American workers were rewarded with more than a paid holiday last week as Labor Department data showed wages rose across the country in August. The robust jobs report served to strengthen the dollar and put the nation on track for more interest rate hikes, market forces that pushed down gold prices.

However, as the U.S. economy climbed toward the longest expansion on record, emerging markets crumbled in the face of increasingly unserviceable debt due to the strong dollar and the trade war. Investors’ confidence in the dollar to shield them from financial risk faltered as geo-economic conditions worsened, evident in a spike in demand for gold—the historically proven safe haven.

Events impacting the global and domestic economy have played a large role in the price of gold lately. Read “How These 10 Factors Regularly Influence Gold Prices” to see what else shapes the market.

Gold Price Movement Indicators

Monday, September 3, 2018

Increasing Domestic Demand for Gold Jewelry

Exceptional demand for physical gold has come from the U.S. jewelry industry so far this year, noted a report on Monday. First quarter gold jewelry demand was the strongest it’s been since 2008, contributing to a year-to-date total of 51.9 tons. In the second quarter, demand increased 5 percent to 28.3 tons, a ten-year high for Q2. U.S. gold jewelry retailer Tiffany & Company reported growing sales, raising its full-year forecast and outpacing analysts’ expectations.[1]

Reasons for the spike in American purchases of gold jewelry included tax cuts, rising wages, record-low unemployment, and healthy consumer confidence. To accommodate the spike in gold buying, department stores have even dedicated more store space for gold jewelry.[2]

Jewelry is only one source of demand for gold. Read about the others in “Top 6 Common Uses for Gold.”

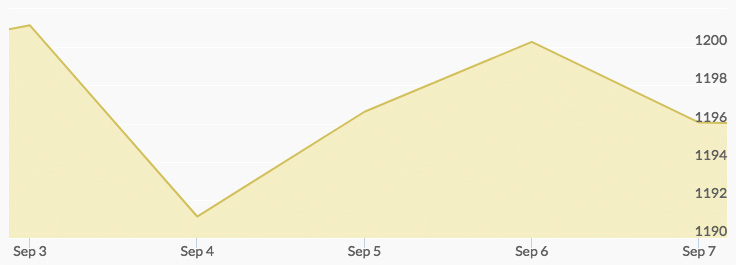

With trading light due to the end-of-summer holiday, the price of gold pulled back from the 5 am high of $1,202.70 to the 3 am low of $1,198.70.

Tuesday, September 4, 2018

Escalating Geo-Economic Risk

Markets opened after the long holiday weekend to unresolved trade issues in North America and escalating tensions between the U.S. and China. The U.S. and Canada had yet to reach a consensus on revising the North American Free Trade Agreement, and the Trump Administration was set to levee an additional $200 billion in tariffs on Chinese goods on Thursday.

The unsettling global economic picture prompted investors to seek safety in the global reserve currency and unload emerging market currencies over fears that the trade war would stunt these export-oriented economies. The Turkish lira, Brazilian real, Argentine peso, South African rand, Indian rupee, and Indonesian rupiah fell. U.S. stocks were also down.[3] The ICE U.S. Dollar index, which tracks the greenback’s strength against six other currencies, rose .3 percent to 95.459.[4]

‘As long as the dollar focus remains strong, upside potential seems limited (for gold),’ explained Ole Hansen, the head of commodity strategy at Saxo Bank. Fortunately for gold bulls, experts have been predicting the dollar to fall soon. If macroeconomic trends don’t take it down, President Trump just might. Read more in “Is President Trump Telling You to Buy Gold Now?”

Dollar dominance on Tuesday contributed to a pullback in the price of gold from the high of $1,199.30 at 2 am to $1,191.10 at 5 pm.

Wednesday, September 5, 2018

Emerging Market Currency Crisis

Investors have been seeking portfolio protection from the greenback amid a summer rife with domestic and international trade disputes, but on Wednesday even the dollar couldn’t weather the raging currency storm in emerging markets.

- Indonesia’s stock market experienced the biggest fall in five years.

- Argentina’s peso and Turkey’s lira sagged.

- South Africa’s rand hit a two-year low.

- Traders dumped Mexican pesos, the most globally traded EM currency.

As a fresh wave of anxiety washed over the stock market, the greenback didn’t appear quite as safe to investors anymore, with the ICE U.S. Dollar Index losing the .3 percent gains it had enjoyed the day prior. Gold prices jumped $6.50 from the 3 am low of $1,192 to the 9 pm and 11 pm high of $1,198.50.

“‘A touch of safe-haven appeal as EM contagion is bleeding into equity markets,’ has given ‘a glimmer of hope for beleaguered gold bulls,’” said the head of trading for the online platform OANDA, Stephen Innes.

Perhaps gold was reclaiming its title as the ultimate safe haven investment.

Thursday, September 6, 2018

Weaker Dollar

Wednesday’s trend continued into Thursday as the threat of another round of U.S. tariffs on $200 billion worth of Chinese goods loomed, pushing the dollar down and gold up. The ICE U.S. Dollar Index declined by .2 percent to 95.033, setting the trajectory to close out the week in negative territory.[5] Gold gained nearly $10 from its 2 am low of $1,195.80 to its 10 am high of $1,205.70—the top gold price for the week, as well.

‘We’re seeing a little bit of a relief rally for the precious metals,’ asserted the president of world markets at TIAA Bank, Chris Gaffney.

‘The bottom is very close because I think the U.S. dollar is close to reaching the top, together with the peak of the U.S. economy,’ indicated Gianclaudio Torlizzi, a partner at the Milan-based consultancy firm T-Commodity.

Investors dealing in foreign currencies took advantage of lower gold prices thanks to the softer dollar. Bargain gold prices throughout the summer have contributed to a spike in gold buying in China, India, and across Southeast Asia. Gold imports to India alone more than doubled last August.

Friday, September 7, 2018

Strong Economic Data

Labor Department data surpassing wage growth expectations published on Friday lifted the dollar, confirming future Fed interest rate hikes and exacerbating the emerging market currency crisis. Average wages increased .4 percent in August, .2 percent more than experts had anticipated. Year-over-year wages grew 2.9 percent, up from 2.7 percent the month prior and the fastest since June 2009. Unemployment remained at the 18-year low of 3.9 percent, and U.S. employers created 201,000 new jobs.

The news served as an infusion of economic optimism into the markets, carrying the ICE U.S. dollar index .4 percent higher to 95.40. Assets pegged to the greenback became pricier to foreign investors, causing gold to slump from the 7 am high of $1,201.30 to the 9 am low of $1,194.10. At the same time, the cost of dollar-denominated loans in emerging markets rose,

signaling a dark undercurrent to America’s record long prosperity. Read “When Will the Economy Crash?” for experts’ recession predictions.

‘With activity booming and core PCE inflation having risen to the 2% target, the continued strength of the labor market keeps the Fed firmly on track to raise interest rates twice more this year, starting with a 25 [basis point] hike at the FOMC meeting in two weeks’ time,’ noted the U.S. economist at Capital Economics, Andrew Hunter.