The story for silver last week was somewhat of a continuation of the week prior: despite an escalating trade war and foreboding economic signals, the white metal moved in tandem with other commodities, which have slumped lately amid geo-economic-driven risk-off sentiment in the markets. Investors are getting defensive, and as soon as silver reverts to its traditional safe haven status, silver prices could jump. For now, long-term market players are taking advantage of opportunities to buy gold and silver coins at bargain prices.

Read more about silver’s typical market movers in “10 Factors that Influence Silver Prices.”

Silver Price Movement Indicators:

Monday, June 25, 2018

Commodity Selloff

Similar to last week, investors unloaded commodities over concerns that the worsening trade war could hurt economic growth and demand for industrial metals. Prices for copper, zinc, and most other metals dipped on Monday, as well as throughout the rest of the week.[1] The good news for gold and silver, though, is that they also serve as safe havens and will likely see such demand in the near future as the trade war takes its toll on the global economy.

Recession

“More than a few investors and strategists feel that the global economy and corporate earnings are at a peak and have nowhere to go but down,” wrote Robert Burgess in Bloomberg on Monday. Strategists at Morgan Stanley have been advising investors to ‘buy 10-year Treasury notes outright,’ Chinese and E.U. officials warned that the trade war could “[push] the world into a recession,” and the chasm between consumer confidence now versus the future continues to widen—a pattern ‘typical of the middle-to-later stages of an economic cycle.’ On top of all of this, Burgess noted that the global stock market recorded its greatest drop since March and cited expert predictions that the trend for equities and the dollar is downward.

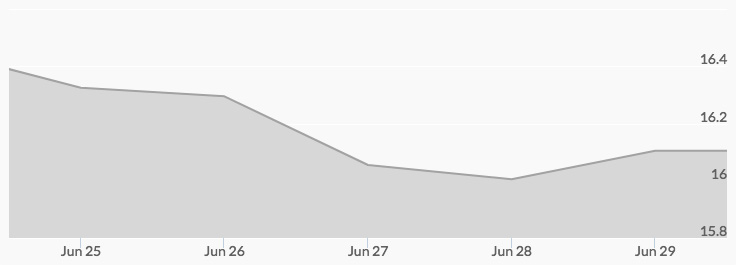

With its generally inverse relationship to the dollar and stocks, silver tends to perform well during times of economic downturn. For now, though, the economy is still red hot, keeping silver prices on the cool side with a low of $16.27 at 2 am followed by the high of $16.39 at 8 am.

Tuesday, June 26, 2018

Rising Oil Prices

Investor fears of a global shortage of oil in the second half of the year caused prices for crude to rally on Tuesday. Recently, the Wall Street Journal reported that the U.S. is warning that it will impose sanctions against countries that continue to import oil from Iran after November 4, 2018. At the same time, economic and social problems in Venezuela could hinder the country’s oil production. Combined with the temporary shutdown of the Canadian oil-sands facility and the seizure of oil ports in Libya by a National Oil Corporation, these issues could strain output and result in steeper prices.[2]

Rising oil prices can push inflation higher and slow down the economy—both bullish trends for gold and silver. Prices for the white metal were, however, still hemmed in by the commodities selloff and strong dollar on Tuesday. The low of $16.14 was hit at 8 am and the high of $16.28 at 1 am.

Wednesday, June 27, 2018

Currency War

Global trade isn’t the only sphere where a war is brewing. Reuters reported on Wednesday that the Chinese yuan dropped below the psychologically key 6.6 per dollar level for the first time in six months. Since April, the currency has lost over 5 percent, 3.5 percent of which occurred in the last two weeks as the trade war exploded into a tit-for-tat tariff battle. The news stoked market fears that China will wield its currency as a weapon in the trade conflict with the U.S.

Currency wars are a true testament to the value of precious metals, which can serve as a safeguard against currency fluctuations and devaluations. Further devaluations of the yuan could spur safe haven buying, which would benefit gold and silver. The price of silver on Wednesday, however, continued its pullback, with a low of $16 at 4 pm and a high of $16.23 at 8 am.

Thursday, June 28, 2018

Weak Economic Data

Thursday brought downbeat economic data. First quarter U.S. economic growth was revised down from 2.2 percent to 2 percent, and weekly jobless claims jumped by 9,000. Consumer spending was the weakest it’s been in nearly five years despite rising incomes. While the economy has picked up thanks to tax cuts, the stimulus is only expected to propel growth for another year.

When the economic crash comes, investors who bought silver during price dips like those seen last week will avoid steep safe haven premiums. The high for silver of $16.11 was hit at 2 pm.

See where silver prices may be headed in 2018 — Read: Silver Price Forecast 2018

Friday, June 29, 2018

Technical Analysis

Silver markets rallied slightly on Friday, but technical analysis reveals the white metal will struggle with short-term buyers until it breaks above the $16.50 level, according to Christopher Lewis of FX Empire. However, Lewis saw opportunities in the silver market: “These dips offer value for the longer-term ‘buy-and-hold’ investors. Eventually, fiat currencies are all going to have issues, and gold and silver will be where people run to.”

The white metal climbed from the low of $16.02 from 7 am to 9 am to the high of $16.13 at 2 pm.

Need today’s spot silver prices? Check out our Spot Silver Price Chart for historic and live silver prices.