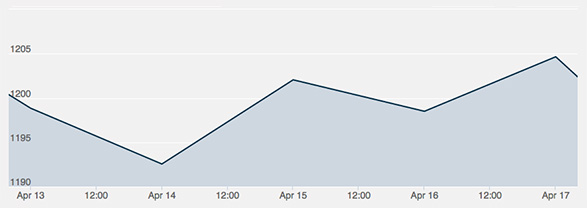

Gold again enjoyed a week of peaks and valleys that left it rising on the aggregate, thanks to subsequent gains that outperformed losses. The metal closed last week at an acceptable $1,204 per ounce, just toeing the line of what most economists agree is a healthy value. The relationship between gold and the dollar continues to be the driving factor of gold’s ever-so-slight bull market.

Monday saw gold drop on the back of a stronger dollar index, falling below the $1,200 mark to close out the day at just $1,199. Silver followed suit, although it only lost eight cents, not five dollars. As the dollar rose to its highest point in four weeks, fewer investors seemed to view gold as a hedge against inflation. The dollar index is so strong, in fact, that it makes up for the fact that the Euro is currently trading at a twelve-year low.

Tuesday continued the downward slide of gold, closing out the day at $1,192 per ounce. Higher equities kept the price of gold down even as economic data suggested that U.S. retailers didn’t enjoy as much of a boost as had been hoped in the first quarter of 2015, gaining .9% instead of the projected 1%. Spot gold fell to its lowest price in two weeks.

The middle of the week saw gold rebound by gaining nearly ten dollars per ounce, welcome news for investors worried about a prolonged slide. The big gains come squarely at the hands of the dollar index positively crashing: the Federal Reserve Beige Book noted that U.S. growth enjoyed only a “moderate” or “modest pace,” not enough to drive currency values up—but more than enough to give a boost to precious metals investing.

Thursday saw a three-dollar decline in gold. The net volume of contracts wasn’t particularly heavy, at only 115,000 total trades, suggesting that there’s not much interest in getting into or getting out of gold at the moment—most everyone is satisfied where they are. Another poor day for the dollar index nevertheless meant a not-great day for gold.

Friday would be the second-biggest day of the week, allowing gold to close out at $1,202 on the week—effectively the same price as it opened on Monday. Wells Fargo’s Paul Christopher noted that much of the gold gain in recent weeks can be tied to a harsh winter effect on the economy, which kept the dollar from gaining.