As the broader economy shows signs of foundational weakness, gold and silver (yet again) have proven their inherent value and inflation-hedge properties. Both precious metals have boasted impressive advancements over the last week.

Watch this week’s The Gold Spot to hear Scottsdale Bullion & Coin Founder Eric Sepanek and IRA Liaison Michelle Ellis explain these major price moves, why gold and silver are expected to surge higher, and how investors can take advantage of this situation.

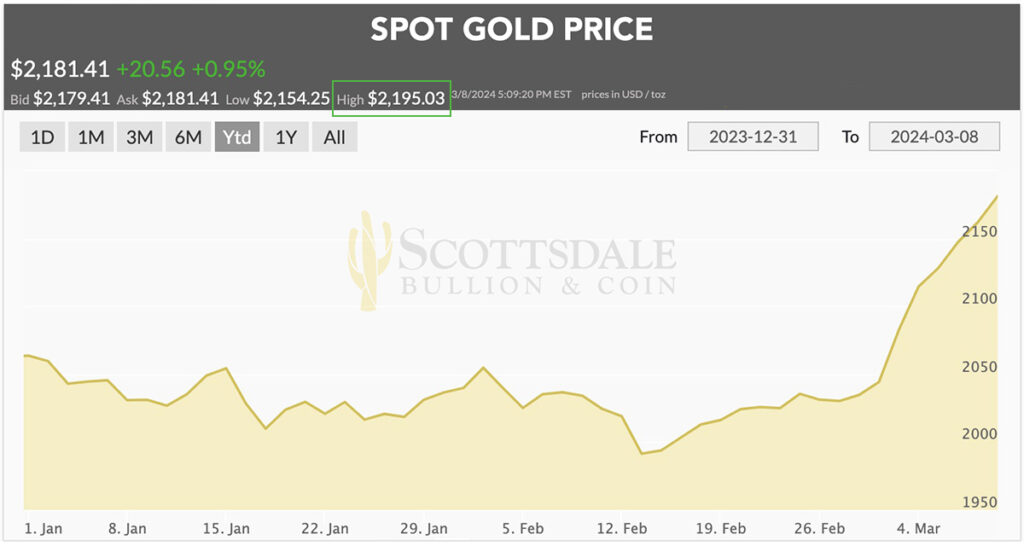

Spot Gold Price Hits All-Time High

This week, spot gold prices took off, notching new highs. On Tuesday, March 5, 2024, the spot price of gold first reached its new high since December 2023 when it hit $2,141.59 an ounce. However, the rally continued as gold brought a new high price each day of the week. As of today, Friday, March 8, 2024, the gold spot price hit a new intra-day all-time high price of $2,195/oz after the release of an overall weaker U.S. jobs report.

The rush into gold comes amidst a backdrop of weaker economic conditions and spiking gold demand. This is gold’s fifth record high price in the past three months alone, underscoring the yellow metal’s fundamental strength and the shift into safe-haven assets. In early December 2023, spot gold prices hit a then-high of $2,135/oz.

The spot silver price is pulling its weight by setting a two-month record1 around the same time. It’s not uncommon for this shiny precious metal to follow closely behind gold’s upward trajectory.

Premiums Are Still Low…For Now

Don’t make the mistake of assuming that elevated gold and silver prices automatically result in higher dealer premiums. Right now, these add-ons remain at favorable lows as the supply of coins, gold bars, and silver bars is healthy.

“Even though [gold and silver] prices are high, premiums are in a really good spot.” – SBC Founder Eric Sepanek

This hasn’t been the case in previous episodes of significant gold and silver price hikes, so investors should take full advantage of the opportunity while it lasts.

Perfect Timing for Contributions

The strength of gold and silver prices and relatively low premiums come at an opportune time for investors looking to optimize their retirement savings. The clock is ticking on 401k and IRA contributions which investors can make for both the 2023 and 2024 tax years, but only until April 15th. Here are the limits based on age and year:

| 2023 IRA Contribution Limits | 2024 IRA Contribution Limits | |

|---|---|---|

| Under age 50 | $6,500 | $7,000 |

| Age 50+ (catch up contribution) | $7,500 | $8,000 |

You can knock out contributions for two years simultaneously, further diversify your portfolio, and lock in gold and silver prices before they jump higher. It’s also a great time to rollover a 401(k), IRA, or another eligible retirement account to expose your nest egg to physical gold and silver.

A Limited Buying Opportunity

Gold prices might have hit all-time highs, but experts think things are just getting started. The recent price ceiling has been re-established as the floor with gold value remaining steady and strong. Due to a confluence of economic fragility, geopolitical instability, and waning investor confidence, gold and silver prices are expected to continue moving upward.

$2,500 an ounce is the average of 2024 gold price forecasts from a slew of market analysts. It’s only the beginning of March, and gold prices are well on their way to hitting this prediction. Investors can expect a few retractions on the way up, but experts are saying this is a prime time to buy physical gold and silver.

“We're very bullish, we're not surprised, and we think it's going to keep going in that direction.”

Don’t Wait to Buy Gold and Silver. Buy Gold and Silver, and Wait

All signs point to higher gold and silver prices in 2024 and beyond. Right now, investors have a limited opportunity to buy gold and silver while premiums are relatively low and before prices jump higher. Waiting around until the “perfect” time is a failed strategy. As always, investors are much better off buying gold and silver and waiting for their inevitable rise in value.

Related Resources

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields