‘Conditions across the global financial markets [will] become more supportive for precious metals prices later this year.’ -Metals Focus, Silver Focus 2018 [1]

Gold and Bitcoin made headlines in 2017, but silver has continued to gain traction, leaving the metal perfectly positioned for the breakout that’s already underway. While gold prices increased twice as much as silver prices —14 percent vs.7 percent—many of the market factors driving prices for the white metal last year are gaining momentum, and we’re starting to see silver outperform gold.[2] See why it could prove to be a banner year for silver.

Where Are Silver Prices Headed?

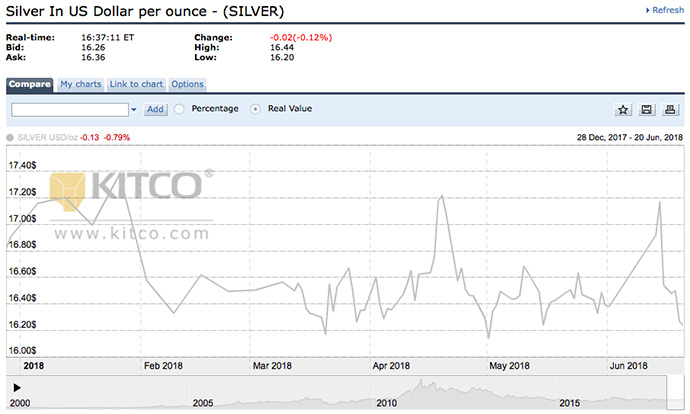

Silver traded in a tight range from January to June, leading many analysts to predict silver prices to soar by the end of the year. Indeed, following the Federal Reserve’s most recent rate hike and signals of rising inflation, silver prices have started trending upward.[3][4]

Silver Price Predictions 2018

| Silver Price | Organization |

|---|---|

| $18 | Gold Newsletter |

| $19 | Bank of Montreal |

| $20 | TD Securities |

| $20 or Higher | Metals Focus |

Read more about the direction of silver prices in our “Silver Price Forecast 2018.”

Why Is Silver a Good Investment in 2018?

What will drive the price of silver higher this year? From supply and demand to political and economic trends, many of the usual suspects are behind the silver rally that’s just starting to pick up speed.

Learn more about the “10 Factors that Influence Silver Prices.”

Supply and Demand

The silver supply and demand equation is favorable for higher prices.

Silver Supply

Mine Supply

Mine output has been decreasing in recent years. In 2017, global mine production dropped by 4.1 percent due to supply disruptions in North and South America. Production problems were also reported in Australia, Argentina, Peru, and China.

Scrap Supply

Compounding the supply shortage was a decrease in scrap silver, which fell to 138.1 Moz. 2017 marked the sixth consecutive year of decline.[5]

Central Bank Supply

Equally troubling, Central Banks contributed absolutely no silver to the global supply from their stockpiles for the third year in a row. One reason is that their supplies dwindled from 207 Moz. in 2007 to 89.1Moz. in 2016.[6]

Silver Demand

Investor Demand for Silver

“The enormous range of economic, financial and political issues facing the world and individual investors seems more likely to lead to a rekindling of silver demand from

investors.” -CPM Group [7]

Similar to gold, silver is viewed as a safe haven investment during times of economic, political, or financial turmoil. Halfway through the year now, problems in all three areas are escalating.

Economic Factors

Entering its ninth year, the current economic expansion will become the longest in modern history if it lasts through June 2019. Thanks to tax cuts and an increase in government spending, it most likely will be. But Uncle Sam is running out of resources and will only be able to support economic growth for another year, maybe two.

We’re already seeing signs of the next recession in the form of less spending and lower birth rates. Clearly, consumers sense what economists are already predicting: the financial devastation that inflation and rising interest rates will bring to an already debt-burdened country—dealt a final blow by an all-out global trade war.

Political Factors

At home and abroad, the political climate is heating up. Internationally, America’s relationships with both longtime enemies and allies is deteriorating. The U.S. has imposed sanctions against Syria, NorthKorea, and Iran and levied trade tariffs against Mexico, Canada, and the E.U.[8][9] From military clashes in the Middle East toretaliatory tariffs, lives and livelihoods are at stake.[10]

Financial Factors

Experts in the financial sector have been saying the stock market is overvalued for some time. With interest rates climbing and recent tax cut gains diminishing, President’s Trump’s ‘unpredictability’ is once again a major concern. Investor sentiment is mirrored in increasing stock market volatility: so far in 2018, the S&P moved 1 percent up on 21 trading days and down on 15; since 1958, it has averaged 53 days of 1 percent moves or more annually. In February, the CBOE Volatility index (VIX) shot to 37.3 and remains elevated even on calm days.

A closer look at the domestic and global picture reveals that we’re teetering on the threshold of sheer crisis. Many will wait until the catastrophe hits to seek the safety of silver—but savvy investors are taking advantage of bargain prices and buying silver now.

Industrial Demand

‘We expect silver to move moderately higher in 2018 and 2019 based on strong industrial demand and limited supply,’ -James Steel, chief precious metals analyst at HSBC. [11]

More abundant and less expensive, silver has far greater applications than gold and therefore more sources of demand. Its excellent electrical conductivity makes silver a key component of solar panels, electric vehicles, and consumer electronics. The medicalindustry values the white metal for its antimicrobial and non-toxic qualities. Lustrous and malleable, silver is used in everything from jewelry and silverware to nuclear reactors.[12]

Industrial demand for silver rose 4 percent in 2017. Below were the sectors that contributed significantly to the spike.

Jewelry

Purchases of silver jewelry in North America and India accounted for a 2 percent bump in demand.

Silverware

Global annual silverware fabrication rose 12 percent, largely due to a surge in domestic production in India.

Industrial Fabrication

Solar was a key player in the industrial sector, fueling a 19 percent jump in silver demand over the previous year. Over 50 percent of the world’s new solar panel installations were in China. India and Europe were also leaders in the renewable energy revolution.

Robust growth in China and Japan contributed to a 4 percent increase in brazing alloy and solder silver fabrication.[13]

Given its strong performance in 2017, the lead analyst for Thomson Reuters’ GFMS, Johann Wiebe, predicts industrial demand for silver will continue to rise in 2018.[14] Combined with safe haven buying, we could see the spot price of silver take off soon.

Technical Analysis

“We suspect the high gold:silver ratio indicated that the market had been expecting another major crisis could be looming, or at the least that it was about time for equities correction, and thereforeinvestors have been accumulating physical gold.” -The Silver Institute, World Silver Survey 2018 [15]

Not since November 2008 have we seen the gold silver ratio so high: 80.48 then versus a historic high of 82 inApril. Just prior to the Great Recession, silver was selling for $9.70 an ounce; by 2011, the price had shot up more than 400 percent to $49.82.[16]As of June 14, 2018, the white metal was trading at $17.32 per ounce.[17] Where can we expect silver prices to go?

UP!

The precious metals industry is buzzing that the high gold silver ratio is setting the stage for silver prices to explode. Typically, when the gold silver ratio surpasses 80, it reverses back. With the ratio currently at 75.64, we’re already seeing this trend play out in the markets. The silver rally is here!

Technical analysis reveals that silver was trading in one of the historically tightest ranges of $1 since the beginning of year. With the price of silver’s recent breakout from this range, the volatility experts have been predicting may have returned to the markets.

Is It Worth Buying Silver Now?

Rising inflation, an overheated economy, and a tense geopolitical climate all make diversifying your portfolio with precious metals a must for 2018 and beyond. Market fundamentals of supply and demand, as well as technical analysis, signal that silver prices—already rising significantly—will continue climbing. At this point in the year, the longer you wait to buy silver, to more you’ll pay to protect your wealth in the long run.