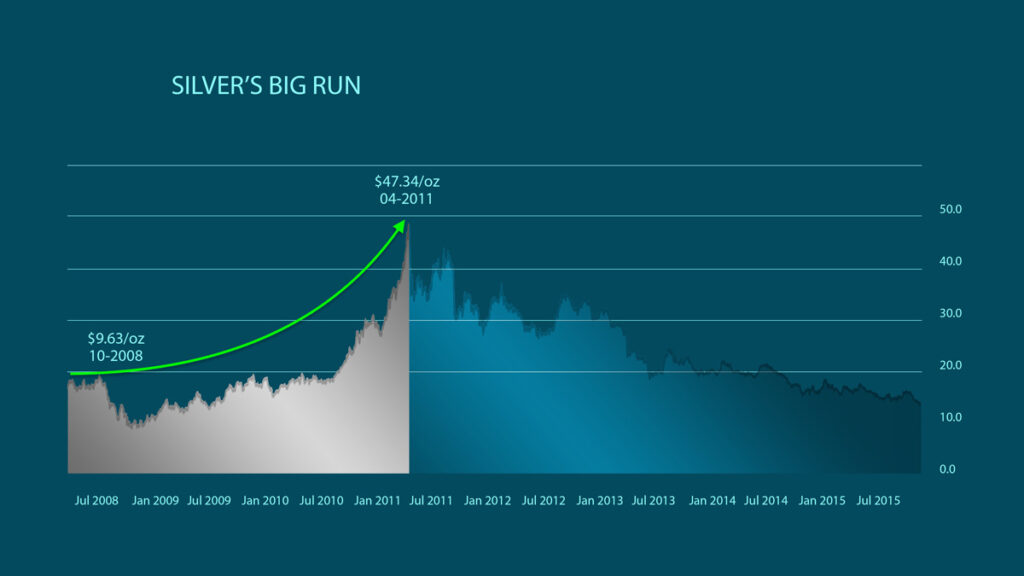

The Last Silver Pop: 2008–2011

Silver’s recent surge past $35/oz and its spike to $39/oz broke through technical resistance levels that had held firm for 14 years. The last true breakout came between 2008 and 2011, when silver skyrocketed from $9.63/oz to $47.34/oz. That sharp rally delivered a 391% gain in under three years, pushing silver prices within reach of the 1980 all-time high near $50/oz.

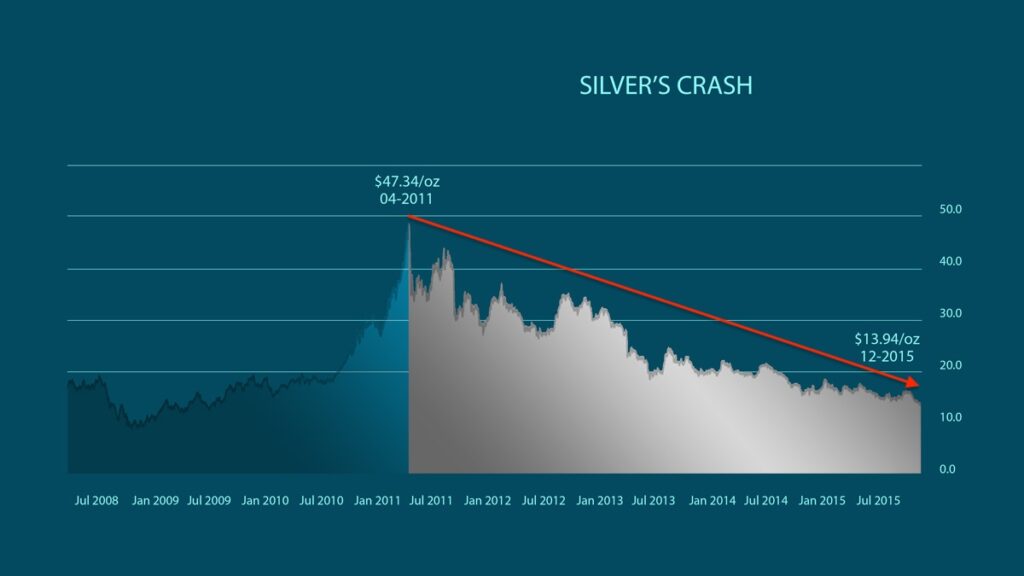

Yet, the climb didn’t last. After peaking in 2011, prices plunged, bottoming out at $13.94/oz by 2015—a brutal 70% drop.

Still, that correction didn’t fully wipe out the metal’s earlier momentum. Much of the reversal was driven by deliberate market manipulation, as large institutional players heavily shorted silver ETFs to suppress spot prices.

The Morgan Dollar Exception

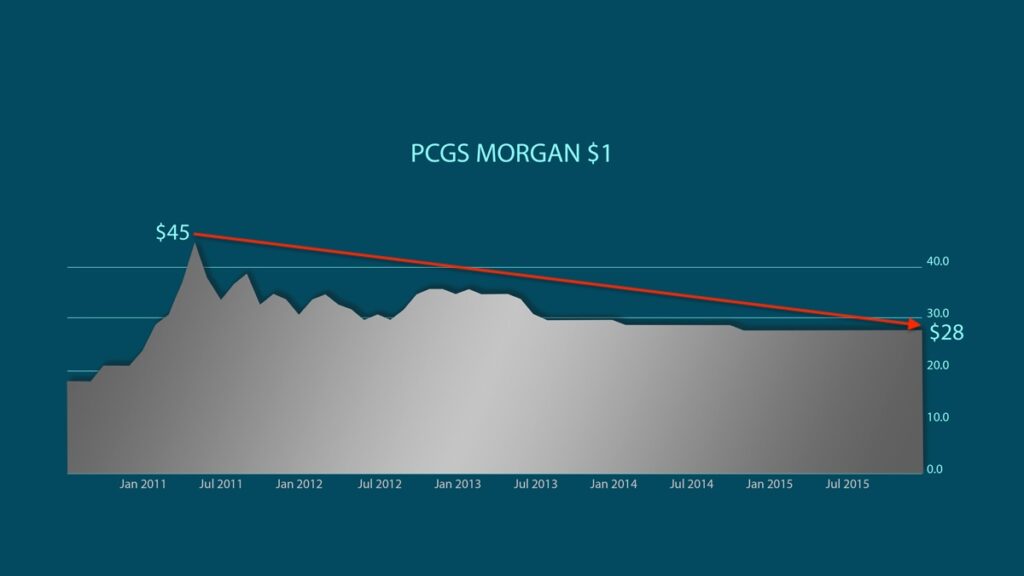

While most silver bullion products, which closely track the silver spot price, were hit hard during the market-wide downturn, Morgan Dollars held their ground. The average value of a circulated Morgan Dollar fell from around $45 in May 2011 to $28 by December 2015.

That 38% decline was far less severe than the 70% drop seen across the broader silver market. In other words, Morgan Dollars retained more than twice the value lost by typical bullion coins during the same period.

“Morgan Dollars showed much more stability than silver bullion. They rely on physical buying and selling to support their prices.”

This resilience comes from the fact that Morgan Dollars draw value from more than just their silver content. Historical significance, collectible demand, and scarcity all contribute to their numismatic worth, making them less susceptible to fluctuations in spot prices.

While the crash led many silver holders to sell, Morgan Dollar owners had more confidence that their coins would hold value and waited to sell.

Silver Turns the Tide in 2025

After years of stagnation, silver has finally broken out decisively to the upside, delivering around a 50% return. The metal entered 2025 near $26/oz following a strong 2024, and has since surged to a recent high of $39/oz.

While silver’s upward momentum mirrors the 2011 rally, this one feels different. The current climb has been marked by surprising resilience amid market uncertainty, shifting policy signals, and inconsistent demand trends.

Aside from the temporary dip following the post–Liberation Day tariff announcement, silver has maintained a steady upward trajectory. That consistency sets it apart from past rallies, which often reversed just as quickly as they rose.

For example, the 1980s silver spike, driven by the Hunt brothers’ attempt to squeeze the market, ended in a dramatic crash known as Silver Thursday, prompting tighter trading rules. Likewise, the explosive 2008 to 2011 rally ended abruptly after a wave of profit-taking and aggressive margin hikes cooled the market almost overnight.

Morgan and Peace Dollars See Demand Boost

Silver’s exceptionally stable rally directly boosts demand for Morgan Dollars and Peace Dollars, as investors recognize their unique role as wealth preservers in the space. Their high precious metals content allows investors to gain exposure to spot price spikes, while their numismatic value helps protect against dips.

As mentioned before, Morgan and Peace Dollars boast limited mintages, unique histories, and strong collector demand, imbuing them with value beyond their silver content. Most of these investment grade coins were melted down to help fund the World War II effort, adding to their rarity and boosting their upside potential.

Silver’s Breakout Makes These Coins a Bargain

With silver breaking out of a years-long holding pattern and 2025 silver price predictions pointing to continued growth, now is a prime opportunity for investors to scoop up Morgan and Peace Dollars.

While a 1 oz American Eagle Silver bullion coin will set you back over $40*, these historic silver coins are currently priced lower, at around $35* (*at the time of this posting). These two pieces of American coinage history have a proven track record of hedging against market downturns and volatility.

Many experts are already predicting $40/oz silver on the horizon, with some even calling for $50/oz silver, $250/oz silver, and even higher: $300/oz silver! Though nobody can predict precisely when these further gains will land, savvy investors are topping up their reserves beforehand, instead of trying to time the market.

Why Silver Belongs in Every Portfolio Right Now

As uncertainty looms over the economy, now is a critical time for investors to rethink diversification strategies. Precious metals—especially investment grade coins like Morgan Dollars and Peace Dollars—have a long-standing track record of preserving wealth through every kind of market cycle.

“With everything that’s happening with the dollar, there’s never been a more important time to understand how physical precious metals can preserve and protect your assets.”

If you want to learn more about how silver can protect your wealth, get your FREE COPY of our popular Silver Investor Report today!

Unlock Silver Investor Trade Secrets in our Investor Report.

Get Your Free Report

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields