The rot of US debt had been festering for years before bursting into public awareness after gratuitous pandemic-era spending plopped an unignorable $5 trillion onto the pile. Now, the ramifications of decades worth of fiscal mismanagement are hitting globally.

In this week’s The Gold Spot, Scottsdale Bullion & Coin Sr. Precious Metals Advisor Damian White and Precious Metals Advisor Todd Graf explore how we arrived at this debt bubble, how federal debt affects individuals, and why gold is a solution.

A Debt-Based Economic System

The Federal Reserve is the puppet master of US fiscal policy. As the country’s central banking system, it can create money, set interest rates, and regulate financial institutions, among other monetary controls. Whenever the Fed “prints” money, it’s technically borrowing the funds through open market operations, issuing government bonds, and adjusting reserve requirements. Thus, the Fed is the ultimate source of debt in the country.

Debt is part of our [monetary] system, and it’s everywhere right now.–

Debt isn’t merely a side effect of our financial system; it’s the foundation. Until the weight of Modern Monetary Theory (MMT) is lifted, the country is bound to sink further and further into debt. Every US dollar tacked onto the debt threatens the economic stability of everyday Americans and the entire economy.

Feckless Fiscal Leadership

The US monetary system is undeniably intricate and complicated. However, that should be no excuse for fecklessness and confusion at the highest decision-making level. Yet, even our fiscal leaders fail to understand the basics of our economy’s foundation. This is painfully obvious in a viral clip of Jared Bernstein, the United States Council of Economic Advisers chair, failing to answer a straightforward question regarding US debt. The video is equal parts self-parodying and infuriating. Note, after fumbling the question, he dares to conclude, “I don’t think there’s anything confusing there.”

$1 Trillion in Interest Payments

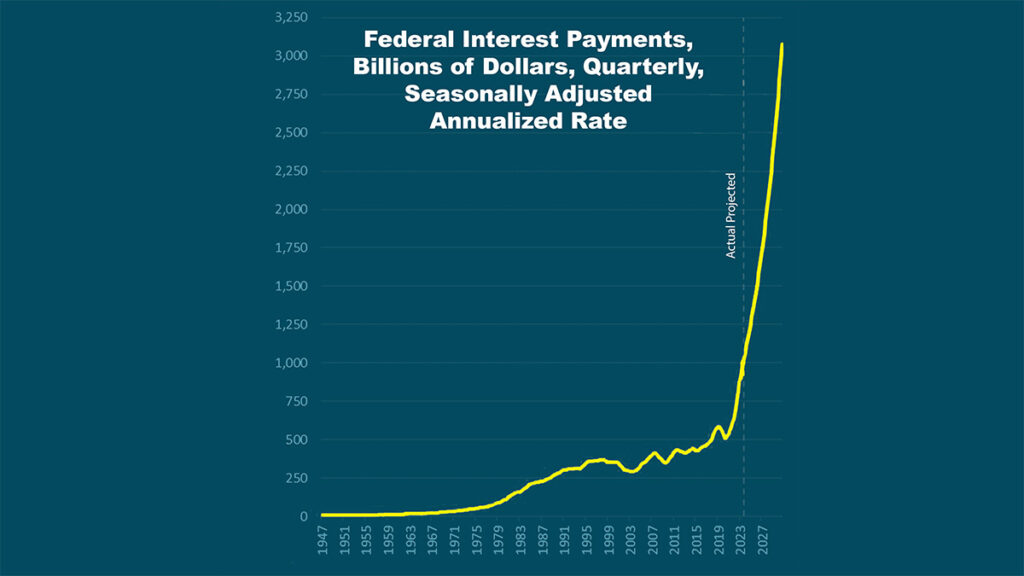

Since a large chunk of US spending is borrowed money, it inevitably incurs interest payments. These interest payments comprise an increasingly large percentage of the annual budget. In 2023, interest payments reached a staggering $1 trillion. As the chart below demonstrates, these payments are expected to surge in the coming years.

Federal Interest Payments (in billions $, qaurterly) Seasonally Adjusted Annualized Rate 1947-2027

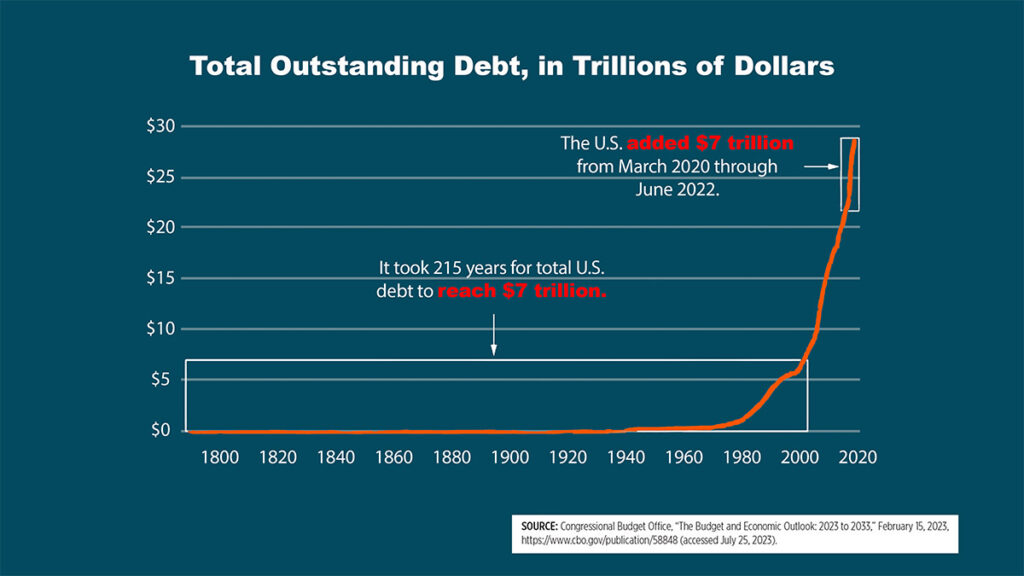

Looking at the sheer scale of the $34 trillion national debt, it’s easy to assume the growth has been incremental. However, the numbers paint a different story. Between our nation’s founding and the early 2000s – a period of 215 years – the US only accumulated $7 trillion of debt. As the graph below illustrates, debt jumped by the same amount within just two years between 2020 and 2022.

The Government Accountability Office called the addiction to debt an “unsustainable long-term fiscal path.” Even the World Economic Forum (WEF) president is sounding the alarm bells, saying, “We haven’t seen this kind of debt since the Napoleonic Wars”. It seems everyone but the decision-makers are taking notice of this incoming catastrophe.

As our national debt grows higher and higher, there’s no mathematical way this can be paid off and set back to zero.–

Trickle-Down Debtonomics

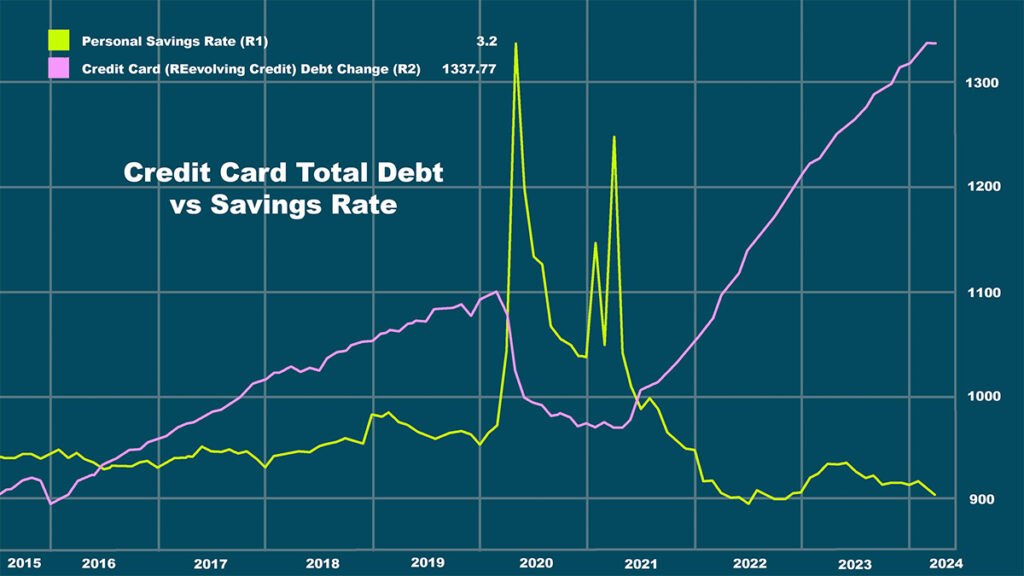

Fiscal malpractice at the federal level is trickling down the individual realm. Recently, US credit card debt reached over $1 trillion – the highest point in American history. At the same time, the personal savings rate is plummeting, creating a massive gap between what people have to spend and what they can save.

How to Protect Yourself from a Debt Crisis

When the towering US debt falls – which, unfortunately, seems guaranteed at this point – individuals and families will suffer the brunt of the impact. That’s why people have been diving into physical assets like gold bars, silver bars, and coins. With an inverse relationship to the broader market, precious metal assets tend to rise in value when the economy falls.

This increased gold demand has resulted in an massive rally in gold prices. Instead of anticipating a pullback, experts are raising their gold price predictions for 2024 and 2025.

If you’re concerned about US and global debt, learn how gold could protect your wealth. Request your free copy of our popular Precious Metals Investment Guide today. It’ll teach you everything you need to know about securing your financial future with physical gold and silver.

Questions or Comments?

"*" indicates required fields