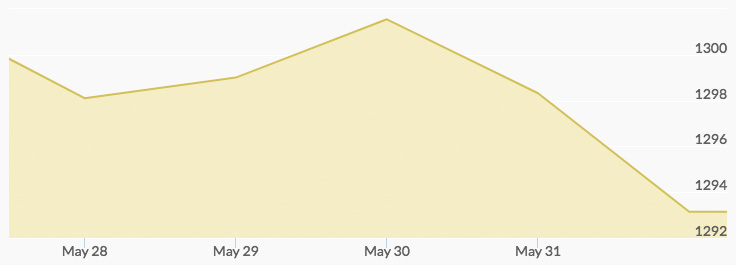

The New York and London markets were closed for the Memorial Day holiday, so the week started off with light trading and gold prices flirting with reaching the all-important $1,300 level on Monday evening, reported the historical price of gold chart. They hovered above $1,300 throughout the middle of the week, buoyed by geopolitical risk and international trade tensions, only to be pulled back by strong economic data on Friday.

Read more about the 10 factors that affect gold prices.

Gold Price Movement Indicators:

Monday, May 28, 2018

Geopolitical Stability

After stirring up fears of further tensions with nuclear time bomb North Korea last week by calling off a June 12 summit with leader Kim Jong Un, President Trump said that a U.S. team was in North Korea to prepare for the meeting on Sunday. Studies have found that political uncertainty can weaken the dollar, which was certainly the case in 2017 and remains to be seen for the remainder of the year.

Markets reacted to the news by moving away from safe haven assets, and gold hit its low of $1,296 at 3 am. The yellow metal found more support during day trading, though, reaching $1,299.90 by 9 pm.[1]

Tuesday, May 29, 2018

Geopolitical Risk

Actions by Italy’s president to set up a snap election as early as August sent jitters through the markets, causing gold prices to break through the psychologically-important $1,300 threshold to $1,303.90 by 5 am. Investors fear the country’s membership in the European Union could be threatened during the elections.

Gold’s usual contender, the dollar, stole some of its glory by 10 am, when prices for the precious metal dipped to $1,294. Traders have been opting for the dollar over the euro, boosting it to a 10-month high. Markets are heading toward a “massive risk-off event,” predicts Vice President of Sprott Asset Management firm Shree Kargutkar, but gold will continue to ‘maintain an uptrend against the U.S. dollar.’[2] GFMS even predicts gold prices could reach $1,500 later in the year.

Wednesday, May 30, 2018

Weak Economy

On Wednesday, the U.S. Commerce Department revised its gross domestic product (GDP) data for the first quarter of 2018. The GDP grew at an annualized rate of 2.2 percent, not the 2.3 percent the organization initially reported. Compared to the 2.9 percent growth reported for the fourth quarter of 2017, economic expansion is off to a sluggish start for the year.

Economic uncertainty typically sends investors to the safety of gold, but the weak economic data also knocked the dollar down from record highs, making dollar-denominated precious metals less expensive for foreign investors—a double win for gold![3] The yellow metal jumped from its low of $1,296.80 at 7 am to a high of $1,302.80 by 9 am.

Thursday, May 31, 2018

Trade War

As if the renewed threat of a trade war with China wasn’t enough to fray the nerves of investors, on Thursday President Trump announced the U.S. would impose steep tariffs on aluminum and steel from three of our top trading partners: the EU, Mexico, and Canada. Effective midnight on Thursday, trade penalties of 10 percent on imported aluminum and 25 percent on imported steel would be levied against these countries. The backlash was immediate, marked by promises of retaliatory tariffs.

The Dow dropped 200 points amid the economic upheaval. Gold prices climbed to $1,305.20 at 4 am.

Friday, June 1, 2018

Rising Interest Rates

Jobs, jobs, jobs—the economy added 45,000 more jobs in May than expected: 233,000 vs 188,000. Coupled with rising wages, the data solidified expectations that the Federal Reserve will increase interest rates in June. The news lifted the dollar and Treasury yields and overall weighed on precious metals prices. Although the day started out promising for gold, with a high of $1,298.80 recorded at 6 am, prices pulled back to $1,291.60 by 9 am and gained just a few more dollars by the close.[4]

Given indications from the Fed that they would allow inflation to overshoot their 2 percent target, rates may not rise as quickly as many expect, which would keep the dollar in check and allow the price of gold to bounce back by the end of the year.

Read more about where gold prices could be headed in our Gold Price Forecast 2018.