All signs pointed to a shift in the direction of silver prices during the last week of summer. The gold silver ratio was back at record highs, and historic trends in the Dow to Gold ratio and interest rates pointed to a breakout in the price of silver. Whether investors were following these charts or simply scared by the record long bull run and escalating trade war, they were buying silver bullion coins. They were also taking advantage of bargain prices before they slip away with the warmer season.

What can you expect from the white metal this fall and winter? Read “Silver Price Forecast 2018.”

Silver Price Movement Indicators

Monday, August 27, 2018

Historically High Gold Silver Ratio

Monday brought news that the gold silver ratio was back up at the historic high of 81, meaning that it would require 81 ounces of silver to purchase one ounce of gold. Since the mid-1990s, the ratio has only been this high four times. In three of the four times the gold silver ratio has surpassed 80, silver has rallied.[1] A breakout in silver prices is on its way!

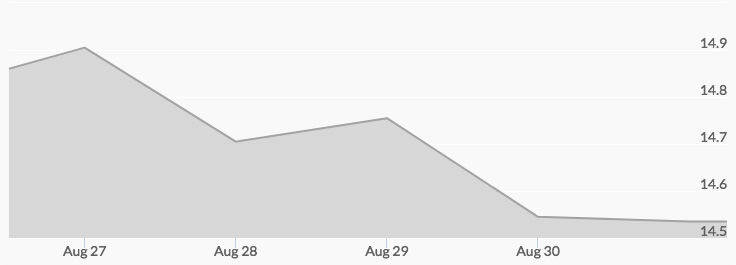

Silver prices climbed to the daily high of $14.86 at 9 pm but pulled back to the low of $14.81 by 11 pm.

Tuesday, August 28, 2018

American Silver Eagle Bullion Coin Sales Up

One sector of the silver market reportedly shined last month: American Eagle 1 oz silver bullion coins. Sales of American Eagle silver coins jumped 72 percent from 885,000 coins in July to 1,505,000 coins in August.[2] For the year, silver sales increased nearly 50 percent from August 2017.[3]

With inflation rising and the next recession predicted to hit as soon, investors may be hedging their portfolios against imminent financial risk. Silver and other precious metals have an inverse relationship to stocks and bonds. When these riskier assets plummet during times of economic downturn, silver prices typically rise, making silver coins excellent portfolio diversification instruments. Since its inception in 1986, the American Eagle silver coin has been particularly popular among investors and collectors alike, especially during the Great Recession when sales were temporarily suspended.

Increasing sales of silver coins contributed to overall demand for the white metal. The price of silver reached the weekly and daily high of $14.94 at 6 am, but prices dipped to $14.66 by 3 pm.

Wednesday, August 29, 2018

Historic Market Trends

The number of ounces of gold it requires to purchase one share of the Dow Jones Industrial Average is known as the Dow to Gold ratio. This measurement can reveal much about economic conditions and the direction of silver prices, argued analyst Hubert Moolman on Wednesday. For example, the ratio has historically traced highs (1929, 1966, and 1999) and lows (1932 and 1980) in the stock market.[4]

Moolman asserted that silver has rallied every time during the period after a peak in the Dow to Gold ratio over the last 100 years, with the exception of the years following the 1999 ratio peak. In 1980, the price of silver hit $50; however, after the 1999 Dow/Gold ratio peak, silver prices didn’t jump as high, reaching around $49, which Moolman read as an indicator that “all-time highs are still coming.”

Moolman added another historical trend to his analysis: silver has rallied after interest rate bottoms. This was the case following the bottom of 1941. Interest rates dropped even further in 2016, supporting his prediction that silver prices are set to soar.

Learn more about what moves the price of the white metal in “10 Factors that Influence Silver Prices.”

Silver prices are above, and the Dow is below in the chart.

The price of silver continued to trade in a tight range: the low of $14.64 at 4 am was followed by the high of $14.75 at 1 pm.

Thursday, August 30, 2018

Stock Market Bubble

Strong economic data published on Wednesday and negotiations between the U.S., Mexico, and Canada on revising the North American Free Trade Agreement (NAFTA) imbued the markets with a taste for risk.[5] The S&P 500 and the Nasdaq Composite Index enjoyed their longest streak since the beginning of the year, and the Dow Jones Industrial Average rose within 2 percent of its all-time high of 26,616.71, which was recorded on January 26.[6] Even though stocks were slightly lower on Thursday due to the potential for the trade war with China to escalate further, the market celebrated the longest bull market in history just one week prior.

Similar to the lead up to the last financial crisis, experts have been calling a stock market bubble in recent years. But Fed members characteristically have not been among them, pointed out an article published in Silver Doctors on Thursday. Despite the record long bull run, Fed Chairman Jerome Powell delivered a reportedly dovish speech at the Economic Policy Symposium in Jackson Hole, Wyoming, saying the Fed would set policy according to ‘signs of excesses’ in the markets.

The author of the article went on to remind us that Fed members have historically been terrible at detecting market ‘excesses.’

‘The Federal Reserve is not currently forecasting a recession,’ reported former Fed Chairman Ben Bernanke one month after the official start of the Great Recession.

‘In my judgement, we are closer to the end of the market turmoil than the beginning,’ said Bernanke three months before the market tanked in 2008.

‘Our banking system is a safe and a sound one,’ claimed former Treasury Secretary Hank Paulson sixty days from the epic meltdown on Wall Street.

The bottom line: the equities run can’t last forever, regardless of what Fed members say. Protect your portfolio with precious metals before the crash hits and prices skyrocket.

Thursday was certainly a good day to take advantage of bargain prices. After hitting a high of $14.63 at 9 am, the price of silver dipped to $14.49.

Friday, August 31, 2018

Rising Geo-Economic Risk

News that President Trump plans to go through with tariffs on $200 billion more worth of Chinese goods rocked the markets on Friday. Analysts view the move as a “massive escalation of the trade war with China,” as more than 50 percent of imports from the country would be subject to tariffs.

Faced with the renewed threat of higher operating costs for businesses and in turn rising consumer prices and inflation, investors panicked, causing stocks to fall. Safe havens silver and gold rose amid the worsening trade war, helped along by a weaker dollar.[7]

Learn more about the risks to the American economy in “Why Buy Gold During a Trade War?”

The price of silver hit its high of $14.68 at 4 am and then pulled back to the low of $14.46 at 3 pm.

Get the latest prices for the white metal in our Spot Silver Price Chart.