Negotiations between the world’s leaders on multiple geopolitical and economic issues stalemated last week. Not that Wall Street noticed. Traders shrugged off looming economic threats while riding the record-long rally. Economists and financial experts, however, continued to issue warnings of the coming economic crisis and the dollar’s demise. Signs that some of them were starting to ring true were evident in the weaker dollar. Spot gold and silver prices edged higher during the week as a result.

Why is the dollar predicted to plummet and gold prices to soar? Read expert analysis in “Is President Trump Telling You to Buy Gold Now?”

Gold Price Movement Indicators

Monday, September 17, 2018

Weaker Dollar

Investors have treated the dollar as a safe haven from geo-economic risk all summer, but on Monday, despite the threat of a further escalation of the trade war, the dollar weakened. The first trading day of the week opened with markets concerned President Trump would follow through with tariffs on another $200 billion in Chinese goods, as reports the week prior indicated he was planning on it. If there was any doubt as to where the president stood on the issue, he cleared it up with a tweet that morning.[1]

Tariffs have put the U.S. in a very strong bargaining position, with Billions of Dollars, and Jobs, flowing into our Country – and yet cost increases have thus far been almost unnoticeable. If countries will not make fair deals with us, they will be “Tariffed!”

— Donald J. Trump (@realDonaldTrump) September 17, 2018

Making matters worse was news that China claimed it might decline offers from the White House to discuss trade if Trump proceded with the threatened tariffs. A senior Chinese official explained the country’s stance to The Wall Street Journal: ‘China is not going to negotiate with a gun pointed to its head.’ Trump announced the U.S. would levee the proposed tariffs late on Monday.[2][3]

The ICE U.S. Dollar Index lost .5 percent at 94.502, adding to the .5 percent loss recorded the week prior. Prices for assets denominated in the greenback, including gold, rose as they became less expensive in other countries.

‘Much of (gold’s move) is dollar-driven today. There’s probably some safe-haven bids coming in. There’s a bit of worry about China helping gold,’ explained the head of commodity strategies at TD Securities, Bart Melek. (Read “Is China’s Long-Term Strategy Focused on a New Gold Standard?”)

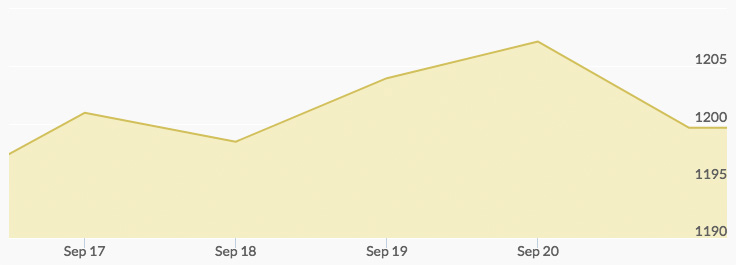

Gold prices climbed from the 1 am low of $1,194.40 to the 10:40 am high of $1,203.90.

Tuesday, September 18, 2018

Stronger Dollar

Rising geo-economic risk and the expectation of another Fed interest rate hike the following week lifted the dollar on Tuesday, making gold more expensive to foreign investors. After President Trump imposed a 10 percent tariff on another $200 billion in Chinese goods, China threatened to retaliate with additional tariffs on $60 billion in U.S. goods. Markets were weary that Trump would up the ante by taxing nearly all imports from the world’s second largest economy.

Investors sought safety in the dollar and U.S. Treasuries. The 10-year government bond yielded 3.048 percent, a level not seen since May 22. A measure of the greenback against six other major currencies, the ICE U.S. Dollar Index gained .2 percent at 94.664.[4]

Market anticipation that the Fed would hike interest rates during its meeting the following week also contributed to dollar strength. ‘I think there’s a secondary factor where higher rates and real rates are helping lift the dollar and that’s putting pressure on gold,’ explained the senior investment strategist for U.S. Bank Wealth Management, Rob Haworth.

Gold prices traded in a similar range to Monday, rising from the low of $1,196.90 at 3:10 am to the high of $1,202.50 at 9:40 am.

Wednesday, September 19, 2018

Stronger Emerging Market Currencies

Economic and political conditions across the globe have certainly favored holding safe havens in recent months, but the strong dollar has proven a hindrance to buying gold and silver for investors in emerging markets. Wednesday presented precious metals purchasing opportunities for these investors as their currencies rose against the greenback: the Taiwan dollar, the South Korean won, and the Indian rupee were all stronger compared to the dollar. Japan’s yen and the European Union’s euro were also higher.

‘The dollar is weaker against not just the majors. There’s been some expectation about some resurgence in emerging market currencies. That’s supporting gold,’ noted the director of metals trading at High Ridge Futures, David Meger.

The ICE U.S. Dollar Index lost .1 percent at 94.538, with the gauge set for a .4 percent loss for the week. Factors influencing the weaker dollar included Brexit difficulties, higher-than-expected British consumer price inflation data, and an escalating trade war with China, whose representative indicated the country would not use currency devaluation as a weapon in the trade war.[5] Analysts indicated that investors were starting to view tariffs as detrimental to the U.S.—not just China—and turning to precious metals over the dollar to hedge against financial risk with. Read more about gold’s role as a portfolio protector in “Gold: The Ultimate Safe Haven Investment.”

Gold prices increased from the low of $1,200.60 at midnight to the high of $1,206 at 11 pm.

Thursday, September 20, 2018

De-Escalation of Geo-Economic Risk

Strong U.S. economic data and news that China planned to cut the average tariff rates on imports from most of its trading partners, including the United States, sent optimism into the markets on Thursday. U.S. stocks soared: the S&P 500 and the Dow Jones Industrial Average set records. Safe haven demand for the dollar dropped. Gold prices hit their weekly high of $1,209.20 at 9 pm as foreign investors took advantage of bargain prices due to the softer dollar. Read more about the dollar’s influence on gold prices in “How These 10 Factors Regularly Influence Gold Prices.”

“We ‘must uphold multilateralism, the rules of free trade… If there are problems, negotiation is needed to solve them,’” asserted Chinese Premier Li Keqiang after vowing the country would not resort to currency devaluation to increase exports. Combined with the news of import tariff rate reductions, the announcement was viewed as China taking a softer stance on the trade war.[6]

At the same time, record low first-time jobless claims, a September jump in the Philadelphia Fed’s manufacturing index, and reports that the economic expansion is on track for 3 percent growth in the second half of 2018 confirmed traders’ belief that the U.S. was immune to the trade war threat. The chief executive officer of JP Morgan Chase & Co, Jamie Dimon, went so far as to downgrade the trade war to ‘a trade skirmish.’

Such complacency among Wall Street players had some investors concerned. ‘The end result is an ever-growing threat to the world economy—and to markets—that may be ignored until it is too late, especially because the imminent threat seems less expected and markets haven’t sold off. For that reason, I believe caution is warranted and I would take this rally with a grain of salt. I don’t think we can blow the all-clear sign until steps are in place to resolve trade concerns with China, which are now more of a threat than ever,’ explained the chief investment officer at Independent Advisor Alliance, Chris Zaccarelli.[7]

Even if trade disputes were to be resolved, the U.S. could have domestic economic problems to face. Learn more in “When Will the Economy Crash.”

Friday, September 21, 2018

Rising Geopolitical Risk

The possibility of a no-deal Brexit caused the dollar to rise against the British sterling and the euro on Friday, increasing the price of gold for these buyers. On the home front, the U.S. and Canada still hadn’t reached a consensus on revising NAFTA, and there was talk that the U.S. and Mexico would strike a deal without their northernmost trading partner. Despite its daily gain, the greenback was still down for the week. Experts expect this downtrend in the dollar to hold. Read “When Will the Dollar Crash?”

After European Union leaders rejected the U.K.’s post-Brexit proposal, Prime Minister Theresa May introduced the possibility of a ‘no deal Brexit’ during a speech.

‘A big selloff in the pound and euro sent the dollar sharply higher. And gold, being dollar-denominated, fell as a result of that,’ indicated Fawad Razaqzada, an analyst at FOREX.com.

White house economic adviser Kevin Hassett said “that the U.S. was ‘very, very close’ to going ahead with a trade deal with Mexico alone and excluding Canada, sending the Canadian dollar lower against the greenback, which was up .4 percent on Friday but down .7 percent for the week.[8]

The price of gold pulled back from the 3 am high of $1,209 to the low of $1,195.10 at 9 am.

Overall, the price gold climbed last week, and many analysts think this trend will continue. The window to take advantage of bargain prices is closing quickly. Find out why in “Smart Money Buying Up Physical Precious Metals, Sales Skyrocket 126%.”