Silver prices continued to move sideways last week as a strong dollar deterred foreign buyers and trade-war-panicked investors sold commodities over concerns of declining demand from China. It won’t be long, however, before both market forces trigger a global economic crisis—if the dollar doesn’t become a casualty of the trade war first. Either way, expect silver and gold prices to breakout in the near future.

Long-term precious metals investors consider market fundamentals when evaluating when to buy gold and silver. Many are taking advantage of buying opportunities now because they know the markets are due for a rally. Want to learn more about silver’s historical price movers? Read “10 Factors that Influence Silver Prices.”

Silver Price Movement Indicators:

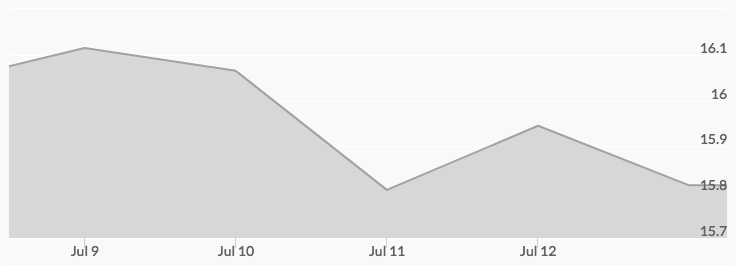

Monday, July 9, 2018

Declining Dollar

Fed interest rate hikes are usually a tailwind for the dollar, but the currency has been declining: it was down .5 percent on Monday. This made assets pegged to the dollar, such as gold and silver, less expensive for foreign investors. The price of silver jumped 6 percent to $16.10—the highest it’s been since June 27.

The precious metals complex showed signs of starting to recover from the commodities selloff the trade war initially triggered. China is one of the biggest metals purchasers in the world, and investors have been concerned about the impact of the trade conflict on its already decelerating economy in recent months.[1] Platinum prices, which was especially hit by the threat of auto tariffs, also climbed to a near two-week high of $844.

Tuesday, July 10, 2018

Credit Crisis

“No Place Will Be Spared When The Credit Crisis Tsunami Comes Crashing Down,” read the headline of an article by financial expert Jim Rickards published on Tuesday. Here are some of the highlights:

- China: Insolvent banks and state-owned enterprises owe more than a quarter-trillion dollars.

- Emerging Markets: Turkey, Argentina, and other emerging economies are overleveraged from years of the cheap debt that resulted from central banks’ loose monetary policy. Teetering on the verge of bankruptcy, all these countries need is the push of tightening monetary policy to fall into a complete credit crisis.

- U.S. Student Loan Debt: Young Americans seeking “The Dream” through pricey universities often only to find a scarcity of jobs awaiting them after graduation owe more than $1.5 trillion in outstanding debts, and the rate of default is nearing a whopping 20 percent.

- Junk Bonds: The purchase of highly speculative corporate bonds known as ‘junk bonds’ rose to the record high of 58 percent during the financial recovery. Leveraged businesses currently have a total of $3.7 trillion in outstanding junk bonds. Read Jim Rickards full article here.

Economists have already been predicting that the next economic crash will come within a year. When it does, expect a colossal credit crisis. Buying gold and silver now is one of the best ways to protect your portfolio—especially at the current bargain prices.

On Tuesday, however, Wall Street was in risk-on mode following the most recent Fed rate hike. Silver prices slipped .13 percent to $16.05 an ounce.

Wednesday, July 11, 2018

Escalating Global Economic Risk

Relations between the U.S and major national trading partners have deteriorated further. On Tuesday, the threat of another 10 percent tax on an additional $200 billion in Chinese goods was announced by the White House, escalating the tit-for-tat trade war with China and resulting in a commodities selloff on Wednesday. With its widespread industrial applications, such as solar panels, silver declined along with other base metals: the high of $15.96 at 4 am was followed by the low of $15.74 at 2 pm and 9 pm.

On Wednesday, President Trump’s aggressive tactics at the North Atlantic Treaty Organization (NATO) summit “amplified a narrative of [the president] endlessly feuding with European allies—one he stoked just weeks earlier at the G7 summit amid increasing trade tensions.”

What investors see in this narrative, however, is an eventual attack on the dollar by Trump and the resulting triumph of gold and silver. ‘Having picked major fights on trade with friends and foes it is our belief that President Trump will sooner or later go on the attack against the stronger dollar as greenback strength complicates his vision of reducing the U.S. trade deficit. … We believe investors will continue to seek diversification and protection against potentially mispriced financial and geopolitical risks,’ asserted the head of commodity strategy at Saxo Bank, Ole Hansen. He predicted gold will end the year at $1,325 and silver at $17 an ounce.

SUGGESTED READING: see what other experts are predicting for silver and gold prices this year – read articles: Silver Price Forecast 2018 and Gold Price Forecast 2018.

Thursday, July 12, 2018

Stock Market Bubble

Financial experts have been labeling strong equities performance a “stock market bubble” for years now, and on Thursday economic analyst John Sneisen added further support to this evaluation. Citing a Wall Street Journal article stating that “S&P companies are looking to repurchase as much as $800 billion in stock this year,” breaking the 2007 record, Sneisen contended that the stock market is in a “buyback bubble.”

Despite frenzied corporate repurchasing, share prices have stagnated. Moreover, the rewards of such buybacks are dwindling: nearly 60 percent of the over 350 companies in the S&P 500 that purchased back shares in 2018 are trailing the index’s increase of 3.2 percent. These are telltale signs that the stock market is hurtling toward the next crash.

With their negative correlation to stocks and bonds, silver and gold can serve as a hedge against a crash in the equities market. On Thursday, however, the white metal continued to trade in a tight range: the low of $15.81 at 7 am was followed by the high of $15.96 at noon.

Friday, July 13, 2018

Trade War

Silver was swept up in a trade-war-fear-fueled commodities selloff on Friday. A report revealing China’s trade surplus with the U.S. hit a record high in June brought market expectations of an escalation of the trade conflict. Spooked investors unloaded silver and other commodities in anticipation that demand from China would decline.[2] Silver prices pulled back from a high of $15.94 at midnight to a low of $15.73 at 10 am.

The market’s initial reaction to the trade war presents a huge buying opportunity for precious metals investors. Economists and now even Fed officials have been issuing warnings about how detrimental the trade war could be for the economy. On Friday, Dallas Fed president Robert Kaplan told Reuters that the economy’s prospects could be harmed if the trade conflict continued to worsen. If and when that occurs, investors will seek the safety of gold and silver.

Need the latest silver prices? Check our Spot Silver Price Chart.