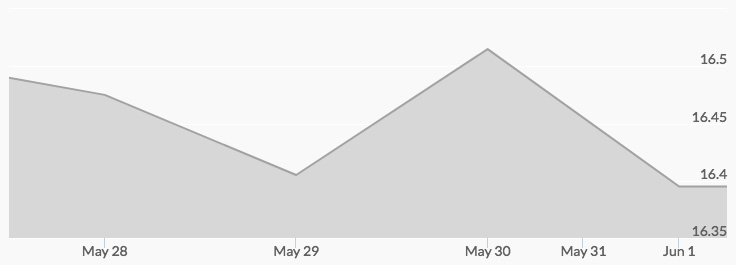

A short week for the London and New York markets due to the Memorial Day holiday, silver continued to trade in a tight range below the psychologically important $17 level, indicated the silver spot price chart. The spotlight was on the economy, which reports released last week suggest continues to hurtle along toward one of the longest economic expansions ever. Other silver market movers were industrial demand, technical analysis, and mining discovery innovation.

Silver Price Movement Indicators:

Monday, May 28, 2018

Advances in Mining Technology

Recent innovations in x-ray fluorescence (XRF) technology are improving the efficiency of the gold and silver mining discovery process, reducing costs and discovery times. The technology is based on spectrometry, which is a type of metals analysis. Geologists use portable XRF guns in the field to measure the secondary x-ray emissions samples release when exposed to x-ray fluorescence, helping them identify the chemical signatures of a sample’s elemental composition in minutes instead of sending it to a lab for weeks.[1]

With declines in silver mining production recorded since 2016, cutting costs and boosting output with the use of XRF guns could increase supplies of the white metal, causing prices to dip.

Despite supply shortages, silver prices pulled back on Monday, with a low of $16.41 hit from 9 am to 10 am.

Read more about Silver Supply and Demand: 2018 Outlook.

Tuesday, May 29, 2018

Technical Analysis

Tuesday brought further technical support for an imminent surge in silver prices: the 50 and 200 week moving averages are both at $16.74. With trading within a $1 range since the start of the year, the white metal is in one of the tightest ranges in history. While analysts predict silver prices could pullback another 2 or 3 percent from the bottom of the range, they also foresee a silver breakout coming. Some experts have even predicted silver will upsell gold this year. The key for investors is to buy now before prices rise.[2]

Trading reflected this trend, with the high of $16.44 at 2 am and 6 am followed by the low of $16.32 at 10 am.

Check out our Silver Price Forecast 2018 for more analysis on were the white metal may be headed.

Wednesday, May 30, 2018

Strong Economy

Reports of a falling U.S. trade deficit and a tightening labor market on Wednesday suggested the economy is on solid ground. The government indicated that the trade gap in goods, excluding services, decreased from $68.6 to $68.2 billion in April. The 0.6 percent dip could be an indicator of faster economic growth in the second quarter, adding further momentum to an expansion entering its ninth year this month and that is set to be the longest ever.

Wednesday also brought payrolls processor ADP’s job growth data. In May, the U.S. added 178,000 private-sector jobs. Statements from employers corroborate the numbers, with many reporting difficulties adding qualified candidates.[3]

Demand for safe haven assets tends to soften when the economy is humming along. However, silver has many technology applications, so it can shine in a strong economy. Wednesday’s high for silver prices of $16.50 was reached at 4 pm and 9 pm.

Thursday, May 31, 2018

Solar Demand

Nevada may be home to the capital of guilty pleasure, but the consciences of Las Vegans and tourists alike could get a little clearer thanks to clean energy powering The Strip and the rest of the state. On Thursday, NV Energy announced that it had contracted over 1 gigawatt of new solar energy and 100 megawatts of battery energy capacity. Although contingent on the outcome of an upcoming high-profile ballot measure, the new solar and battery projects are expected to serve customers by the end of 2021.

An excellent conductor of electricity, silver is a main component of solar panels, the usage of which is expected to grow 75 percent from 2015 levels this year. Greater demand for silver for renewable energy projects like the one slated in Nevada could diminish supplies and drive up prices. Thursday also brought the weekly high for the price of silver of $16.55 from 4 am to 6 am.

Friday, June 1, 2018

Strong Economy

More positive economic data on Friday resulted in a pullback in silver prices. The government reported that 223,000 jobs were added to the U.S. economy in May, average hourly wages increased by 0.3 percent, and unemployment dropped to 3.8 percent—the lowest level recorded in 18 years. Markets took the news as further support for the Federal Reserve raising interest rates at least twice more this year.[4] Silver prices were among the lowest for the week, with a low of $16.32 at 8 am and a high of $16.43 from 11 am to noon.