Economic and political conditions at home and abroad last week set the stage for the coming gold rally. Geopolitical and global-economic tensions escalated. The Fed confirmed the likelihood of more interest rate increases due to employment data suggesting the economy continues to heat up, while the Treasury Department predicted the federal government’s borrowing in the second half of the year to reach levels not seen since the last financial crisis.

At the same time, sales of gold and silver coins have been climbing, suggesting long-term precious metals investors are heeding the warning signs and taking advantage of bargain prices.

What are the typical indicators that it’s a good time to buy gold? Find out in “How These 10 Factors Regularly Influence Gold Prices.”

Gold Price Movement Indicators

Monday, July 30, 2018

Central Bank Policy Meeting

On Monday, markets were fixated on the Federal Open Market Committee’s meeting on Tuesday and Wednesday. While most expected the Fed to maintain its plans for two more interest rate hikes in 2018, investors were anticipating clues as to when the next increase would occur. Higher rates raise the yields on interest-bearing assets and the opportunity cost of holding precious metals.[1] Investors may adjust their portfolios when they see greater earning potential in paper assets, though in recent years interest rates haven’t been high enough for significant returns.

The Fed’s policy of continued rate raising has served as a tailwind to the dollar, adding further pressure to assets denominated in the greenback. Advances in the dollar since mid-April have contributed to losses of approximately 10 percent for the spot price of gold. ‘Gold is still a dollar story and I see no sign of the correlation breaking down,’ asserted ING commodities strategist Oliver Nugent.[2][3]

National Debt

News headlines brought more flashbacks to the last financial crisis on Monday. “Treasury Sees Second-Half U.S. Borrowing at Most Since 2008,” read the title of an article Bloomberg published. The economy may be thriving, but the country’s fiscal health is deteriorating, prompting the Treasury Department to predict the U.S. government’s borrowing to rise to levels not seen since 2008 in the second half of 2018: $1.1 trillion then compared to $769 billion later this year.

The budget gap has been growing after President Trump approved $1.5 trillion in tax cuts last year and Congress greenlighted about $300 billion in additional spending. By 2020, total government spending could exceed revenue by $1 trillion predicted the Congressional Budget Office. The CBO expects budget deficits to keep climbing.

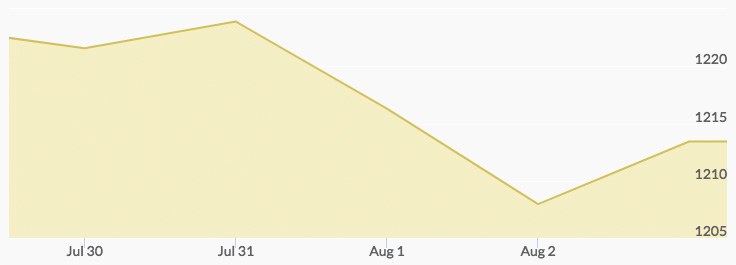

What do rising interest rates plus ballooning national debt plus soaring personal and private sector debt equal for gold prices? A rally! The price of gold on Monday, however, remained subdued by near-term events: the low of $1,219.50 at 3 am was followed by the high of $1,224.10 at 11 am.

Tuesday, July 31, 2018

Rising Geopolitical Risk

After breathing a collective sigh of relief when President Trump and Kim Jong Un pledged to “work toward the complete denuclearization of the Korean Peninsula” during a summit last June, world leaders and citizens were once again uneasy when news broke on Tuesday that U.S. spy agencies suspect North Korea is still producing new ballistic missiles. Satellite photographs revealed the appearance of an active missile factory near the capital of the country.

Back in June, analysts were critical of the lack of specific measures or timelines for Kim Jong Un to commit to giving up North Korea’s nuclear and missile capabilities, and that issue appears to underlie the continued threat the country poses to the U.S.[4] It was this same threat that prompted President Trump to warn the North Korean government last August that the U.S. would respond to provocations with ‘fire and fury like the world has never seen.’

Escalating geopolitical tensions involving North Korea last summer sparked a gold rally. Gold prices on Tuesday, however, followed a similar trajectory to the day prior: they climbed from a low of $1,218.20 at 6 am to a high of $1,225.70 at 1 pm.

Gold Bullion Sales Up

What usually accompanies a hot geopolitical climate? Safe haven investing! Tuesday brought a report that 2018 has been a banner year for American Buffalo Gold coins. Sales of the gold bullion coins increased by 24,500 ounces in July, a 276.9 percent jump from June and 308.3 percent surge from July 2017. Compared to the same time period in 2017, year-to-date sales are up 8.3 percent. July sales of American Eagle gold coins were up 42.9 percent from June and 50 percent from July 2017.[5]

Wednesday, August 1, 2018

Hawkish Federal Reserve

Even though economists have been predicting the next recession as soon as next year, the Treasury expects the national debt to soar in the last half of 2018, and even the president has expressed disapproval on continued interest rate hikes, the Fed made it clear on Wednesday that the central bank plans to keep increasing rates: ‘The FOMC expects that further gradual increases in the target range for the federal funds rate will be consistent with sustained expansion of economic activity, strong labor market conditions, and inflation near the committee’s symmetric 2 percent objective over the medium term.’

Despite rising after the Fed rate hike on June 13, the price of gold pulled back following the Fed statement: the high of $1,223.10 at 7 am was followed by the low of $1,215.50 from 5 pm to 6pm.

Thursday, August 2, 2018

Stronger Dollar

Several factors pushed the dollar higher throughout the week: the Fed’s confirmation of future interest rate hikes, the escalation of the U.S.-China trade war, and finally strong employment data on Thursday. The dollar rose nearly .5 percent against a basket of currencies, making assets denominated in the dollar more expensive for foreign investors. Spot gold prices dipped .3 percent to a low of $1,206.80 at 10 pm.

Bureau of Labor Statistics data showed that July job growth slowed more than expected. In a Reuters poll, economists predicted a 190,000 increase in payrolls last month, but the BLS tally came in at 157,000 jobs. At the same time, a broader measure of unemployment decreased to the lowest level since March 2001, 7.5 percent, suggesting that labor market conditions continued to contract last month.

Economists have also been predicting that the trade war could hurt the economy. ‘Financial markets are feeling the impact. … The ongoing trade war with China and our allies could hurt investment spending and hold back job and wage gains,’ asserted Sung Won Sohn, the chief economist at SS Economics in Los Angeles.

The Bank of England raised interest rates on Thursday, not two months after the European Central Bank announced plans to wind down stimulus measures. “Tightening monetary policy elsewhere could begin to push the dollar lower and help gold recover to above $1,300 next year,’ said Bernard Dahdah, an analyst at Natixis.

Friday, August 3, 2018

Rising Geo-Economic Risk

The tit-for-tat trade war with China escalated on Friday when the Chinese Commerce Ministry vowed to impose tariffs on $60 billion in U.S. goods if the White House doesn’t put a stop to penalties that are pending on Chinese imports. Beijing said it was ‘forced to act’ after President Trump threatened to increase the proposed tariff rate from 10 percent to 25 percent on $200 billion worth of Chinese goods.

U.S. government data published Friday showed that the trade deficit with China reached a record level in the first six months of 2018. Business groups and international business relations experts expressed concerns over the detrimental impact of the trade war on the economies of both countries. ‘I sense that we’re seeing a hardening of attitudes on both sides. … [It’s a] race to the bottom that will harm American consumers, farmers and U.S. industry,’ indicated the vice president of China relations at the U.S. China Business Council, Jacob Parker.

Economists have been predicting a recession as soon as next year and the trade war could exacerbate the coming downturn. Read “When Will the Economy Crash?”

Gold prices reacted positively to the worsening geo-economic picture, gaining nearly $15 dollars from the low of $1,204.10 at 4 am to the high of $1,219 at 10:50 am.

Need today’s gold prices? See our Gold Spot Price Chart.