The economy is stumbling into 2024 as US debt hits new highs, investor confidence wanes, and the cost of living mounts. On a high note, the Fed’s decision to cut rates could be a boon to gold prices, stretching their gains from last year.

Watch this week’s The Gold Spot to hear Scottsdale Bullion & Coin Precious Metals Advisor Joe Elkjer and Sr. Precious Metals Advisor Steve Rand discuss the potential impact of the Fed’s policy reversal on gold’s performance and why it’s cutting rates now.

Anticipated Interest Rate Cuts in 2024

At its most recent meeting, the Federal Reserve said rates were likely at or near highs and reaffirmed strong expectations of several rate cuts in 2024. However, the consortium of financial bigwigs also acknowledged that rates would remain restrictive.

The goal is to stimulate economic growth and stave off a recession by making borrowing more affordable for consumers and businesses. The market is still pricing in DOUBLE the amount of rate cuts relative to Fed expectations, which means most investors remain highly cautious.

What Will Happen to Gold Prices if the Fed Cuts Rates?

Nobody can say for certain how these anticipated interest rate cuts will affect gold prices. However, we can gain some valuable insights from historical patterns. During the infamous 2008 financial crisis, the Fed slashed rates from a relative high of 5.25% to historical lows of 0% to 0.25%.

In response, gold prices surged dramatically (as did silver prices) from roughly $800 an ounce to around $1,900 an ounce within three years. Poor economic conditions, such as a weaker dollar and higher inflation, lead to increased gold purchases by central banks and investors seeking a stable store of value.

A lot of the current economic conditions mirror those of 2008, prompting expectations of higher gold price performance shortly. This is partially why the gold price predictions and forecast for 2024 are so healthy.

Why Rate Cuts Now?

Many investors are perplexed by the Fed’s decision to slash interest rates as the stock market flexes its resilience. Looking back to 2008, the stock market was comparatively weak when our fiscal leaders rolled back rates aggressively to stimulate growth.

The Fed’s commitment to several rate cuts despite the market’s relative strength betrays their lack of confidence in the future of the economy. On the surface, the economy appears to be robust, but these fiscal policies reveal the underlying desperation of policymakers.

Although only three rate cuts are on the docket now, there’s no telling how many the Fed could enact. It all depends on how heavy the economic burdens weigh down.

US Debt Sets (Another) Record

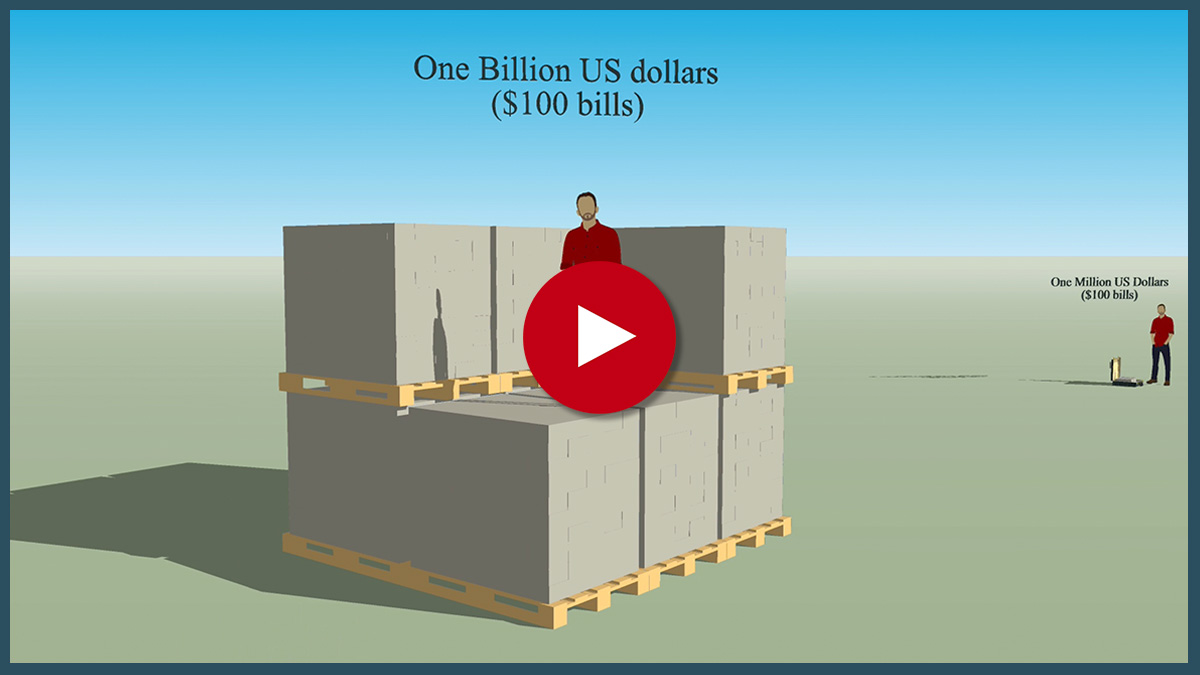

All of this policy meddling is happening amidst the backdrop of baffling levels of debt. The US debt just broke another record, surpassing $34 trillion! The country’s debt-to-GDP ratio is worse than it was during WWII. At this pace, the US debt is expected to double in the next three decades!

These astronomical figures are getting tougher to conceptualize, so we created a helpful visualization of US national debt for investors.

Household and credit card debt are also on the rise, reaching over $17 trillion and $1 trillion respectively. With a debt-crippled dollar, the cost of living is soaring, affecting groceries, energy, real estate, and everything in between. This paints a concerning picture of the current economic state and underscores the potential impact of the Federal Reserve’s upcoming rate cuts.

De-risk Your Investment Portfolio for 2024

The Fed’s rate cut policy for 2024 is remarkably similar to its strategy in 2008. If gold’s historical performance is any indication of its future trajectory, this rate hike reversal could give a serious boost to gold. Plus, there’s the added momentum of a precarious economy where investors are actively looking for reasons to stash their money in safe-haven assets like precious metals.

Smart money investors see the proverbial writing on the wall which indicates that gold is a good investment in 2024. You can put your portfolio in the best position for maximum protection and optimal returns for this eventful year. Request a FREE COPY of our insightful Gold and Silver Report to learn how to get the most out of your gold and silver investments.

Related Resources

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields